Confirmation of the Profitable Growth

Profile

- 55.6% growth in half-year revenue

- Strong momentum across all Group's businesses

- Half-year adjusted1 EBITDA of EUR 1,677 thousand (23.7%

of revenue)

- Half-year operating profit of EUR 1,158 thousand (16.3%

of revenue)

- Consolidated half-year net profit of EUR 1,134 thousand

euros (16.0% of revenue)

- Consolidated available cash at EUR 4,832 thousand as of

June 30, 2023

- Signature of the first contract for engine control

applications for aerospace

- Confirmation of MEMSCAP profile shift: a solid model of

profitable growth

- Growth and profitability momentum expected to continue in

the second half of 2023

Regulatory News:

MEMSCAP (Euronext Paris: MEMS), leading provider of

high-accuracy, high-stability pressure sensor solutions for the

aerospace and medical markets using MEMS technology (Micro Electro

Mechanical Systems), today announced its earnings for the first

half of 2023 ending June 30, 2023.

Analysis of consolidated revenue

In accordance with the previous quarterly press releases,

consolidated revenue from continuing operations for the first half

of 2023 amounted to EUR 7,089 thousand compared to EUR 4,555

thousand for the first half of 2022.

Over the first half of 2023, the distribution of consolidated

revenue from continuing operations by market segment is as

follows:

Market segments / Revenue (In

thousands of euros)

H1 2022

H1 2022 (%)

H1 2023

H1 2023 (%)

Aerospace

3,492

77%

4,515

64%

Medical

1,011

22%

1,709

24%

Optical communications

--

--

798

11%

Others (Royalties from licensed

trademarks)

52

1%

67

1%

Total revenue from continuing

operations

4,555

100%

7,089

100%

(Any apparent discrepancies in totals are due to rounding.)

Consolidated revenue from continuing operations in the first

half of 2023 increased by 55.6% compared to the first half of

2022.

The aerospace segment, the Group's largest market, posted

revenue of EUR 4,515 thousand for the first half of 2023, an

increase of 29.3% compared to the first half of 2022. This segment

represented 64% of consolidated revenue for the first half of

2023.

Sales in the medical segment also demonstrated strong dynamism,

reaching EUR 1,709 thousand for the first half of 2023, thus an

increase of a 69.0% compared to the first half of 2022. This

segment represented 24% of consolidated revenue for the first half

of 2023.

The optical communications business, including design and sales

of variable optical attenuators (VOA) according to a fabless

organization, achieved a revenue of EUR 798 thousand for the first

half of 2023, i.e. 11% of consolidated revenue.

Royalties from licensed trademarks amounted to EUR 67 thousand

for the first half of 2023, similar to the first half of 2022.

Analysis of consolidated income statement

MEMSCAP’s consolidated earnings for the first half of 2023 are

given within the following table:

In thousands of euros

H1 2022

H1 2023

Revenue from continuing

operations

4,555

7,089

Cost of revenue

(2,841)

(4,030)

Gross margin

1,714

3,059

% of revenue

37.6%

43.2%

Operating expenses*

(1,685)

(1,901)

Operating profit /

(loss)

29

1,158

Financial profit / (loss)

95

23

Income tax expense

(38)

(47)

Net profit / (loss) from

continuing operations

86

1,134

Profit / (loss) after tax from

discontinued operations

(657)

--

Net profit / (loss)

(571)

1,134

(Financial data were subject to a limited review by the Group’s

statutory auditors. On August 31, 2023, MEMSCAP’s board of

directors authorized the release of the interim condensed

consolidated financial statements on June 30, 2023. Any apparent

discrepancies in totals are due to rounding.) * Net of research

& development grants.

The strong growth in business volumes and the evolution of sales

mix resulted in a consolidated gross margin of EUR 3,059 thousand

for the first half of 2023, representing 43.2% of consolidated

revenue, compared to EUR 1,714 thousand for the first half of 2022,

representing 37.6% of consolidated revenue. This represented an

increase of 5.6 percentage points in margin.

Operating expenses, net of research and development grants,

amounted to EUR 1,901 thousand for the first half of 2023, compared

to EUR 1,685 thousand for the first half of 2022. This increase was

mainly driven by significant developments in commercial operations

and by the impact of the growth in business volumes on the Group's

structure.

The average equivalent full-time workforce related to continuing

operations increased from 41.3 people in the first half of 2022 to

51.7 people in the first half of 2023.

For the first half of 2023, the Group posted an operating profit

from continuing operations of EUR 1,158 thousand (16.3% of

consolidated revenue), compared to breakeven operating earnings for

the first half of 2022.

The financial result was at breakeven for the first half of

2023, compared to a net gain of EUR 95 thousand for the first half

of 2022, resulting from the exchange rate fluctuations of the US

dollar and the Norwegian krone.

