The cats and mouse game between Republicans and Democrats continues. The Trump administration agreed on a stimulus proposal of $1.8 trillion, but House Speaker Nancy Pelosi called it “insufficient”, rejecting it. Thus, hopes over a new relief package before the elections have been shuttered. A similar situation can be observed either with Brexit talks. The parties have until October 15th to decide the future of Britain’s position in the European Union.

Talking about Covid-19, many countries are experiencing a drastic increase in the number of cases. As a result, governments are reimposing social distancing rules, however, without announcing similar lockdowns we saw in March. Howbeit, even these measures will have consequences on the economy. In order to start talking about full recovery or, at least, the path to it, the world needs a well-functioning vaccine, improved therapeutics, or herd immunity. On the positive side, online businesses will continue growing.

In terms of perspectives, earlier in June, the IMF forecasted a severe global GDP contraction in 2020. Now they estimate that developments in the second and third quarters were somewhat better than expected, allowing for a small upward revision to our global forecast for 2020. IMF expects a partial and uneven recovery in 2021. To add a bit of criticism, they don’t consider the political crisis in the US after the elections. US President Donald Trump has refused to commit to a peaceful transfer of power if he loses November’s election.

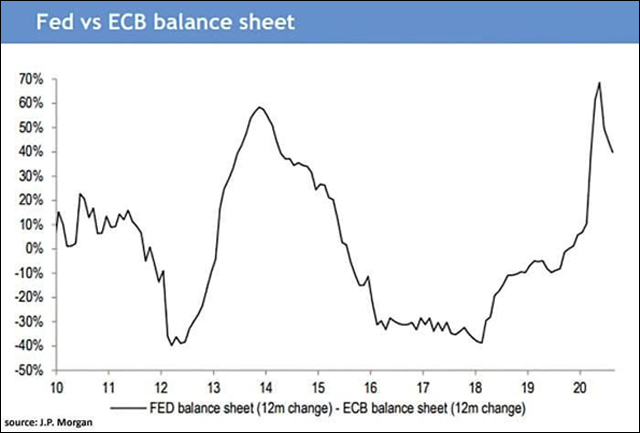

Clearly, none of that would be possible without government interventions. On the first side, we wouldn’t have to deal with that crisis if it wasn’t for global lockdowns, on the other hand, consumption and job markets would have fallen even further if not for extraordinary policy measures. Overall, governments have provided around $12 trillion in fiscal support to households and firms. In the case of the US, the end of previous stimulus packages would mean a new wave of layoffs and furloughs.

In the first week of October, the number of Americans who applied for jobless benefits decreased, but hopes for the further recovery diminish amid another wave of corporate layoffs. Initial jobless claims filed through state programs slid to 840,000 in the week ended Oct. 3 from a revised 849,000 in the prior week. It is also worth mentioning that despite the fact that the unemployment rate has fallen to 7.9%, the number of permanent layoffs has jumped, meaning that the remaining 10.7 million lost jobs will take longer to return. Companies that are suffering most from the pandemic are in sectors like travel, hospitality, and energy.

In Canada, the Reserve Bank of Australia’s statement seems to be prepared for easier monetary policy, despite keeping its cash rate of 25 bp. Are we going to see another rate cut on November 3? Well, that depends on the economic situation. The Bank of England could also announce a rate cut, together with an increase in Gilt purchases

In Europe, we have a second wave of coronavirus, low inflation, strengthening euro, and Brexit uncertainty. Those are the ingredients for the Pandemic Emergency Purchase Program expansion and extension. The crucial date will be the October 29 – ECB meeting will discuss and give a clue of its intent before moving in December.

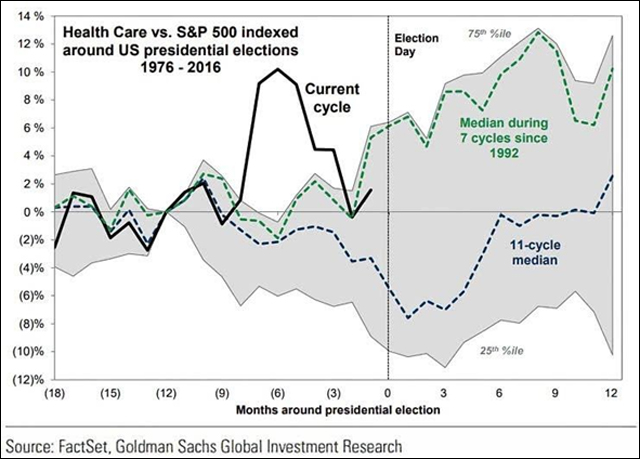

Chart of the week

Macroeconomic Data & Events

October 12: BoE’s Haskel and Bailey will speak. Also, it is the US holiday Columbus day.

October 13: Consumer Price Index and Federal budget, UK employment change, Germany inflation, UK employment change, and Euro area, and Germany ZEW index.

October 14: Japan industrial output, Spain inflation, Euro area industrial production, and US PPI.

October 15: EU Summit, US second presidential debate, US Weekly unemployment claims, France inflation, China new yuan loans, total social financing, M2, and South Korea unemployment rate.

October 16: The US industrial figures and retail sales, EU inflation print.

Hot Features

Hot Features