U.S. economy shrinks by 4.8 per cent in first quarter

The American economy has suffered its worst contraction in over a decade as a result of the ongoing Covid-19 crisis.

A January survey by Deloitte found that 97 per cent of American CFOs thought an economic slowdown had either already begun or would start sometime in 2020.

However, none of these executives could have foreseen that the U.S. economy would suffer its worst quarter since the Global Financial Crisis as a result of a novel coronavirus outbreak from China.

In the first quarter of 2020 the American economy contracted at an annualised rate of 4.8 per cent. As significant as this figure is, it does not reflect the true scale of the pandemic’s impact on the world’s largest economy.

Kevin Hassett, a senior economic adviser to the White House, has predicted that U.S. GDP will fall by 30 per cent at an annualised rate in the next quarter.

While debate still rages as to the veracity of China’s coronavirus statistics, per official figures the United States is currently the nation worst-affected by the outbreak, with over 1 million confirmed cases and more than 59,000 deaths.

The widespread lockdowns imposed to limit the spread of the virus have haemorrhaged the U.S. economy, with businesses of all sizes struggling to cope and laying off staff despite government rescue packages.

In the past five weeks, 26 million Americans have filed for unemployment benefits. Although this in itself is a record figure, it is thought to belie the true level of joblessness as many states are struggling with a backlog of claimants. Indeed, Goldman Sachs has forecast America’s unemployment rate to rise from its current 4.4 per cent level to 15 per cent by mid-2020.

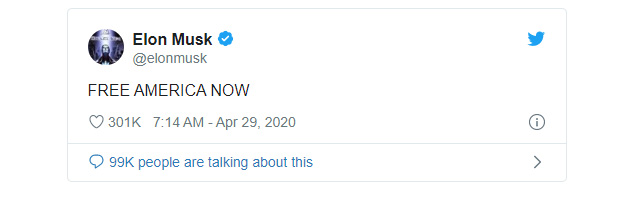

Such an outcome would be surpassed only by the Great Depression. Hoping to limit the economic devastation wrought by Covid-19, there have been increasing calls to ease the restrictions currently imposed. Most notably Tesla and SpaceX founder Elon Musk, who recently praised Texas for reopening businesses and tweeted: “FREE AMERICA NOW.”

Any relaxations would now only limit the devastation triggered by Covid-19, as the latest figures and Goldman’s forecasts indicate, the damage to the American economy has already been done.

Hot Features

Hot Features