May is shaping up to be a tough month for equities. Rising inflation, a tech pullback, and increasing yields are hitting markets hard. What to trade in May?

On the face of it, the month of May 2021 began with a boom. However, two weeks in and things aren’t looking quite so hot. As of mid-May, anemic gains were recorded over the past month for the Dow Jones Industrial Average (DJIA), and the New York Stock Exchange Composite Index (NYSE). Unsurprisingly, the S&P 500 index, the NASDAQ composite index, and the S&P/TSX composite index reported losses over the past 1 month.

Against the backdrop of a tech sector rout, Treasury yields rising, and increasing inflation, traders are looking towards many different options for generating an ROI. For the bulls out there, gains remain to be had. You just have to look a little harder for them. The recent jobs report reveals that additional stimulus doesn’t seem to be the solution to the US economy. Not only was the Friday morning US employment report the most disappointing on record, it also sent stock markets plunging. Analysts expected 1 million new jobs to be created, but the Bureau of Labor Statistics (BLS) reported that just 266,000 jobs were created in April.

Recall that traders can profit from rising or falling stocks, provided they call it correctly. Among the biggest movers and the shakers are the following stocks to watch this week:

- Peloton (NASDAQ: PTON)

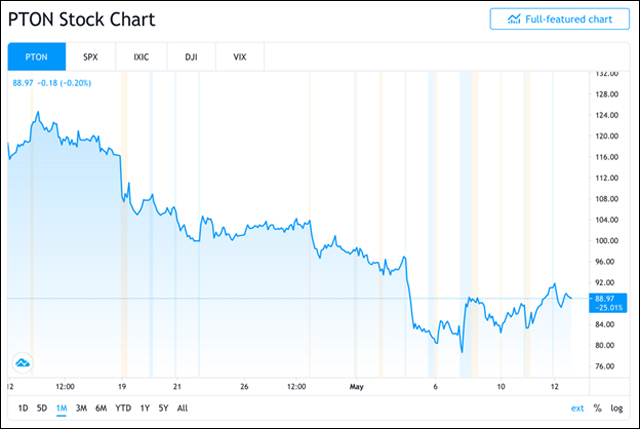

Source: TradingView

Peloton (NASDAQ: PTON) stock is trading sharply lower over the past 1 month, and is regarded as a sell. Analysts rate it as an institutional short. The stock has a 52-week high of $171.09, and a 52-week low of $29.64. At current prices, the company has a market capitalization of $26.05 billion. While there has been some horizontal movement of late, the trend is clearly bearish.

- Starbucks (NASDAQ: SBUX)

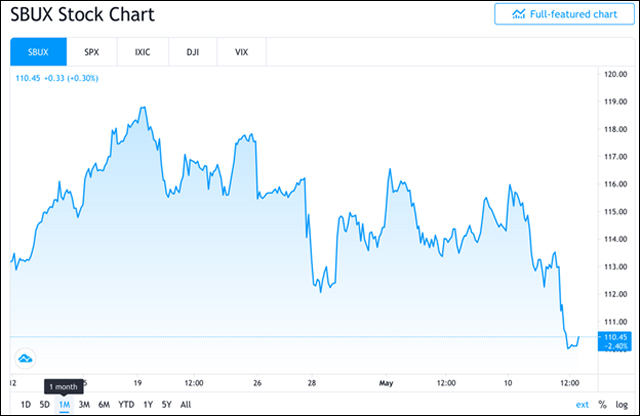

Source: TradingView

Starbucks may always taste good in-store, but the stock is looking a little sour to traders out there. The prices whipsawed wildly in recent weeks, dropping from $119 per share to around $110 per share. It is technically a sell in mid-May, in tandem with the NASDAQ sell-off of big tech. The stock has a 52-week high of $118.98, and a 52-week low of $70.65. The current market capitalization is $130.249 billion. At the beginning of May, there were rising prices with Starbucks, but pullbacks in the second week of May have hurt many NASDAQ stocks.

- DraftKings (NASDAQ: DKNG)

Source: StockCharts

DraftKings Incorporated (NASDAQ: DKNG) was stable heading into May, but sold off sharply in the second week of May. From a price of around $58, it plummeted to $42.31 per share in mid-May. The stock is technically regarded as a sell, with a 52-week high of $74.38 and a 52-week low of $18.35 per share. The market capitalization of DraftKings stock is $16.998 billion.

the rapid sell-off of late tends to indicate that a bounce may be on the cards. This could present favorable trading opportunities for market participants, on the proviso that all the fundamentals are in place, and sufficient sell-off has occurred. The Bollinger Bands tend to agree that it is oversold, and ready for a bounce.

- Coinbase Global (NASDAQ: COIN)

Source: StockCharts.com

Coinbase (NASDAQ: COIN) initially soared, but it quickly retraced as it dropped from well above $300 + per share to under $280 per share. In a sense, it mirrored the performance of another much-anticipated tech stock in the form of Facebook (NASDAQ: FB) back in the day. The stock has steadily lost value since being listed in April, but cryptocurrencies are soaring with Bitcoin still in the $50,000 – $60,000 range, and Ethereum hovering around $3800 – $4000 per unit. The global crypto market cap is well over $2.37 trillion, and Coinbase (NASDAQ: COIN) is the biggest cryptocurrency exchange in the US. Provided a mass sell-off of crypto doesn’t occur any time soon, Coinbase (NASDAQ: COIN) should maintain its appeal as a top crypto-industry stock to hold, buy or sell.

- Builders FirstSource Inc (NASDAQ: BLDR)

Source: StockCharts

The first bullish stock on this list that recently lost value is Builders FirstSource Inc (NASDAQ: BLDR). Despite many retracements – indicated by the red candlesticks – the stock has been trending bullish thanks to a spectacular run of form in January, February, March, and April. May has been rather lackluster, owing to the recent jobs report, inflation news, and the tech stock selloff on the NASDAQ. However, the stock is still up for the year-to-date, despite losing value over the past 1 month. It is technically bearish, with a sharp sell-off from around $53 to its current price around $46.96.

Stock Prices Can Turn on a Dime During Volatile Trading Sessions

The current volatility in the stock markets is part of a broader trend of an economic hiccup during the coronavirus recovery phase. While the multi-trillion dollar stimulus has already circulated through the economy, we have yet to see a big boost in jobs numbers. Already, inflation is tracking higher and this is causing jitters in the financial markets. Fortunately, traders don’t need stocks to appreciate for profits to be generated. Shorting stocks (betting against them) can also yield favorable returns. The current market is characterized by whipsaw activity, and close attention to detail is warranted before any trading decisions are made.

Hot Features

Hot Features