This year ahead, we are in damage control mode. People are cutting all expenses to the minimum, meaning we are going to see a massive drop in consumer demand for the next 12 months. On a year to date basis only 2 sectors are showing positive growth – Tech (+5,26%) and Communication Services (+0,15%). Top losers were Energy stocks (-35,91%), Financial Sector (-28,78%) and Industrials (-21,64%).

Last week, many of the big US retailers reported their first post-lockdown results. As expected, the vast majority of them suffered very serious losses. Many brick-and-mortar retailers have been forced to tap credit lines, fire employees and suspend dividends and buybacks in order to stay afloat. Even though, J Crew, J.C. Penney, and Neiman Marcus Group filed for bankruptcy after failing to cope with market uncertainties and mounting debt. Macy’s, on the other hand, said it could rack up operating losses of up to $1.11 billion in the first quarter. Walmart, in turn, registered unprecedented growth.

In order to understand if your portfolio is doing well or not so, you would have to compare it with the benchmark, for example, previously used S&P 500. It will also give an insight on whether passive investing (Beta) is more convenient or a hands-on approach (Alpha) should be implemented. In other words, whether the average investor should look for alpha or beta results from his or her portfolio.

To measure how well an investment performed compared to its benchmark, you can use the Alpha Calculator. It allows checking if investment decisions were good or bad.

Despite certain negativity, the major U.S. indexes grew over 3% on optimism over the reopening of the economies. Another possible reason for the positive sentiment could be an announcement from a pharma company AstraZeneca that is looking forward to develop a coronavirus vaccine. The U.S. Department of Health and Human Services (HHS) agreed to provide up to $1.2 billion to accelerate British drugmaker AstraZeneca’s vaccine development and secure 300 million doses for the United States.

Nevertheless, geopolitical tensions are back on track with China planning to impose a new security law on Hong Kong and the U.S. looking forward delisting Chinese companies from U.S. exchanges.

Monetary or fiscal policy changes

- The Reserve Bank of India (RBI) on Friday cut repo rate by 40 basis points (bps) to 4% from 4.40% and reverse repo by as much to 3.35% from 3.75%. The bank rate stands reduced to 4.25%.

- Argentina is trying to escape default after missing the bond payment. For now, creditors have agreed to extend negotiations on restructuring $66 billion in foreign debt.

- The South African Reserve Bank has announced an additional rate cut, of 50 basis points. Thus, the current repo rate to 3.75% per annum, with effect from 22 May 2020. The prime rate moves to 7.25%

- Turkey’s monetary policy committee once again lowered the benchmark rate by 0.5% to 8.25 percent.

- The Bank of Japan decided to launch a new lending facility that aims to channel more funds to small and midsize businesses suffering from the economic blow of the coronavirus pandemic. New funding for banks is estimated to reach Yen30 trillion ($280 billion).

- Abu Dhabi completed a USD3 billion tap of its recently issued package of five, ten, and 30-year debt sold in April. It placed USD1 billion at each maturity, at 135 and 150 basis points over US Treasuries and at 3.25%, in line with the earlier tranches: the final pricing was 30-35 basis points below initial guidance.

- Kingdom of Belgium launched a USD1 billion 10-year deal on 18 May, with initial price guidance of mid-swaps plus 37 basis points area.

- The UK placed GBP7 billion of 0.5% 2061 debt priced at 0.5852%, bringing total sales in the financial year from April to GBP98.8 billion.

Macroeconomic Data & Events

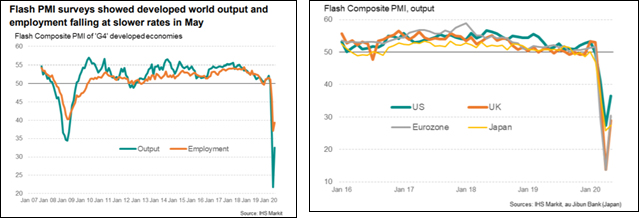

The key data in the week ahead will be a fresh estimate of US GDP in the first quarter. Besides that, other GDP updates will be released, from India, Singapore, Taiwan, Germany, France, and Italy. So far, PMI data showed a record of global economic contraction in April, pointing to recessions in many cases. Even though, it is worth mentioning that rates of decline are slowing down.

May 25: U.S. Memorial Day holiday; U.S. markets closed; Germany GDP (Final, Q1), Ifo surveys (May).

May 26: Germany consumer confidence, Gfk; S&P/Case-Shiller 20-City Composite Home Price Index; U.S. Consumer Confidence Index; and New home sales from U.S. Census Bureau.

May 28: US GDP QoQ, Initial Jobless Claims, Pending home sales, and Durable goods orders.

May 29: The week ends with the University of Michigan Index of Consumer Sentiment and U.S. Personal income and consumer spending. In GB we will know consumer confidence, Gfk.

A special thanks to an Economist, Guillermo Padron for his remarks on the subject of the information

Hot Features

Hot Features