The cryptocurrency markets have come a long way over the last eleven years. For anyone who’s been following, it’s been a rollercoaster ride. However, after emerging beaten and bruised from the ashes of the ICO boom in 2018, it’s becoming increasingly evident that cryptocurrencies have entered a new stage of maturity. Over the last two years, institutional investment has been flowing in at an unprecedented rate. Coinbase alone is now seeing $200-400m each week flowing in from institutional customers, according to CEO Brian Armstrong.

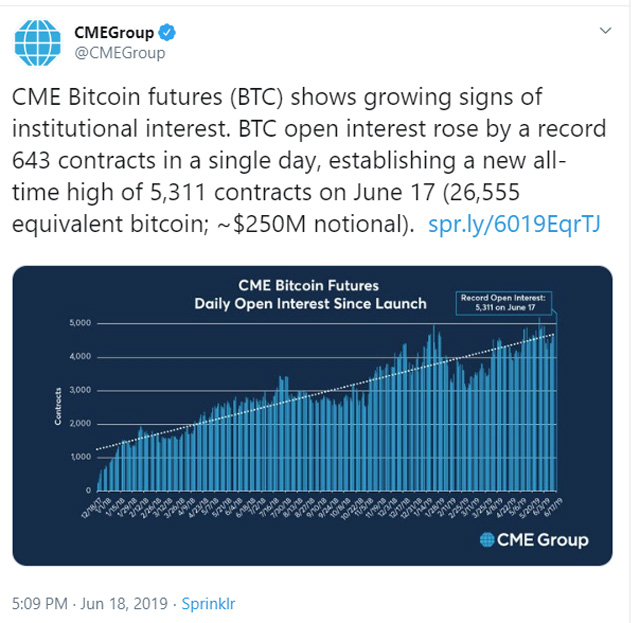

However, Coinbase currently only offers access to the spot markets. It’s the cryptocurrency derivatives markets that have proven to be fertile ground for growth during 2019, particularly for institutional investors. CME has reported record trading highs for its Bitcoin-backed futures, and there was much fanfare as Bakkt finally entered the market with its physically-settled Bitcoin futures contracts.

Bloomberg compared the growth in regulated crypto-futures trading to Moore’s law, stating that volume and open interest are currently doubling every 18 months.

For any institution looking to get into this burgeoning space, it’s easier than ever before. Due to the increased market maturity, there are now plenty of reliable sources to get started with cryptocurrencies and the underlying technology. For example, both IBM and Accenture have extensive libraries of information about blockchain and its use cases. The cryptocurrency media has also matured, with leading publications like CoinDesk and CoinTelegraph dominating the space with hot-off-the-press news 24/7. CoinMarketCap is the go-to for market data.

In terms of exchanges, institutions have more choices for digital asset and derivative trading than they ever have. Here’s a roundup of just a few options.

CME

CME was the first to the institutional market with regulated cash-backed derivatives back in 2017 along with competitor Cboe. However, the latter dropped out of the market earlier this year, meaning CME was able to capitalize on the 2019 Bitcoin price highs in June.

In September, the exchange filed with the U.S. Commodity Futures Trading Commission (CTFC) to double its position limit, increasing a trader’s maximum exposure from 5,000 to 10,000 BTC.

Recently, CME confirmed it would be launching a new cryptocurrency derivative – options on Bitcoin futures. It has since set a date of January 13 for the launch. The exchange also offers reliable indices on cryptocurrency pricing.

Bakkt

Bakkt entered the market in September this year with a sluggish start on its regulated, physically-settled futures contracts. Fortunately for the ICE-owned exchange, it now appears to be gaining traction.

Bakkt has confirmed it plans to beat CME to market with its own options on futures contracts, which it will launch in December. The company has also recently confirmed it would be introducing custodial services for institutional clients.

Deribit

Dutch crypto-derivatives exchange Deribit has been operating in the market since 2016. Open to both institutional and retail traders, Deribit has firmly established a place for itself on the market with around half a billion in daily traded volume. It’s managed this despite the apparent dominance of its main rival BitMEX, which has been beset by issues including a CTFC investigation.

Deribit’s USP is that it is the only venue offering cryptocurrency-backed options, which are European-style, cash-settled instruments. At the start of 2019, it expanded its product range into Ethereum-backed futures, perpetuals, and options.

Earlier this year, Deribit teamed up with Paradigm to launch the first-of-its-kind, institutional-grade, OTC block trading solution. Using the platform, institutions can directly negotiate crypto-derivative block trades with counterparties of their choosing via chat. Once agreed, the trades are settled automatically by Deribit, off the order book.

TroyTrade

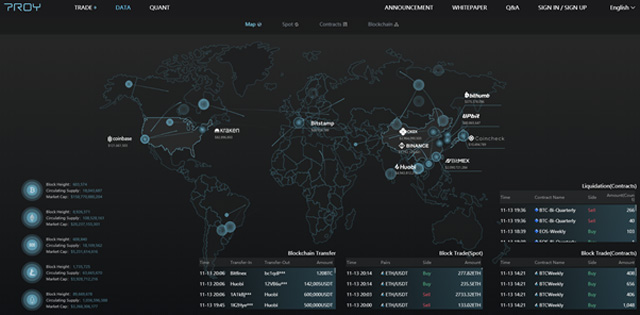

TroyTrade offers an all-in-one solution for any institutional investor wanting to get into cryptocurrency. It’s a prime brokerage service, providing access to global cryptocurrency liquidity pools from all major exchanges, covering spot markets and crypto-backed derivatives. Exchanges include Coinbase, Kraken, Binance, Bitstamp, and BitMEX, spanning all time zones.

Unlike the other exchanges mentioned here, pooling the global liquidity in this way gives access to hundreds of altcoin trading pairs. These offer new investment channels and the opportunity for potentially higher returns. This could be an attractive proposition, as altcoins generally remain more volatile while currently, Bitcoin is in a period of unprecedented relative stability.

TroyTrade also offers a brokerage service with real-time fund transfer and settlement, margin, and OTC services.

Along with trading and brokerage services, Troy users have access to a sophisticated data analytics platform providing extensive real-time information from spot and derivatives markets. Crucially, it’s also the only platform combining market data with on-chain data. This enables users to monitor blockchain activity, which represents actual market activity, as it’s happening.

Blockchain data can give far deeper insights than platforms such as CoinMarketCap, which have limited means of weeding out falsely inflated trading volumes.

TroyTrade’s data analytics tools.

Essentially, TroyTrade aims to do for crypto what Goldman Sachs does for the traditional markets.

Overall, the cryptocurrency markets are firmly into a new era of maturity, where the institutional infrastructure is evolving quickly. Nevertheless, there are still plenty of opportunities to take advantage of daily price movements through the spot markets or a growing variety of derivatives. For institutions, there has never been a better time to get into crypto.

Hot Features

Hot Features