Shares of Caza Oil & Gas, Inc. (LSE:CAZA) are enjoying their 64-week high today as its first operated well in the highly prospective Bone Spring formation south east of New Mexico, United States hit pay and further de-risked the acreage, which is now the focus of the firm’s exploration programme for the year.

By 11:00 AM GMT, Caza shares traded on the Alternative Investment Market of the London Stock Exchange reached as high as 18.69 pence at an aggregate volume of 10 milion shares following the announcement that the Copperline prospect has been flowing oil, gas and frac fluid for the past week.

The Copperline prospect is the third well drilled within the Bone Spring formation with two others, Bradly and Quail Ridge, successfully encountered a combination of oil and natural gas.

According to Caza, Copperline well has produced about 1,865 barrels of oil equivalent in the past 24 hours and has been flowing at an average rate of 1,688 boe.

“This is an exceptionally good result for Caza’s first operated horizontal Bone Spring well. We are very pleased with the result and the value created for our shareholders,” Caza’s Chief Executive Officer, Michael Ford, said in a statement.

De Risking Potential

Caza holds 45% working interest and 45.9% net revenue interest in the said project which targets the Bone Spring sands, which have also been the focus of independent oil producers in the New Mexico, resulting in increase in leasing of acreages in the oil producing US state.

Several other prospects are lined up by the company, including the Forehand Ranch, which is currently undergoing horizontal drilling after successfully encountering oil and natural gas as indicated by mud log shows.

“We hope to build on this initial success,” CEO Ford continued, saying that the success in Copperline has de-risked a large portion of the Bone Spring acreage.

The company is now down to 3,300 acres of potential play following the success of Copperline, which de-risked about 700 acres of the 4,000 acres of potential play it mentioned back in August from the said acreage.

Lagging Share Price

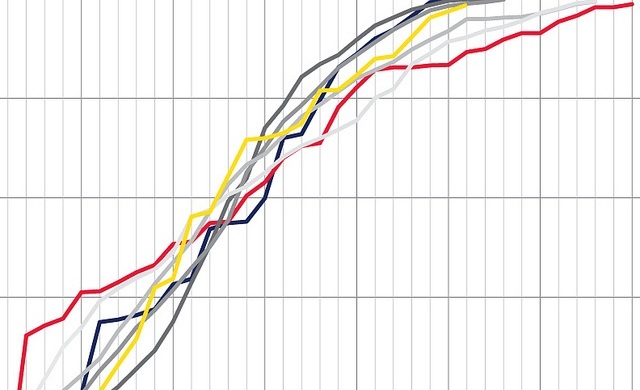

Caza’s share price has reached as low as 6.375 pence this year while awaiting update from the company’s exploration projects in the United States, where its operations are focussed.

The company’s share price has reached as high as 60 pence, in November 2010, when the company revealed successful results from its interests in Texas and Louisiana.

ADVFN’s resident analyst, Azeez Mustapha, has recommended a buy on the stock a week ago, and his prediction has again proved right as the company has just proven significant potential from its acreage.

At 12:00 PM GMT, shares were up 33.9% to 18.75 pence, the same as how it was priced back on 16th August 2011, when it released its quarterly results for the second half of 2011 fiscal year.

Hot Features

Hot Features