Adex Mining Inc. ("Adex" or the "Company") (TSX VENTURE:ADE) is pleased to

announce the results of an updated National Instrument ("NI") 43-101 mineral

resource estimate for the North Zone ("NZ") at its Mount Pleasant Mine property

in New Brunswick, Canada.

The updated mineral resource estimate includes 12,400,000 Indicated tonnes

averaging 0.38% tin ("Sn"), 0.86% zinc ("Zn"), and 64 parts per million (ppm)

indium ("In"). Compared to the May 6, 2009 mineral resource estimate, this

represents a 14% increase in Indicated tonnes using a cut-off grade 64% higher

than in the 2009 report. Contained metal in the Indicated category within the

new mineral resource estimate is 47,000,000 kilograms (kg) of tin, 107,000,000

kg of zinc and 789,000 kg of indium. Compared to 2009, contained tin is

approximately the same but contained zinc and indium have increased by

34,000,000 kg and 100,000 kg, respectively.

"These are exciting results that further strengthen our confidence in Mount

Pleasant," said Patrick Merrin, Chief Operating Officer for Adex. "Our updated

resource was calculated using a higher cut-off grade and we have succeeded in

reclassifying a portion of our resource from Inferred to Indicated. The 2010 and

2011 drill programs along with the metallurgical testing that we have completed

has given us a much better understanding of how to extract the most value from

this resource."

The updated mineral resource estimate also includes 2,800,000 Inferred tonnes

averaging 0.30% tin, 1.13% zinc, and 70 ppm indium. Contained inferred metal

from the new mineral resource estimate is 8,600,000 kg tin, 32,000,000 kg zinc

and 198,000 kg indium.

Mineral resource and contained metal estimates are summarized below in Tables 1

and 2.

In addition to the known tin-zinc-indium resources in the NZ, the results of the

2011 drill program confirmed and expanded the extent of the high-grade

tungsten-molybdenum-bismuth (WO3-MoS2-Bi) mineralization in the NZ and Saddle

Zone with grades and widths similar to those being assessed at the Fire Tower

Zone ("FTZ") (News Release, Jan. 31, 2012). A follow-up drill program is planned

(News Release, Feb. 16, 2012) with the purpose of further expanding and

amalgamating the WO3-MoS2-Bi mineralized bodies, which were originally part of

the initial 2009 NZ NI 43-101 mineral resource estimate, with those in the FTZ.

This will be conducted in conjunction with the preparation of an updated NI

43-101 resource estimate and feasibility study for all of the WO3-MoS2-Bi

mineralized bodies at Mount Pleasant Mine.

RESULTS

Table 1: February 2012 Mineral Resources - North Zone, Mount Pleasant

Property

Mineral Tonnage

Resources (Millions of Sn Grade, Cut Zn Grade, Cut In Grade, Cut

Class tonnes) (%) (%) (ppm)

----------------------------------------------------------------------------

Indicated 12.4 0.38 0.86 64

----------------------------------------------------------------------------

Inferred 2.8 0.30 1.13 70

----------------------------------------------------------------------------

1. Resources were estimated using composites within a Block Model with

block dimensions of 5x5x5m and using an inverse distance squared grade

interpolation method. Top cuts were applied to Sn, Zn and In assays

before compositing. A cut-off of US$75 Gross Metal Value ("GMV") was

applied and a recovery of 100% is assumed;

2. Mineral resources which are not mineral reserves do not have

demonstrated economic viability. The estimate of mineral resources may

be materially affected by environmental, permitting, legal, title,

socio-political, marketing, or other relevant issues;

3. The quantity and grade of reported inferred mineral resources in this

estimation are uncertain in nature and there has been insufficient

exploration to define these inferred resources as an indicated or

measured mineral resource and it is uncertain if further exploration

will result in upgrading them to an indicated or measured mineral

resource category; and

4. The mineral resources in this press release were estimated using the

Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM

Standards on Mineral Resources and Reserves, Definitions and Guidelines

prepared by the CIM Standing Committee on Reserve Definitions and

adopted by CIM Council November 27, 2010.

