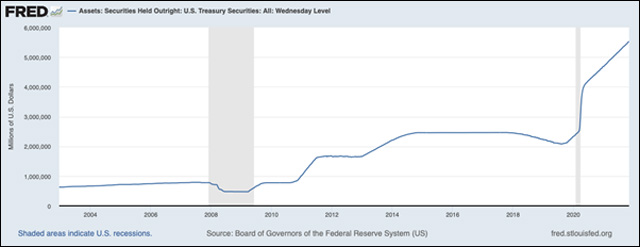

As expected, the FOMC decided to start reducing the monthly pace of its net asset purchases by $10 billion for Treasury securities and $5 billion for mortgage-backed securities.

Thus, purchases of Treasury bonds will be reduced to $70 billion and purchases of mortgage-backed securities to $35 billion per month by the end of November. At the beginning of December, these amounts will be cut to $60 billion and $30 billion per month, respectively. The regulator also made it clear that it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook.

Speaking of inflation, although the FOMC acknowledged that inflation “is elevated”, it has again used the term “transitory”. According to the regulator, supply and demand imbalances related to the pandemic and the reopening as the main driver have contributed to a significant increase in prices in some sectors. For this reason, the FOMC maintained the target range for the federal funds rate between 0 and 0.25% and expects that it is appropriate to maintain this range until labor market conditions have reached levels consistent with full employment and inflation is on track to moderately exceed 2% for some time.

The Bank of England, on the other hand, opted once again to keep its main interest rate at the historic low of 0.1% as risks to growth (pandemic developments, supply-side tensions) remain. On the other hand, the committee voted 6-3 to maintain the sovereign bond purchase program at £875 billion and the corporate bond purchase program at £20 billion.

So for now, the only change was that the BoE has lowered GDP growth for this year by 25 basis points to 7%. In addition, the bank acknowledged that there are some signs of a natural cooling of domestic demand, so it would not be necessary at this point to raise interest rates. On the inflation side, the bank has warned that prices will continue to rise in the coming months, partly due to higher energy prices, in addition to higher goods and food prices.

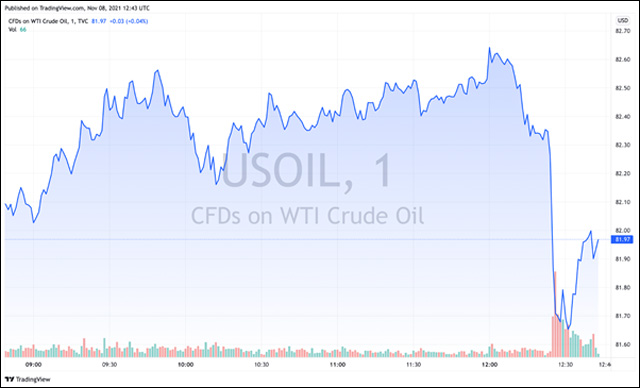

The problem is getting worse as OPEC members continue to waive requests from importing countries and the United States to increase production by 600-800 thousand barrels per day. The communiqué following the meeting of the alliance’s energy ministers stated that in December the cartel will maintain the current plan to increase production, increasing it by only 400 thousand barrels.

Hot Features

Hot Features