The tax expense recorded for the first half of 2023 and 2022

corresponded to the variation in deferred tax assets. This charge

has no impact on the Group's cash flow.

The Group reported a net profit after tax from continuing

operations of EUR 1,134 thousand for the first half of 2023

compared to a net profit of EUR 86 thousand for the first half of

2022.

The Group therefore posted a consolidated net profit of EUR

1,134 thousand for the first half of 2023 (16.0% of consolidated

revenue) compared to a net loss of EUR 571 thousand for the first

half of 2022 including discontinued operations*.

*As part of the FABLITE program, the US Custom products

division, including the design and manufacturing of MEMS components

for third parties and the related foundry services, was sold in

December 2022. In accordance with IFRS 5, the net loss relating to

this business, i.e. EUR 657 thousand for the first half of 2022,

was recognized in loss after tax from discontinued operations.

Evolution of the Group’s cash / Consolidated shareholders’

equity

Adjusted EBITDA1 from continuing operations for the first half

of 2023 amounted to EUR 1,677 thousand compared to EUR 711 thousand

for the first half of 2022.

In line with the increase in business volumes, the Group's

working capital requirement increased by EUR 1,779 thousand for the

first half of 2023, compared to an increase of EUR 127 thousand for

the first half of 2022. This significant increase in the working

capital requirement was due to the rise in accounts receivable and

inventory levels.

As of June 30, 2023, the Group posted available cash of EUR

4,832 thousand (December 31, 2022: EUR 5,456 thousand) including

cash investments (Corporate bonds / investment securities) recorded

under non-current financial assets.

As of June 30, 2023, MEMSCAP shareholders’ equity totalled EUR

16,079 thousand (December 31, 2022: EUR 15,587 thousand).

1 Adjusted EBITDA means operating profit before depreciation,

amortisation, share-based payment charge (IFRS 2) and including

foreign exchange gains/losses related to ordinary activities.

Perspectives

The 2022 financial year was marked by the completion of the

FABLITE program, which ended with the sale of the Group's Custom

Products business and its US-based factory. This sale operation was

accompanied by the establishment of a fabless organization,

enabling the Group to address the variable optical attenuators

(VOA) market with the creation of the optical communications

business unit, whose commercial activities were effective in

January 2023.

Following the successful completion of the FABLITE program

within the initially planned timeframe, the Group launched the 4G

development plan from the first quarter of 2023. This 4G plan aims

for consecutive, competitive, profitable, and responsible growth of

the Group's activities, with an average annual consolidated revenue

growth rate of 20% over the period from 2022 to 2026. The plan

highlights strong development prospects for the aerospace and

medical activities in growing structural markets as well as new

opportunities.

With an adjusted EBITDA1 of EUR 1,677 thousand for the first

half of 2023, representing 23.7% of consolidated revenue (compared

to EUR 711 thousand for the first half of 2022), and a net profit

of EUR 1,134 thousand for the same period, MEMSCAP demonstrates the

success of its 4G plan launch.

To ensure the growth of its aerospace activities over the next 3

years, the Group first intends to leverage its reputation in its

current markets (air data computer, cabin pressure control systems,

ground-based aerial tests, etc.) to increase business volumes with

existing customers and expand its market share with new clients.

The Group also aims to continue meeting the growing market demand

for UAV (Unmanned Aerial Vehicle) and address the market for

electric Vertical Take-Off and Landing Vehicles (eVTOL).

Additionally, MEMSCAP plans to strengthen its growth by penetrating

the engine control market, both in Engine Monitoring Units (EMU)

and Full Authority Digital Engine Control (FADEC). This will

require the qualification of the new SP85 sensor family developed

as part of the Sensor Technology for Green and Safe Jet Engines

(STEGS) program which aims at developing safer and more

environmentally friendly engines and was funded in previous years

by the Norwegian government.

In this context, the Group announced in May 2023 the signing of

a multi-year development and supply contract for pressure modules

for Engine Monitoring Units (EMU) with Meggitt PLC. Under this

contract, MEMSCAP will provide Meggitt with various configurations

of pressure modules, incorporating a customized and ruggedized

version of the new generation of its SP85 pressure sensor.

The growth drivers in the MEMSCAP’s medical business primarily

rely on the development of the Group’s current markets, especially

those that have been established in recent years. These markets

include pressure measurement solutions used as medical accessories

for patient monitoring in intensive care units, sensors integrated

into blood filtration equipment, and solutions implanted in the

human body. Additionally, MEMSCAP continues to expand its solutions

for the urology market (already representing 10.8% of its half-year

medical revenue) and is initiating commercial efforts in the fields

of lung/heart devices and angiography.

Furthermore, the Group leverages its intellectual property to

serve its niche market of variable optical attenuators (VOA) for

fiber optic systems, thanks to its new fabless organization as

previously mentioned.

