California Business Bank Announces First Quarterly Profit

April 18 2007 - 1:00PM

Business Wire

California Business Bank (OTCBB:CABB) announced today its first

quarterly profit in the amount of $45,460 for the quarter ending

March 31, 2007. This milestone was successfully achieved through

the continued growth of our core business. During the first

quarter, total assets increased 10.81% or $9.2 million to $94.3

million. Both loans and deposits growth remain brisk. Gross loans

rose $10.7 million or 20% to $64.2 million. Total deposits

increased $8.9 million or 13.1% to $77.2 million over December 31,

2006 results. Mr. Wood, President and Chief Executive Officer,

stated, �We are particularly pleased by our strong loan and deposit

growth. Furthermore, our asset quality remains very good as we have

not experienced any problem loans or losses. Moreover, our Deposit

Express� (Remote Deposit Capture product) continues to grow and

expands deposit delivery channel to support loans growth. "The Bank

will continue to focus on organic growth mainly in the core

commercial and industrial loan areas. We are committed to

developing long-term business loan and deposit relationships. The

bank is in the process of opening a loan production office situated

in the Inland Empire to further expand our growth in business

lending.� California Business Bank offers a wide range of financial

services to individuals, small and medium size businesses in Los

Angeles and the surrounding communities in Southern California. Our

commitment is to deliver the highest quality financial services and

products to our customers. Forward Looking Statements Certain

matters discussed in this press release constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, and are subject to the safe harbors created by

the act. These forward-looking statements refer to the Company�s

current expectations regarding future operating results, and growth

in loans, deposits, and assets. These forward-looking statements

are subject to certain risks and uncertainties that could cause the

actual results, performance, or achievements to differ materially

from those expressed, suggested, or implied by the forward-looking

statements. These risks and uncertainties include, but are not

limited to (1) the impact of changes in interest rates, a decline

in economic conditions, and increased competition by financial

service providers on the Company�s results of operation, (2) the

Company�s ability to continue its internal growth rate, (3) the

Company�s ability to build net interest spread, (4) the quality of

the Company�s earning assets, and (5) governmental regulations.

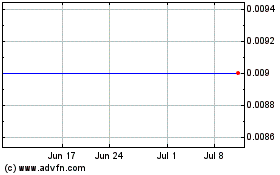

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From Apr 2024 to May 2024

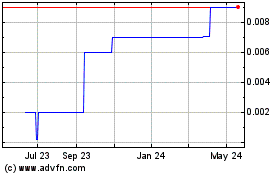

California Business Bank (CE) (USOTC:CABB)

Historical Stock Chart

From May 2023 to May 2024