Slowly but steadily the global economy is recovering from the pandemic slump, global economic activity is growing and output is expected to expand around 4 percent in 2021 but still remain more than 5 percent below pre-pandemic projections.

As an increasing number of people in the United States are returning to normal life, starting to spend money outside the home, inflation is expected to rise even above the Federal Reserve’s 2% target. As the President of the Federal Reserve Bank of Dallas said, “The temporary jump in inflation or rise won’t surprise me — the question for me will be how persistent is it.”

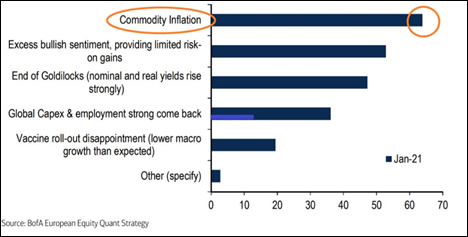

The situation has reached the point where many began talking about hyperinflation. Back in March of last year, Deutsche Bank economist Oliver Harvey warned that helicopter money could lead to hyperinflation and much more. Potential inflationary pressure also should be seen as a risk factor to S&P 500 profit margins as companies struggle to loft prices at the same pace as rising input costs.

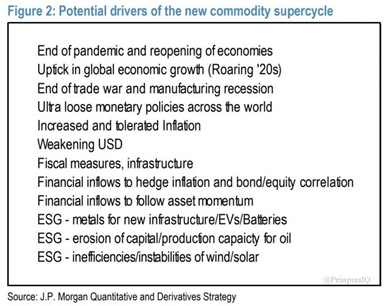

Thus, it shouldn’t be a surprise that the CRB commodities index is up 9.46% year to date and +24.49% in the past 6 months. JP Morgan even called for a commodity supercycle. According to them, prices may also jump as an “unintended consequence” of the fight against climate change, which threatens to constrain oil supplies while boosting demand for metals needed to build renewable energy infrastructure, batteries, and electric vehicles.

Consumers have $322 billion saved up and additional stimulus is coming on behalf of the Fed. Most probably this will create a boom for the industries that were most hurt by the pandemic. It is worth mentioning that even Copper prices started to increase as inflation forecasts hot-up.

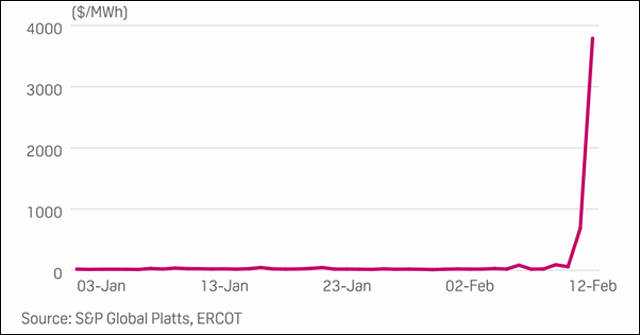

However, that is not the only reason behind inflation. In particular, spot electricity prices on Texas electric grid skyrocketed more than 10,0000% amid bad weather and generator outages. According to SPGlobal, ERCOT (The Electric Reliability Council of Texas) North Hub real-time next-day Feb. 15 on-peak power prices skyrocketed to trade above $3000, up from its previous settlement of $325/MWh. Next-day prices broke high records, and they had not seen similar four-digit prices since Aug.

In the Midcontinent ISO, Indiana Hub on-peak jumped to its highest price since January 2019 to trade above $100/MWh. West power prices, on the other hand, surged to the triple digits, the highest prices of the year so far, as a Pacific storm system was forecast to hit the Pacific Northwest to generate heavy snow and ice accumulations from Portland to Seattle.

Finally, gas processing plants across Texas are shutting as liquids freeze inside pipes, disrupting output just as demand jumps. And oil production in the Permian Basin, the biggest U.S. shale play, is moderating as wells slow down or halt completely.

Hot Features

Hot Features