Ellington Financial Inc. Completes Non-QM Securitization

April 29 2024 - 6:04PM

Business Wire

Ellington Financial Inc. (NYSE: EFC) (the "Company") today

announced the closing of a $300 million securitization backed by a

pool of non-qualified residential mortgage (“non-QM”) loans.

Ellington Financial contributed approximately 64% of the loans

included in the securitization, with the remainder contributed by

funds managed by Ellington Management Group, L.L.C.

The debt tranches issued in the securitization were rated by

S&P, with the senior-most tranches receiving AAA(sf) ratings.

The Company retained certain tranches of the securitization in

compliance with credit risk retention rules, and also retained the

option to call the securitization at any time following the

optional redemption date.

About Ellington Financial

Ellington Financial invests in a diverse array of financial

assets, including residential and commercial mortgage loans and

mortgage-backed securities, reverse mortgage loans, mortgage

servicing rights and related investments, consumer loans,

asset-backed securities, collateralized loan obligations,

non-mortgage and mortgage-related derivatives, debt and equity

investments in loan origination companies, and other strategic

investments. Ellington Financial is externally managed and advised

by Ellington Financial Management LLC, an affiliate of Ellington

Management Group, L.L.C.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240426546602/en/

Investor Inquiries: Ellington Financial Inc. Investor

Relations (203) 409-3575 info@ellingtonfinancial.com Press &

Media Relations: Amanda Shpiner/Sara Widmann Gasthalter &

Co. for Ellington Financial (212) 257-4170

Ellington@gasthalter.com

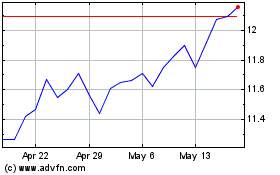

Ellington Financial (NYSE:EFC)

Historical Stock Chart

From Apr 2024 to May 2024

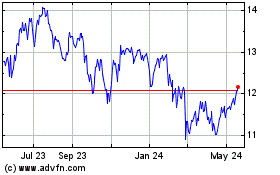

Ellington Financial (NYSE:EFC)

Historical Stock Chart

From May 2023 to May 2024