World Bank sees a downtrend growth in China’s and other South East Asian economies even as it foresees an accelerating global growth in the next three years.

In its April release of the East Asia and Pacific Economic Update, World Bank expects growth in China in 2014 and 2015 to be at 7.6 percent and 7.5 percent, respectively. In 2013, the world’s second largest economy grew by 7.7 percent.

The economies of the Association of South East Asian Nations (ASEAN) members are also expected to slow down. Except for Malaysia, which is expected to grow by 4.9 percent this year, Indonesia and the Philippines will grow only by 5.3 percent and 6.6 percent, respectively, while Thailand will remain unchanged at 3 percent.

“The larger Association of Southeast Asian Nation (ASEAN) economies are operating close to potential and facing tighter global financial conditions and higher levels of household debt,” the report stated.

In contrast, global growth is projected to accelerate to 3.0, 3.3, and 3.4 percent, in the next three years through 2016.

“The recovery will be led by high-income countries, aided by reduced policy uncertainty, a slower

pace of fiscal consolidation, and renewed private sector activities,” the report said.

World Bank noted tighter credit, higher debt servicing costs, ongoing fiscal consolidation, reduced profits from commodities, and higher import costs resulted in weaker demand, particularly investment, in Indonesia and Malaysia, caused by weaker currencies, while implementation delays and political uncertainties were held by the bank as the major contributors of the weak domestic demand.

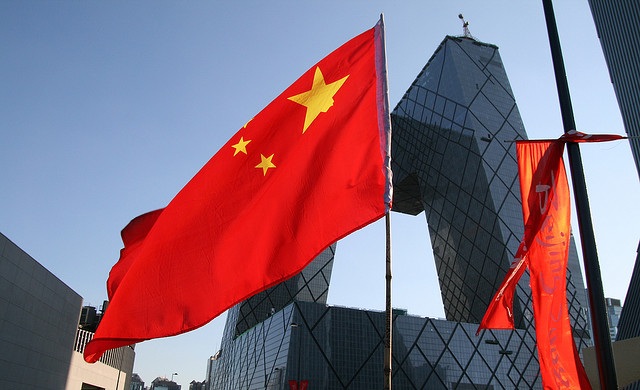

Chinese Reform

But unlike the ASEAN nations, which have “limited rooms to ease policies”, World Bank said China’s economic support program helped stabilize growth and enabled investment as the main driver of demand and rebalancing the economy, despite the Chinese economy ‘s “bumpy start” this year.

“It is a significant policy move, indicating a political will to reduce state interventions and address government-led distortions in the economy,” the report stated.

“If implemented, the reforms will have a profound impact on China’s land, labor, and capital markets, and enhance the long-term sustainability of its economic growth. Some reforms are also likely to support growth in the short term.”

The Chinese economy accounted for 28% of the global growth in 2013, up three percentage points from 2012.

Hot Features

Hot Features