There is no need to present one of the most iconic characters in the financial industry. What should be mentioned is that Warren Buffett doesn’t have a crystal ball, thus investors shouldn’t blindly follow his suggestions or positions. For example, in 2008, Buffett bought a large stake in the stock of ConocoPhillips as a play on future energy prices. However, this turned out to be a bad investment, because Buffett bought in at too high of a price, resulting in a multibillion-dollar loss to Berkshire Hathaway.

Last Saturday he published a 15-page annual letter to shareholders with many comments about the pandemic and the impact on the businesses but didn’t say anything about topics that are key to his conglomerate, such as the market environment amid a tumultuous year.

Here are other key takeaways from Buffett’s letter and Berkshire’s annual report:

- Berkshire earned $42.5 billion in 2020 according to generally accepted accounting principles (commonly called “GAAP”). Thus, its earnings fell an astonishing 48%! The four components of that figure are $21.9 billion of operating earnings (decreasing 9%), $4.9 billion of realized capital gains, a $26.7 billion gain from an increase in the amount of net unrealized capital gains that exist in the stocks we hold and, finally, an $11 billion loss from a write-down in the value of a few subsidiaries and affiliate businesses that they own. All items are stated on an after-tax basis.

- Berkshire Hathaway bought a record $24.7 billion of its own stock as its captain struggled to find better ways to invest his enormous pile of cash. Most importantly, it is likely to keep purchasing its own stocks. As a result, investors’ ownership in all of Berkshire’s businesses by 5.2% without requiring the first to do anything.

- The company “made no sizable acquisitions” in 2020, besides making a small amount of progress in paring the cash pile, which fell 5% in the fourth quarter to $138.3 billion. Buffett has struggled to keep pace with the flow in recent years as Berkshire threw off cash faster than he could find higher-returning assets.

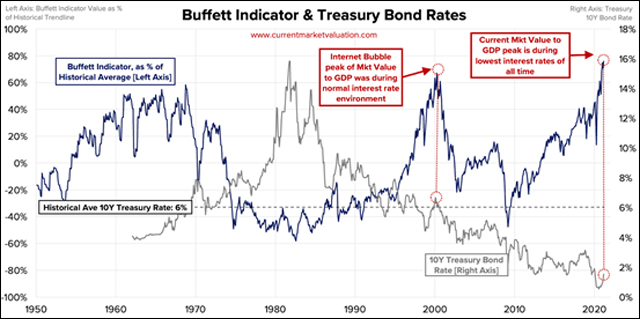

- The bond market is not where you want to be right now. “Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.” Risky loans, however, are not the answer to inadequate interest rates.

- The US energy sector is in need of a major overhaul. The costs will be huge.

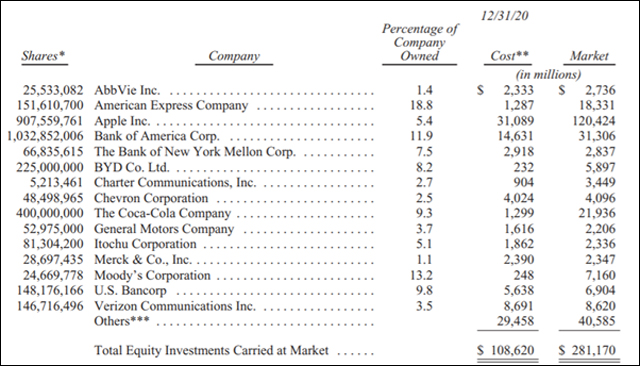

- Its second and third most valuable asset is Apple, where Berkshire owns 5.4%. He began buying Apple stock late in 2016 and by early July 2018, owned slightly more than one billion Apple shares (split-adjusted). He began building a stake in the iPhone maker in 2016 and spent just $31.1 billion acquiring it all.

- Buffett admitted error in the $37.2 billion deal he made in 2016. That year, Berkshire purchased Precision Castparts (“PCC”), and Buffett paid too much for the company. He was simply too optimistic about PCC’s normalized profit potential. “Last year, my miscalculation was laid bare by adverse developments throughout the aerospace industry, PCC’s most important source of customers. In purchasing PCC, Berkshire bought a fine company – the best in its business. I was wrong, however, in judging the average amount of future earnings and, consequently, wrong in my calculation of the proper price to pay for the business.”

- Berkshire Hathaway registered a near 14% gain in operating earnings in the fourth quarter, compared YoY thanks to a record quarter for railroad BNSF since its 2010 purchase and one of the best quarters for the manufacturing operations since mid-2019.

We could mention that Berkshire made dramatic changes to its stock investment portfolio in 2020. In particular, he sold all his JPMorgan Chase shares, while also buying up then quickly cashing out airline stocks. Additionally, Buffett entered drug stocks and invested in IPO stock Snowflake and increased positions in Verizon stock and Chevron. While underperforming, both stocks offer attractive dividend yields. Pfizer’s stake has been replaced by AbbVie, Merck, and Bristol-Myers Squibb. Berkshire also exited Barrick Gold after slashing its stake in Q3 and open a position in the miner in Q2.

Finally, earlier in 2020, Berkshire Hathaway got rid of Costco, Delta Air Lines and all of its airlines’ stocks amid the coronavirus hit to global air travel. Overall, Buffett’s selections normally must meet a wide range of criteria, including:

Top 25% of all stocks in terms of five-year annual EPS growth rate.

15% or greater sustainable growth.

12% or better return on equity.

15% or greater sustainable EPS growth rate.

Hot Features

Hot Features