A summary of the weekly Commitment of Traders Report (COT) from CFTC to show market positioning among large speculators.

Please note the data release was delayed due to US holiday last week

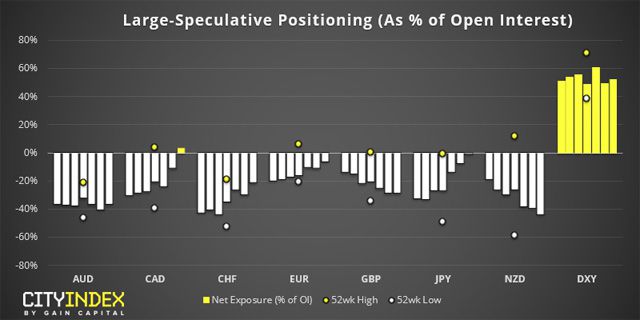

As of Tuesday 2nd of July:

- EUR and CAD saw the largest weekly change among FX majors, both reducing short exposure by 24.5k and 21.1k respectively

- Large speculators on CAD futures flipped to Net-long exposure

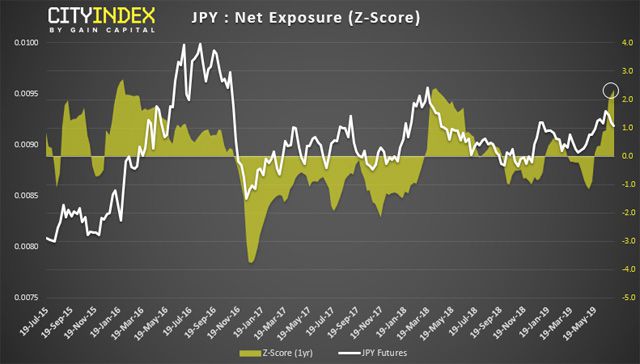

- Traders are their least bearish on JPY futures since June 2018, and on the cusp of hitting net-long exposure

- Short exposure on GBP futures has hit its most bearish level since September 2018

EUR: At -31.7k contracts net-short, this is the least bearish traders have been on the Euro since October. We’ve seen short covering pick up pace in recent weeks and, until recently, appeared set Euro traders could flip to net-short. However, the combination of weak data from Europe, a dovish ECB, a slightly less dovish Fed and Friday’s strong NFP report has seen a turn of events or Euro and short interest has presumably spiked. Therefore, unless we see a dovish Powell this week in front of congress or the FOMC minutes, downside pressures for EUR/USD are likely to persist over the near-term.

CAD: We have been observing the dwindling short interest this year and used it as a case for a major inflection point on USD/CAD. However, we’ve now seen long interest spike up (the final ingredient for a bullish case) which has seen exposure flip to net-long for the first time since March 2018. Keep an eye on Wednesday’s BOC meeting despite there being no changes to policy expected. Data has as remained strong so there is a chance for a hawkish tone to their statement and provide CAD another tailwind.

JPY: Short exposure has hit its least bearish level since flipping to net-short in June 2018. However, this is purely been a function of short covering and bulls remain hesitant to pile into the long positions. Furthermore, the relatively fast pace of short-covering has pushed its 1-year Z-Score over +2 standard deviations, suggesting current positioning could be stretched. If so, this leaves potential for a swing high on the net positioning, and for it to increase its bearish exposure if or when a catalyst arrives.

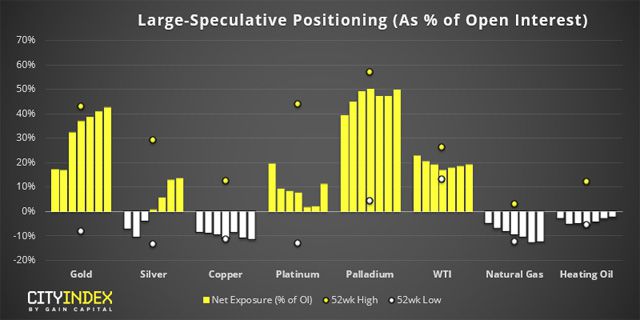

As of Tuesday 2nd of July:

- Gross exposure for gold hit its lowest level since February 2015

- Traders are net-long on Silver for a fourth consecutive week

- Net-long exposure for palladium is at its most bullish level since March

- Net-long exposure for WTI has risen for a fourth consecutive week

Gold: The shiny yellow metal’s ascent has not gone unnoticed. We can see prices have rinse in an almost parabolic fashion and shorts have continued to cover whilst bulls pile into fresh longs. However, one only needs to see the rise in volatility since failing to break above $1440 to see that things are now all well at the top. Indeed, with positioning arguably stretched, and all eyes on the Fed, it’s possible there could be some further shakeouts around these highs before the bullish trend resumes.

City Index: Spread Betting, CFD and Forex Trading on 12,000+ global markets including Indices, Shares, Forex and Bitcoin. Click here to find out more.

Hot Features

Hot Features