One more time, markets have changed places – North American side closed with gains, whilst the good part of European and Asian Indexes finished the week losing positions. In particular, S&P 500 gained 3,5%, Nasdaq Composite increased 6%, Industrial Dow Jones improved 2,56%, UX 100 Index went up by 0,59%, DAX registered a 0,39% upgrade, whereas Euro Stoxx 50 Index movement fell 0,68%. Nikkei 225 went up by 2%, IBOVESPA Index decreased 0,30%, while the Hang Seng Index fined the week falling 1,68%. Finally, the Russian Moex Index and Spanish Ibex 35 lowered 0,34% and 2,01% correspondingly.

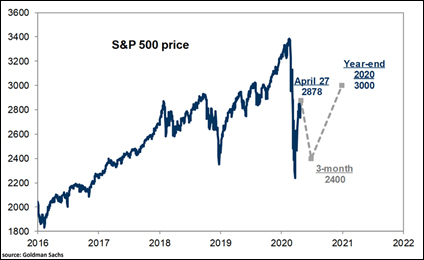

The uncertainty has reached the point where big banks cannot agree on whether it is time to buy stocks or not. Investment bank Goldman warned, given the uncertain outlook for economic growth, the quick return of valuations to February levels is a result of recent stimulus measures, and not stronger potential returns. Others believe that the tech giants were responsible for the market’s recovery. Thus, it shouldn’t be a surprise that Goldman Sachs has set a price target of 3000 by the end of 2020, and a new mid-year S&P 500 target of 2400.

However, we shouldn’t exclude the possibility that firms are encouraging investors to change their portfolios as they make money from trading fees. In this context, it is worth mentioning that BlackRock Inc. Chief Executive Officer Larry Fink stated that “as bad as things have been for corporate America in recent weeks, they’re likely to get worse.” Mass bankruptcies, empty planes, cautious consumers and an increase in the corporate tax rate to as high as 29% cannot benefit the economy…

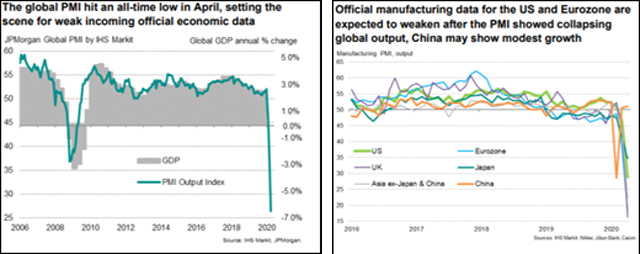

According to SPGlobal, a slump in domestic and foreign demand amid lockdowns at home and abroad has pushed emerging market (EM) economies into recession. The economic recovery will be uneven across EMs, and will crucially depend on the effectiveness of public health and economic responses. The potential for downgrades is highest in the homebuilders, real estate, consumer products, and utilities sectors.

They expect GDP growth for Asia-Pacific to fall to 0.3% in 2020 before a gradual recovery, implying a two-year income loss of over US$2 trillion. In 2020, corporates could see on average 10% to 15% less revenue, and banks may incur over US$400 billion in extra credit costs because of the outbreak.

The US Treasury

The US Treasury Department announced on Monday its plan to borrow $3 trillion during the current quarter to cover the massive cost of the federal government’s response to the coronavirus crisis. It would require a daily bill/notes purchase of almost $ 40 billion from now and until the end of Q2. In addition, the Congressional Budget Office said that it expects the federal budget deficit to hit $3.7 trillion by the end of fiscal year 2020—more than four times the current deficit at the halfway mark of the fiscal year.

The U.S. situation — April 2020

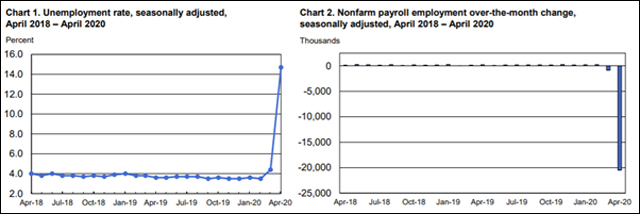

Total nonfarm payroll employment fell by 20.5 million in April, and the unemployment rate rose to 14.7 percent. Employment fell sharply in all major industry sectors, with particularly heavy job losses in leisure and hospitality. Excluding government hiring and firing, private-sector payrolls plunged by 19,520,000, versus the forecasted decline of 22,000,000 after falling by a negatively-revised 842,000 in March.

The number of unemployed persons who reported being on temporary layoff increased about ten-fold to 18.1 million in April. The number of permanent job losers increased by 544,000 to 2.0 million.

US-China trade talks are back on track

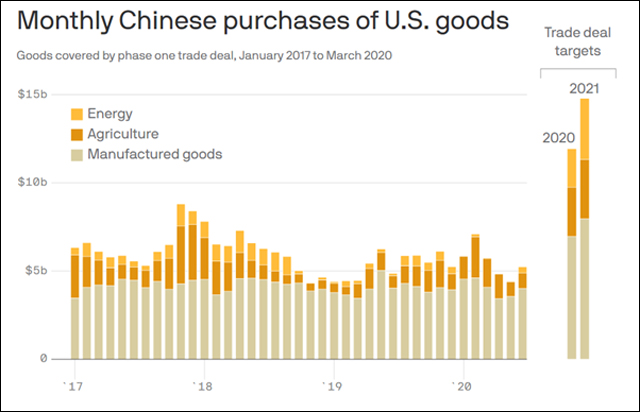

On Friday, U.S. President Donald Trump said he was “very torn” about the future of the agreement signed in January. According to Reuters, the two Trump cabinet officials said in a joint statement that both sides “agreed that in spite of the current global health emergency, both countries fully expect to meet their obligations under the agreement in a timely manner.” Even though, deep uncertainty surrounding the U.S.-China relationship remains.

According to Axios, in turn, China is nowhere near meeting the “phase 1” trade agreement. China is apparently not making purchases on pace for a $200 billion increase, it is now $21.2 billion behind — not even halfway to its target on a monthly basis.

Macroeconomic Data & Events

This week we are going to know retail sales and industrial output numbers, which will provide some insight into how steeply economies may collapse in the second quarter. Inflation data will be also released. In the case of China, we will get industrial production and retail sales data alongside a slew of other indicators including investment. Policy action meanwhile comes from the central bank of New Zealand. Finally, GDP data will be released for Japan, Malaysia, Hong Kong SAR, the UK, Germany, Poland, the Czech Republic, Hungary and the Netherlands.

May 11: Inflation reports for Denmark and Norway, SPES unemployment, together with the latest Riksbank minutes and US inflation expectations.

May 12: China inflation data, the NFIB small business optimism index, the final Norwegian GDP readings for the first quarter. In addition, Fed’s Bullard, Harker, and Mester will speak.

May 13: The preliminary UK GDP readings for the first quarter, Industrial production figures for the UK, and the Swedish inflation report.

May 14: US initial jobless claims and Swedish inflation expectations. France’s unemployment rate (Q1), Germany and Spain inflation (Final, Apr), India WPI (Apr), IEA oil market report (May), China new yuan loans, total social financing.

May 15: GDP data for Germany, Finland, Denmark and the Euro area. We will also get the latest industrial production and retail sales figures for China and the US. The week will end with the New York Fed manufacturing report and the Michigan sentiment index.

Hot Features

Hot Features