All these actions are intended to maintain the positive trend

initiated in the first half of 2023.

"After the success of the FABLITE program, MEMSCAP’s teams

demonstrate once again their execution capabilities by rapidly

turning the ambitious 4G program objectives into reality." says

Jean Michel Karam, CEO of MEMSCAP. "With a solid balance sheet, the

Group is intensifying its efforts to confirm every quarter its

profile of profitable and responsible hyper-growth."

Q3 2023 earnings: October 25, 2023

About MEMSCAP

MEMSCAP is a leading provider MEMS based pressure sensors,

best-in-class in term of precision and stability (very low drift)

for two market segments: aerospace and medical. MEMSCAP also

provides variable optical attenuators (VOA) for the optical

communications market.

For more information, visit our website at: www.memscap.com

MEMSCAP is listed on Euronext Paris (Euronext Paris - Memscap -

ISIN code: FR0010298620 - Ticker symbol: MEMS)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Interim condensed consolidated financial statements at 30

June 2023

30 June 2023

31 December 2022

€000

€000

Assets

Non-current assets

Property, plant and

equipment.................................................................

886

901

Goodwill and intangible

assets..................................................................

6 559

6 888

Right-of-use

assets....................................................................................

4 354

4 764

Other non-current financial

assets............................................................

1 239

1 276

Employee benefit net

asset.......................................................................

5

6

Deferred tax

asset....................................................................................

89

137

13 132

13 972

Current assets

Inventories...............................................................................................

2 894

2 578

Trade and other

receivables......................................................................

3 667

2 494

Prepayments............................................................................................

248

222

Cash and short-term

deposits...................................................................

3 593

4 180

10 402

9 474

Total assets

23 534

23 446

Equity and liabilities

Equity

Issued

capital............................................................................................

1 869

1 869

Share

premium.........................................................................................

17 972

17 972

Treasury

shares........................................................................................

(118)

(144)

Retained

earnings.....................................................................................

1 002

(242)

Foreign currency

translation.....................................................................

(4 646)

(3 868)

16 079

15 587

Non-current liabilities

Lease

liabilities.........................................................................................

4 114

4 479

Interest-bearing loans and

borrowings......................................................

77

128

Employee benefit

liability..........................................................................

72

69

4 263

4 676

Current liabilities

Trade and other

payables.........................................................................

2 571

2 487

Lease

liabilities.........................................................................................

487

576

Interest-bearing loans and

borrowings......................................................

101

101

Provisions.................................................................................................

33

19

3 192

3 183

Total liabilities

7 455

7 859

Total equity and liabilities

23 534

23 446

CONSOLIDATED STATEMENT OF INCOME

Interim condensed consolidated financial statements at 30

June 2023

For the six months ended 30

June

2023

2022

Continuing operations

€000

€000

Sales of goods and

services.................................................................................

7 089

4 555

Revenue............................................................................................................

7 089

4 555

Cost of

sales.......................................................................................................

(4 030)

(2 841)

Gross

profit.......................................................................................................

3 059

1 714

Other

income.....................................................................................................

157

204

Research and development

expenses.................................................................

(938)

(945)

Selling and distribution

costs..............................................................................

(415)

(306)

Administrative

expenses.....................................................................................

(705)

(638)

Operating profit /

(loss).....................................................................................

1 158

29

Finance

costs.....................................................................................................

(97)

(87)

Finance

income..................................................................................................

120

182

Profit / (loss) for the period from

continuing operations before tax..................

1 181

124

Income tax

expense...........................................................................................

(47)

(38)

Profit / (loss) for the period from

continuing operations...................................

1 134

86

Discontinued operations

Profit/(loss) after tax for the period

from discontinued operations......................

--

(657)

Profit / (loss) for the

period...............................................................................

1 134

(571)

Earnings per share:

- Basic, for profit / (loss) for the

period attributable to ordinary equity holders of the parent (in

euros)................................................................................

€ 0.152

€ (0.077)

- Diluted, for profit / (loss) for the

period attributable to ordinary equity holders of the parent (in

euros)....................................................................

€ 0.147

€ (0.077)

- Basic, profit / (loss) for the period

from continuing operations attributable to ordinary equity holders

of the parent (in euros)....................................

€ 0.152

€ 0.012

- Diluted, profit / (loss) for the period

from continuing operations attributable to ordinary equity holders

of the parent (in euros)................................

€ 0.147

€ 0.012

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Interim condensed consolidated financial statements at 30

June 2023

For the six months ended 30

June

2023

2022

€000

€000

Profit / (loss) for the

period........................................................................

1 134

(571)

Items that will not be reclassified

subsequently to profit or loss

Actuarial gains /

(losses)..............................................................................

--

--

Income tax on items that will not be

reclassified to profit or loss..................

--

--

Total items that will not be

reclassified to profit or loss.............................

