Inovalis Real Estate Investment Trust (TSX: INO.UN) ("Inovalis

REIT") today announced that it has entered the Spanish real estate

market with the purchase of two connected office buildings in

Alcobendas, north of Madrid. The high-quality, modern office

buildings, with approximately 118,400 SF of leasable space, are

fully let to two blue-chip tenants from the aeronautical

sector.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220411005902/en/

(Photo: Business Wire)

The leases are in line with market standards, including an

annual indexation of rents to cover inflation and the full recovery

of operating expenses. Current rents are lower than market levels,

however the Inovalis S.A., the manager of the REIT, expects to

align the rents with other competing assets over time, by improving

the certifications and the cosmetic aspects of the asset at minor

cost, offering tenants more services and a better experience in the

building.

The property is part of the Arroyo de la Vega market, an

established office area strategically located a short distance from

downtown Madrid and the Madrid Barajas International Airport. It is

near the A-1 highway, a major roadway that connects many corporate

headquarters with Madrid. The building includes 250 parking spaces,

modern and flexible space with state-of-the art equipment and great

synergy for both tenants. It was built in 2001 and was recently

refurbished.

Inovalis S.A. has been actively pursuing assets in the Spanish

market since 2017 and now manages 10 assets in 5 cities, totalling

$205 million of assets under management.

“We are thrilled to have closed our first transaction in Spain

and our second acquisition of the year,” said Khalil Hankach, Chief

Investment Officer of Inovalis REIT. “It is a result of Inovalis

S.A.'s deep understanding and proven track record in asset

management in this important and competitive market, where we have

successfully negotiated leases, managed projects and executed a

range of value-enhancing measures. Our asset management team builds

long-term trusting relationships with tenants with a focus on

enhancing the quality of our buildings and optimising tenants’

office experience. The REIT will pursue its growth strategy in the

Spanish real estate market and portfolio enhancement through our

innovative and hands-on asset management.”

The Transaction

Inovalis acquired the property from MERLIN Properties. It led

the acquisition and sourced the financing conducted by

Targobank.

Inovalis S.A. is a French fund manager with 25 years’ experience

with all asset classes and with expertise in all principal fields

of real estate. Capitalizing on its experience, Inovalis S.A. has

the ambition to continue its expansion in the main real estate

markets of Spain and to continue to focus on improving its

properties to meet international environmental standards and

certifications and on the quality of its servicing to tenants.

Investing in Spain

Inovalis REIT’s decision to invest in Spain is driven by its

confidence in the strengths of the market, with a balanced

risk/reward ratio, a positive outlook and potential for growth. The

country’s economy is based on solid fundamentals, being central to

Europe and throughout the world (with strong cultural and economic

ties to South America). Under the EU’s long-term budget, coupled

with NextGenerationEU, Spain is expected to receive up to $192

billion to be invested until 2026.

The Spanish Real Estate Market

Spain’s real estate market is well-developed with significant

depth: office stock of more than 140 million SF for Madrid and

almost 75 million SF for Barcelona. International investors were

involved in approximately 80% of all real estate transactions in

the country in 2021, and the market is supported by national,

European and international financial institutions. Market liquidity

continues to grow as both Madrid and Barcelona are now in the top

10 of investment projections in Europe for 2022. Spain is also

attracting more businesses to its cities: Madrid has the fifth

highest start-up density across Europe and Barcelona is

well-regarded for its digital and innovative talent.

The Spanish market offers relatively high yields, low capital

values and rents compared to other markets in major European

cities. It also offers attractive opportunities in established and

mature locations difficult to source elsewhere in Europe when

assessing comparable risk and yields. In Inovalis’ experience,

short term value creation is also possible by converting properties

into prime assets within their micro locations and with a minimal

capital effort by improving the ESG compliance of the properties,

their visibility and identity.

All currency amounts have been converted to Canadian dollars ($)

using an exchange rate of $1.37 per Euro.

