Leading up to its October meeting from the 9th to the 11th of this month in Lima, Peru, the International Monetary Fund released its World Economic Outlook today. The release was skillfully crafted, including its title, “Uncertainty, Complex Forces Weigh on Global Growth.”

Maurice Obstfeld, IMR Economic Counsellor and Director of Research, described the global economic situation perfectly. “Six years after the world economy emerged from its broadest and deepest postwar recession, the holy grail of robust and synchronized global expansion remains elusive.”

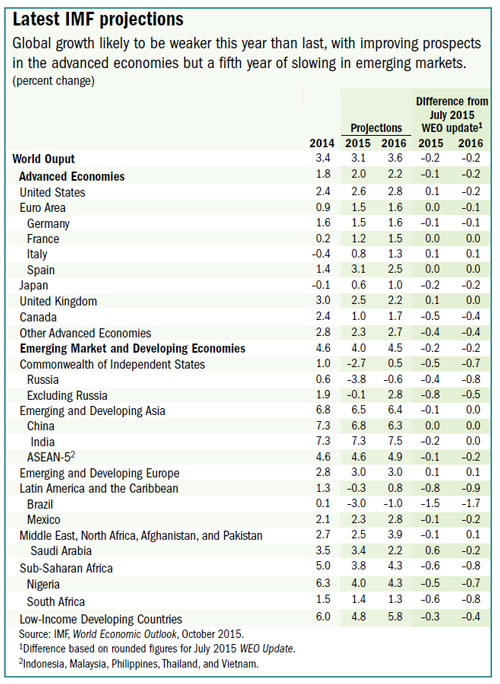

He explained that “The new forecasts mark down expected near-term growth marginally but nearly across the board.” But that was certainly meant to temper what he said next. “Downside risks to the world economy appear more pronounced than they did just a few months ago.” (See IMF chart below.)

Global expansion remains elusive…risks to the world economy appear more pronounced.

Investors run the risk of missing the really big picture. I am a strong advocate of understanding how individual companies are position to weather economic storms in order to make wise investments. However, there are times when one must also understand the complexity of the storm in order to understand the capabilities of individual companies.

I am writing this column from the U.S. state of South Carolina where we are experiencing statewide flooding of historic proportions, following up to two feet of rain over three days. There are many people here who think that now that the crisis is over the rain is over because the rain has stopped. Yet thousands are being told to evacuate entire communities that will be in the path of swollen rivers and streams that have yet to crest as they flow all the way to the coast.

One container ship has already been lost at sea, unable to make it through the storm itself. About a dozen people in the interior of the state have already drowned. Neither the ship nor those citizens were adequately prepared for the storm, although they knew well in advance that it was coming. Others who survived the storm will not be prepared for the aftermath.

I said that to say this: The world is still in survival mode following an economic storm that “officially” begin seven years ago in 2008. If anyone believes that we are clear of the aftermath of what has actually been a convergence of storms, I am inclined to call them fools. A few may prosper, but even some of the strong may not be able to survive a floundering global economy combined the repercussions of a a metamorphosis in the Chinese economy and a geopolitical and military instability that is spreading into Europe with the waves of refugees determined to escape the apparently unstoppable spread of ISIS.

These factors and others will continue to have an impact on many companies, especially those with operations in or near immediate areas of conflict and those who have been heavily involved with supplying commodities to build China’s infrastructure. The IMF noted that current conditions could cause “immense economic and social costs.”

Don’t be scared. Be aware and be prepared.

It is not my purpose to scare, but to prepare investors. We can’t keep expecting new record highs for stocks when the global economic drivers are seemingly beyond anyone’s control. All that the IMF and other agencies are able to do is react.

Consider your investment portfolio wisely. Know which companies are best prepared to sustained prolonged or worsening economic conditions. That is, in my opinion, the best strategy for a sustainable and profitable portfolio. The reason that no one is saying that there is a silver lining behind this cloud is that there may not be one there.

Image courtesy of mrpuen at FreeDigitalPhotos.net

Hot Features

Hot Features