The contained metal within the new mineral resource estimate is:

Table 2: Contained Metal, North Zone Mount Pleasant Property (Capped(i))

Mineral Resources

Class Contained Sn (kg) Contained Zn (kg) Contained In (kg)

----------------------------------------------------------------------------

Indicated 47,000,000 107,000,000 789,000

----------------------------------------------------------------------------

Inferred 8,600,000 32,000,000 198,000

----------------------------------------------------------------------------

1. Top cuts of 3% Sn and 4% Sn were applied to Sn assays before

compositing; top cuts of 5% Zn and 8% Zn were applied to Zn assays

before compositing and top cuts of 500 ppm In and 600 ppm In were

applied to In assays before compositing. The top cuts applied varied

according to the domain. A cut-off of US$75 GMV was applied and a

recovery of 100% is assumed; and

2. Figures may not total due to rounding.

MINERAL RESOURCE STATEMENT

The updated mineral resource estimates have been prepared on behalf of Watts,

Griffis and McOuat Limited, Consulting Geologists and Engineers of Toronto

("WGM") by WGM Senior Geological Associate John Reddick, M.Sc., P.Geo., of

Reddick Consulting Inc. ("RCI") and Mohan Srivastava, M.Sc., P.Geo., of FSS

Canada Consultants Inc., all of whom are independent of Adex.

A total of 27,527 samples in 640 diamond drill holes, representing approximately

76,000 metres of drilling, were used for the estimate. The drilling includes

underground and surface holes completed from the 1950s through 2011. Of these,

81 drill holes from surface totalling 19,027 metres were completed by Adex from

1996 to 2011. The mineral resource is constrained by wireframes of the

favourable host lithologies. Domains were modelled that reflected the different

nature of the Sn, Zn and In mineralisation. Metal grades were interpolated into

5-by-5-by-5-metre blocks using an inverse distance squared (ID2) estimation

method.

Metal prices of US$8.33 per pound Sn, $0.91 per pound Zn, and $600.00 per

kilogram for In, based on the three-year trailing average, were used to estimate

a combined Gross Metal Value ("GMV") of US$75 to establish the cut-off value for

blocks. The GMV of US$75 is equal to a Sn equivalent cut-off grade of 0.41 wt%,

which is 64% higher than the Sn equivalent cut-off grade of 0.25 wt% Sn used in

the initial NI 43-101 resource estimate for the NZ completed in 2009. The higher

cut-off was chosen based upon the results of the 2010 Preliminary Economic

Assessment completed for the NZ (filed on SEDAR), which estimated total

operating costs ranging from US$64 to $109 per tonne and identified Sn, In and

Zn as potentially economic extractable metals for the deposit. In-house data

from Adex and technical data from Reddick Consulting Inc for similar deposits

were also used to derive the cut-off value.

Mineral resources were classified as Indicated in each domain if:

a) there were a minimum of six composites from at least two different holes

available within the search ellipse for each block estimated; and

b) there were a minimum of two octants with samples available for each block

estimated.

Mineral resources were classified as Inferred if at least two composites were

found within the search ellipse. For both classes, the longest search direction

was 35m and the shortest 20m. The search ellipse was determined from variography

analyses and composites contributing to block grades were constrained by the

wireframes.

Assay grades were composited to nominal 3-m lengths prior to resource

estimation. Unsampled intervals were included in the composites at nil grades.

To date all samples have been tested for Sn and Zn, while only 34% have been

tested for In. The applied methodology provides a conservation approach for the

estimation of the In within the resource. Top cuts of 4% Sn, 5% Zn and 500 ppm

In were applied for the Endogranite subzone ("100") domain and top cuts of 3%

Sn, 8% Zn and 600 ppm In were applied outside of the Endogranite subzone domain.

The top cuts were established on the basis of statistical analysis and were

applied to the assays before calculation of composite grades. A GMV cut-off of

US$75/tonne is derived from the value of Sn, Zn and In for each block and the

GMV cut-off is based on the assumption that the deposit is of a potential size

and nature to allow for possible bulk mining methods.

