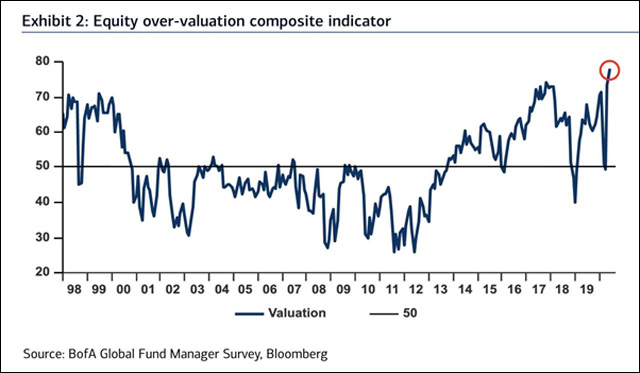

Coronavirus is back on track with rising cases in the U.S., Germany, and China. Beijing, China’s capital, reimposed a travel ban to stop new coronavirus infections. Nevertheless, global stock markets seem to ignore the risk. Investors truly believe the economic rebound is around the corner, whilst a record percentage of money managers see the stock market as overvalued, according to the Bank of America Global Fund Manager Survey. On the other hand, there was an escalation in geopolitical tensions between India and China and also between North and South Korea.

On the positive side, China’s economic rebound continues, with industrial production growing 4,4% YoY in May, up from 3.9% growth the previous month. Retail sales, which include spending by households, governments, and businesses, fell 2.8% year-on-year last month, an improvement on the 7.5% decline in April, but steeper than the median forecast for a 2% drop in the Caixin survey.

In addition, the Fed announced its decision to increase the support. Thus, no matter what happens in the economy, the market will grow until the money inflow stops. Under the Secondary Market Corporate Credit Facility, the Federal Reserve Bank of New York will lend, on a recourse basis, to a special purpose vehicle that will purchase in the secondary market corporate debt issued by eligible issuers. The SPV will purchase in the secondary market:

- Eligible individual corporate bonds;

- Eligible corporate bond portfolios in the form of exchange-traded funds (“ETFs”); and

- Eligible corporate bond portfolios that track a broad market index.

The Reserve Bank will be secured by all the assets of the SPV. The Department of the Treasury will make a $75 billion equity investment in the SPV to support both the Facility and the Primary Market Corporate Credit Facility. The initial allocation of the equity will be $50 billion toward the PMCCF and $25 billion toward the Facility. The combined size of the Facility and the PMCCF will be up to $750 billion.

In other words, the Fed will begin buying a broad and diversified portfolio of corporate bonds to support market liquidity and the availability of credit for large employers.

It is also worth mentioning that the Trump administration is preparing a nearly $1 trillion infrastructure stimulus plan. It will be directed to roads and bridges, but would also set aside funds for 5G wireless infrastructure and rural broadband. House Democrats have offered their own $500 billion proposal to renew infrastructure funding over five years. The question now is how long the administration’s draft would authorize spending or how it would pay for the programs.

Meanwhile, Donald Trump is losing support. According to the latest polls, Joe Biden and the Democrats are taking the lead. Does it mean that the trade war with China will reemerge?

By the way, former national security adviser John Bolton is now allowed to move forward and publish his tell-all book. June 23 is the day to watch out.

In the case of Europe, 27 leaders are still trying to reach an agreement on the proposed €750bn stimulus plan. Unfortunately, it has triggered division among EU countries. Will they manage to bridge the differences? So far, no consensus was reached.

Meanwhile, Brexit negotiators finally make some progress. Last week, the British government announced that relaxed controls will apply for goods coming into the UK from the EU for a period of six months.

On the macroeconomic side, U.S. retail sales registered a record increase in May, growing nearly 18%, as thousands of stores reopened and lockdown measures were eased. Clothing and accessories sales were up 188% MoM in May, but still down 63% in comparison to March levels. Apparently, the helicopter money approach actually works.

Industrial production, on the other hand, improved only 1.4% in May, below the 3.0% consensus. The initial jobless claims data were also disappointing. There was almost no change in those receiving unemployment benefits from May 30 to June 6.

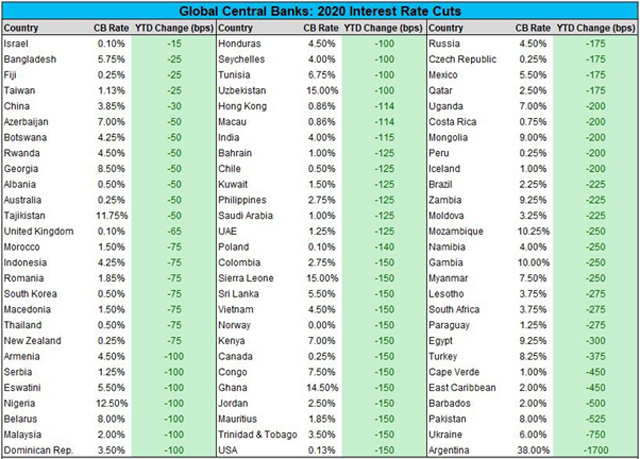

Policy changes

The Bank of England announced a £100B increase in its asset purchase target. The Norges Bank left its policy rate unchanged at zero. Brazil’s central bank announced a 75 bps rate cut, the Bank of Russia lowered its Key rate 1%, whereas Taiwan’s central bank kept rates unchanged.

Chile’s central bank also left rates unchanged at 0.5% but approved the use of non-conventional liquidity and credit support. The Central Bank of Chile will be implementing a special asset purchase program over the next six months, worth USD8 billion.

The Swiss National Bank has not changed policy or deposit rates but mentioned that it will continue to provide the banking system with fresh liquidity via its COVID-19 Refinancing Facility to ensure that companies in the real sector do not become insolvent simply for lack of liquidity. Currently, the Swiss Average Rate Overnight, the key policy rate, and the sight deposit rate are at -0.75%.

Data of the year

Macroeconomic Data & Events

As the economy reopens, the macro slowly improves. The flash PMI updates for the US, Europe, and Japan should give an insight into how things are going. It is also important to keep an eye on the IMF updated forecast.

Besides that, the following countries will announce monetary policy decisions: New Zealand, the Philippines, Thailand, Hungary, and the Czech Republic. In the US, we will get the data for durable goods orders, home sales, house prices, personal spending, income and price data, the University of Michigan consumer sentiment survey, and regional manufacturing surveys. For Europe, the flash PMI data for the Eurozone, Germany, France, and the UK, as well as the IFO survey for Germany will be released.

Most importantly, the EU could decide whether the European recovery fund will see the light or not.

Hot Features

Hot Features