Forward-Looking Statements

Certain statements contained in this news release may constitute

“forward-looking information” within the meaning of applicable

securities laws that involve known and unknown risks, uncertainties

and other factors which may cause the actual results, performance

or achievements to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. The use of any of the words

“anticipate”, “continue”, “estimate”, “expect”, “intend”, “may”,

“will”, ”project”, “should”, “believe”, “confident”, “plan” and

“intends” and similar expressions are intended to identify

forward-looking information, although not all forward-looking

information contains these identifying words. Specifically,

forward-looking information in this news release includes, but is

not limited to, statements made in relation to: the acquisition of

a new asset in Madrid and the REIT’s corporate objectives. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events, performance, or

achievements of the REIT to differ materially from those

anticipated or implied by such forward-looking information. The

REIT believes that the expectations reflected in the

forward-looking information included in this news release are

reasonable but no assurance can be given that these expectations

will prove to be correct. In particular there can be no assurance

that: the REIT will achieve any of its corporate objectives. Given

these uncertainties, readers are cautioned that forward-looking

information included in this news release are not guarantees of

future performance, and such forward-looking information should not

be unduly relied upon. More information about the risks and

uncertainties affecting the REIT’s business and the businesses of

its royalty partners can be found in the “Risk Factors” section of

its Annual Information Form and in its most recent Management’s

Discussion and Analysis, copies of each of which are available

under the REIT’s profile on SEDAR at www.sedar.com. All of the

forward-looking statements made in this news release are qualified

by these cautionary statements and other cautionary statements or

factors contained herein, and there can be no assurance that the

actual results or developments will be realized or, even if

substantially realized, that they will have the expected

consequences to, or effects on, the REIT. The forward-looking

information included in this news release is presented as of the

date of this news release and the REIT assumes no obligation to

publicly update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

About Inovalis REIT

Inovalis REIT is a real estate investment trust listed on the

Toronto Stock Exchange. It was founded in 2013 by Inovalis S.A. and

invests in office properties in primary markets of France, Germany

and Spain. It holds 14 assets representing $643 million of assets

under management. Inovalis REIT acquires real estate properties

indirectly via CanCorpEurope, an Alternative Investment Fund

authorized by the CSSF in Luxemburg, and managed by INOVALIS

S.A.

About Inovalis Group

Inovalis S.A. is a French Alternative Investment fund manager,

authorized by the French Securities and Markets Authority (AMF)

under AIFM laws. Inovalis S.A. and its subsidiaries (Advenis S.A.,

Advenis REIM) invest in and manage Real Estate Investment Trusts

such as Inovalis REIT, open ended funds (SCPI) with stable real

estate focus such as Eurovalys (for Germany) and Elialys (Southern

Europe), Private Thematic Funds raised with Inovalis partners to

invest in defined real estate strategies and direct Co-investments

on specific assets.

Inovalis Group (www.inovalis.com), founded in 1998 by Inovalis

SA, is an established pan European real estate investment player

with $10 billion of assets under management and with offices in all

the world's major financial and economic centers in Paris,

Luxembourg, Madrid, Frankfurt, Toronto and Dubai. The group is

comprised of 300 professionals, providing Advisory, Fund, Asset and

Property Management services in Real Estate as well as Wealth

Management services.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220411005902/en/

David Giraud, Chief Executive Officer Inovalis Real

Estate Investment Trust +33 1 5643 3323

david.giraud@inovalis.com

Khalil Hankach, Chief Financial Officer Inovalis Real

Estate Investment Trust +33 1 5643 3313

khalil.hankach@inovalis.com

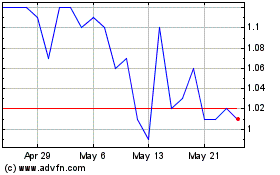

Inovalis Real Estate Inv... (TSX:INO.UN)

Historical Stock Chart

From Apr 2024 to May 2024

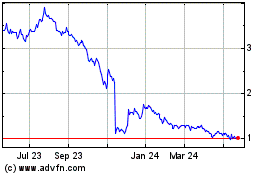

Inovalis Real Estate Inv... (TSX:INO.UN)

Historical Stock Chart

From May 2023 to May 2024