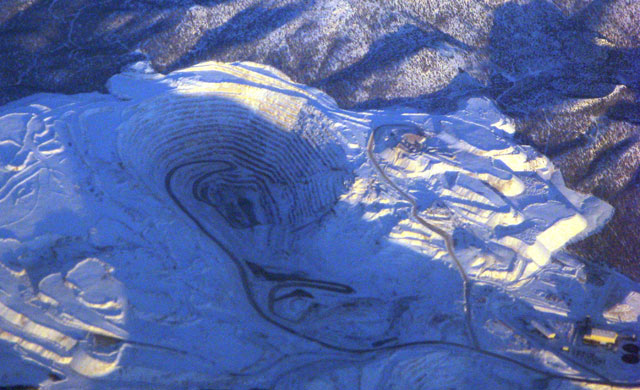

An unnamed investor wanting to acquire a majority interest in an iron ore project northwest of Greenland blasted the trading of Red Rock Resources plc (LSE:RRR) shares, sending the stock on top of the London Stock Exchange’s percentage gainers shortly after midday, London time.

The slow and quiet buy and sell of stakes in the mineral exploration firm earlier today was rocked after the company revealed it received an offer letter from the undisclosed investor, who seeks a 51% interest in the Melville Bugt Iron Ore Project, resulting in the trading of over 87 million shares hours after the offer was disclosed.

International Media Projects Ltd., a private firm representing the investor, said the offer values the shareholding at US$17.75 million, and vouched for the investor’s credibility, saying the unknown entity has the financial capacity and expertise to fund the offer and develop the project.

Red Rock holds 25% interest in the North Atlantic Mining Associates Limited (NAMA), the company holding exploration rights to the Melville Bugt Iron Ore Project, through an earn-in agreement, which provides an option for the London-based explorer a further 35% interest.

Enticing Offer

According to Red Rock, the offer put forward by the investor in a letter sent yesterday, 27th November, it may receive between US$10.7 and US$16.1 million for a portion of shareholding, which – when sold – will be reduced to around 14% to 29% upon completion.

Further, a royalty equal to 2% of the value of the iron ore produced will be given to the selling shareholders on a pro-rated basis.

But that may come at a later time. The Melville Buqt Iron Ore Project is still in the exploration stage with a mineral resource estimate yet to be defined and scheduled to be released by the end of December 2012, following this year’s exploration programme.

The investor also agreed to spend the first US$2 million capital needed by NAMA to complete next year’s work programme.

Red Rock shareholders’ consent may have to be obtained, together with geological and legal due diligence proceedings before any agreement will be signed and the NAMA owners will have until 10th January 2013 to decide.

Meanwhile, the deal offers additional cash to Red Rock, which has only around £ 352,838 (US$563,729) as at 30th June 2012.

At 2:30 PM GMT, shares of Red Rock jumped 63.9% to 1.59 pence.

Hot Features

Hot Features