--

--

Items that may be reclassified

subsequently to profit or loss

Net gain / (loss) on available-for-sale

financial assets...................................

(34)

(141)

Exchange differences on translation of

foreign operations...........................

(778)

(273)

Income tax on items that may be

reclassified to profit or loss......................

--

--

Total items that may be reclassified to

profit or loss..................................

(812)

(414)

Other comprehensive income for the

period, net of tax.............................

(812)

(414)

Total comprehensive income for the

period, net of tax..............................

322

(985)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Interim condensed consolidated financial statements at 30

June 2023

(In thousands of euros, except for

number of shares)

Number

Issued

Share

Treasury

Retained

Foreign

Total

of shares

capital

premium

shares

earnings

currency translation

shareholders’ equity

€000

€000

€000

€000

€000

€000

At 1 January

2022............................................................................

7 476 902

1 869

17 972

(144)

(1 130)

(2 779)

15 788

Loss for the

period............................................................................

--

--

--

--

(571)

--

(571)

Other comprehensive income for the period,

net of tax....................

--

--

--

--

(141)

(273)

(414)

Total comprehensive

income............................................................

--

--

--

--

(712)

(273)

(985)

Treasury

shares................................................................................

--

--

--

(6)

--

--

(6)

At 30 June

2022...............................................................................

7 476 902

1 869

17 972

(150)

(1 842)

(3 052)

14 797

At 1 January

2023............................................................................

7 476 902

1 869

17 972

(144)

(242)

(3 868)

15 587

Profit for the

period..........................................................................

--

--

--

--

1 134

--

1 134

Other comprehensive income for the period,

net of tax....................

--

--

--

--

(34)

(778)

(812)

Total comprehensive

income............................................................

--

--

--

--

1 100

(778)

322

Treasury

shares................................................................................

--

--

--

26

--

--

26

Share-based

payment.......................................................................

--

--

--

--

144

--

144

At 30 June

2023...............................................................................

7 476 902

1 869

17 972

(118)

1 002

(4 646)

16 079

CONSOLIDATED CASH FLOW STATEMENT

Interim condensed consolidated financial statements at 30

June 2023

For the six months ended 30

June

2023

2022

€000

€000

Operating activities:

Net profit / (loss) for the

period..............................................................................

1 134

(571)

Profit/(loss) after tax for the period

from discontinued operations..........................

--

(657)

Profit / (loss) for the period from

continuing operations..........................................

1 134

86

Non-cash items written back:

Amortization and

depreciation..........................................................................

356

499

Loss / (capital gain) on disposal of fixed

assets...................................................

(3)

35

Other non-financial

activities............................................................................

182

52

Accounts

receivable................................................................................................

(1 367)

212

Inventories.............................................................................................................

(597)

(202)

Other

debtors.........................................................................................................

(44)

(52)

Accounts

payable....................................................................................................

(67)

149

Other

liabilities.......................................................................................................

296

20

Net cash flows from / (used in)

operating activities - continuing operations..........

(110)

799

Net cash flows used in operating

activities - discontinued operations......................

--

(614)

Total net cash flows from / (used in)

operating activities.......................................

(110)

185

Investing activities:

Purchase of fixed

assets..........................................................................................

(190)

(223)

Proceeds from sale / (purchase) of other

non-current financial assets......................

19

155

Net cash flows used in investing

activities - continuing operations.........................

(171)

(68)

Net cash flows used in investing

activities - discontinued operations........................

--

(7)

Total net cash flows used in investing

activities.....................................................

(171)

(75)

Financing activities:

Repayment of

borrowings.......................................................................................

(50)

(70)

Payment of principal portion of lease

liabilities........................................................

(242)

(298)

Sale / (purchase) of treasury

shares........................................................................

26

(6)

Net cash flows used in financing

activities - continuing operations.........................

(266)

(374)

Net cash flows used in financing

activities - discontinued operations.......................

--

--

Total net cash flows used in financing

activities.....................................................

(266)

(374)

Net foreign exchange

difference.............................................................................

(40)

(41)

Increase / (decrease) in net cash and

cash equivalents...........................................

(587)

(305)

Opening cash and cash equivalents

balance...........................................................

4 180

3 648

Closing cash and cash equivalents

balance.............................................................

3 593

3 343

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230831570369/en/

Yann Cousinet Chief Financial Officer Ph.: +33 (0) 4 76 92 85 00

yann.cousinet@memscap.com

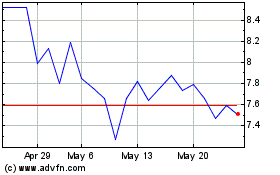

Memscap (EU:MEMS)

Historical Stock Chart

From Apr 2024 to May 2024

Memscap (EU:MEMS)

Historical Stock Chart

From May 2023 to May 2024