For traders in the know, Lithium (Li) is a potential game changer. This eco-friendly element is privy to increasing consumption down under, and globally. These trading tips come in handy.

What Makes a Lithium A Coveted Resource For Rechargeable Batteries?

Of all the tradable commodities in Australia, Lithium is certainly one of the lesser-known elements on the exchanges and futures markets. Yet despite this, Lithium is in now en vogue and in demand, particularly as a key ingredient of renewable energy sources. Lithium batteries are a case in point. The challenges facing the Lithium mining industry are rooted in the lack of experienced miners [for obvious reasons] given the relative newness of the hot industry.

Low Carbon Emissions and Huge Upside Trading Potential

This novel industry is central to the development of a brand-new energy paradigm – that of a low carbon economy. Among others, Lithium has various applications, both technical and chemical. These include use in primary and secondary sources such as non-rechargeable and rechargeable applications. From a trading perspective, multiple strategies have been tested and proven over time. As a rule, commodities are broadly divided into soft commodities and hard commodities. Lithium is a hard commodity which is mined, much like oil, silver, or gold.

Traders with an eye on this hot market can employ various trading strategies for maximum leverage. Foremost among them are those strategies which work to a trader’s strengths. Traders with in-depth knowledge of energy resources are best suited to trading commodities like Lithium. A cursory reading of the strengths and weaknesses of this breakthrough market provides much-needed insights into this eco-friendly alternative.

Common approaches like trend-following strategies work well with commodities like Lithium, particularly when pricing is moving in a definite direction – either up or down. For bullish price movements, call options abound. For bearish price movements, put options abound. Market dynamics, and the state of the industry tend to determine what strategy is best to employ at any given time.

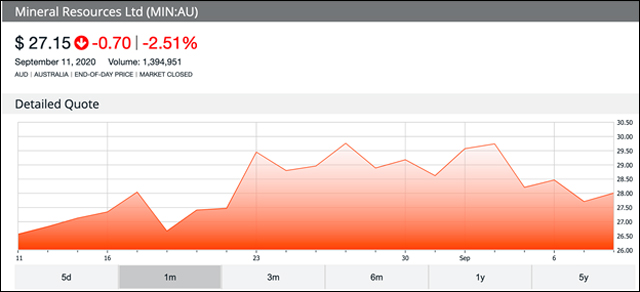

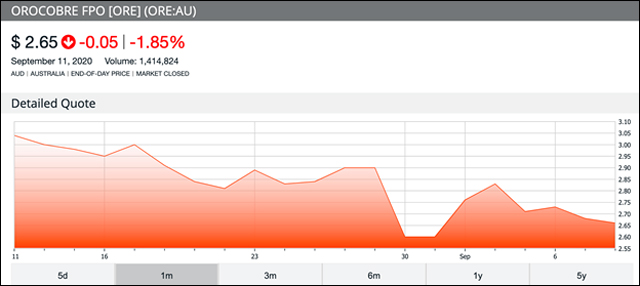

Trading systems like CCI (Commodity Channel Index) indicate strength or weakness when trading Lithium. When trading Australian Lithium stocks such as Pilbara Minerals (ASX: PLS), Mineral Resources (ASX: MIN), Orocobre (ASX: ORE), or Kidman Resources (ASX: KDR), it’s especially important to understand how these companies are performing vis-a-vis market capitalization, price/earnings, yield, value (undervalue or overvalue) and analysts’ expectations.

While commodities like Lithium can be traded in their raw form in futures markets, they can also be traded as stocks (equities) with mining companies. A basket of different commodity holdings is recommended as a balanced approach to a Lithium portfolio of investments.

What Real-World Applications Does Lithium Have?

From a technical perspective, Lithium is widely used in ovens and ceramics, cooking tops, and heat resistant glass. From a future-oriented perspective, Lithium is already in high demand in travel and transportation, with Lithium-powered electric vehicles, scooters, and hybrid vehicle technology. There are limitless applications for Lithium in the field of renewable and non-renewable energy.

In Australia, Lithium is primarily mined from two resources, notably salt lakes which house Lithium-enriched brines, and Lithium minerals from spodumene. In Australia, this precious element is largely available through spodumene. As of December 2017, an estimated 1662+ kilotonnes of proved and probable ore reserves of Lithium were recorded in Australia. Thanks to many new mines currently under development, Lithium is proving to be one of the hottest new commodities in the world. The reserve life of Lithium mines in Australia was reported at 78 years at current production rates.

Will Lithium Become the Eco-Friendly Fuel Source for the New Global Economy?

A great degree of mining and exploration of Lithium takes place in Western Australia. While certainly a major contender among the top producing Lithium countries, Australia is positioned among the top 3 countries with its proven Lithium resources. The ranking nations include China #2, and Chile #1. What makes Lithium particularly attractive to traders and investors alike is its hedge-like status against the diminishing future prospects of fossil fuels like coal, oil, and natural gas.

Dubbed the ‘White Gold’ of Australian commodities, Lithium is worlds apart from nonrenewable energy sources, and it is a far safer option for the planet. While the inexorable swing towards Lithium is gaining momentum, traders have not lost sight of the short to medium term gains available through nonrenewable energy sources such as coal, oil, and natural gas. Lithium, in its own way is similar in part to ethanol as a fuel source for the new global economy.

Hot Features

Hot Features