A copy of the full mineral resource estimate will be available in a

NI-43-101-compliant report on the SEDAR website within 45 days of this press

release. That report will be prepared by Michael Kociumbas, B.Sc., P.Geo. and

Vice-President of Watts, Griffis and McOuat Limited, Steve McCutcheon, Ph.D.,

P.Geo., of McCutcheon Geo-Consulting, John Reddick, M.Sc., P.Geo., of Reddick

Consulting Inc., and Mohan Srivastava, M.Sc., P.Geo., of FSS Canada Consultants

Inc. The mineral resource estimates, which are effective today, were completed

by John Reddick, M.Sc., P.Geo., of Reddick Consulting Inc. and Mohan Srivastava,

M.Sc., P.Geo., of FSS Canada Consultants Inc., and are based on geological

interpretations and data supplied by the Company. Michael Kociumbas, John

Reddick and Mohan Srivastava are 'independent qualified persons' for the

purposes of NI 43-101 Standards of Disclosure for Mineral Projects of the

Canadian Securities Administrators and have verified the mineral resource data

disclosed in this release. Steve McCutcheon, Ph.D., P.Geo., of McCutcheon

Geo-Consulting and an 'independent qualified person' for the purposes of NI

43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities

Administrators, has verified the sampling procedures and QA/QC data delivered to

WGM and is of the opinion that the data are of good quality and suitable for use

in the mineral resource estimates.

McCutcheon, Srivastava and Reddick approved the disclosure of the technical

information contained in this press release. This release has also been reviewed

by Adex's Chief Operating Officer Patrick Merrin, P. Eng.

ABOUT ADEX

Adex Mining Inc. is a Canadian junior mining company with an experienced

management team. The Company is focused on developing its flagship Mount

Pleasant Mine property, a multi-metal project that is host to promising

tungsten-molybdenum and tin-indium-zinc mineralization. Located in Charlotte

County, New Brunswick, the property is situated approximately 80 km south of

Fredericton, the provincial capital, and 65 km from the United States border.

The common shares of Adex trade on the TSX Venture Exchange under the stock

symbol "ADE."

FORWARD-LOOKING STATEMENTS

Certain statements in this press release may constitute "forward-looking"

statements which involve known and unknown risks, uncertainties and other

factors which may cause actual results, performance or achievements of Adex, its

subsidiary or the industry in which they operate to be materially different from

any future results, performance or achievements expressed or implied by such

forward-looking statements. When used in this press release, the words

"estimate", "believe", "anticipate", "intend", "expect", "plan", "may",

"should", "will", the negative thereof or other variations thereon or comparable

terminology are intended to identify forward-looking statements. Such statements

reflect the current expectations of the management of Adex with respect to

future events based on currently available information and are subject to risks

and uncertainties that could cause actual results, performance or achievements

to differ materially from those expressed or implied by those forward-looking

statements. These risks and uncertainties are detailed from time to time,

including, without limitation, under the heading "Risk Factors", in reports

filed by Adex with the Alberta, British Columbia and Ontario Securities

Commissions which are available at www.sedar.com and to which readers of this

press release are referred for additional information concerning Adex, its

prospects and the risks and uncertainties relating to Adex and its prospects.

New risk factors may arise from time to time and it is not possible for

management to predict all of those risk factors or the extent to which any

factor or combination of factors may cause actual results, performance and

achievements of Adex to be materially different from those contained in

forward-looking statements. Although the forward-looking statements contained in

this press release are based upon what management believes to be reasonable

assumptions, Adex cannot assure investors that actual results will be consistent

with these forward-looking statements. Given these risks and uncertainties,

investors should not place undue reliance on forward-looking statements as a

prediction of actual results.

The forward-looking information contained in this press release is current only

as of the date of the press release. Adex does not undertake or assume any

obligation to release publicly any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events, except as required by law.

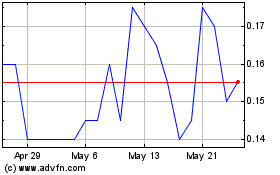

GMV Minerals (TSXV:GMV)

Historical Stock Chart

From Apr 2024 to May 2024

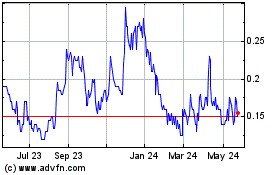

GMV Minerals (TSXV:GMV)

Historical Stock Chart

From May 2023 to May 2024