Despite the negative macroeconomic data, markets still show surprising increases. It can be mainly contributed to the news of a gradual withdrawal of containment measures in most European countries, and most importantly in the US. As a result, the week ended DAX Index growing 3,31%, Euro Stoxx 50 Index improving 4,23%, IBEX 35 gaining 2,61%. North American Indexes, in turn, closed in the red zone. This occurred against the backdrop of Donald Trump’s threats to reignite the US-China trade war over coronavirus. In addition, he claimed to have seen evidence showing the virus originated in a Chinese laboratory. Is it part of the re-election campaign?

Besides that, the document published by the Five Eyes (the US, UK, Canada, Australia, and New Zealand) suggests that China deliberately hid the news of the appearance of coronavirus and destroyed evidence of experiments with COVID-19 in laboratories. It also claims that the Chinese government silenced its most vocal critics and scrubbed any online skepticism about its handling of the health emergency from the internet. Should we expect a new escalation?

Central banks

As expected, the U.S. Federal Reserve Board kept interest rates unchanged. Even though, the Fed also announced two adjustments to its programs. 1) It widened the Payroll Protection Program lenders to include non-depository institutions. 2) It is expanding the Main Street Lending Facility to include some larger companies.

The European Central Bank, in turn, rolled out its cheapest ever loans for eurozone banks and said it would consider expanding a €750 billion ($815 billion) bond-buying program, amplifying its firepower to contain the economic fallout from the coronavirus pandemic. Besides that, it could lower the rate on June TLTRO, which is now set at minus 75 bp.

Macroeconomic data of the week

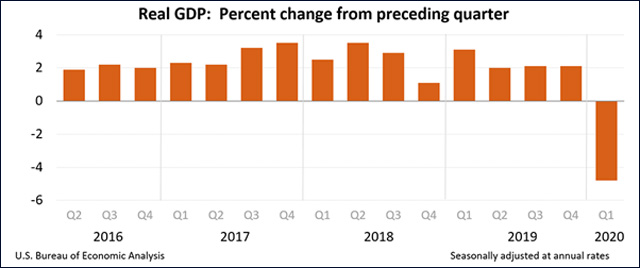

US GDP

As expected, real gross domestic product (GDP) decreased at an annual rate of 4.8 percent in the first quarter of 2020. In the fourth quarter of 2019, real GDP increased by 2.1 percent. Current‑dollar GDP decreased 3.5 percent, or $191.2 billion, in the first quarter to a level of $21.54 trillion. In the fourth quarter, GDP increased by 3.5 percent, or $186.6 billion.

The decline in the first-quarter GDP was, in part, due to the response to the spread of COVID-19, as governments issued “stay-at-home” orders in March. This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.

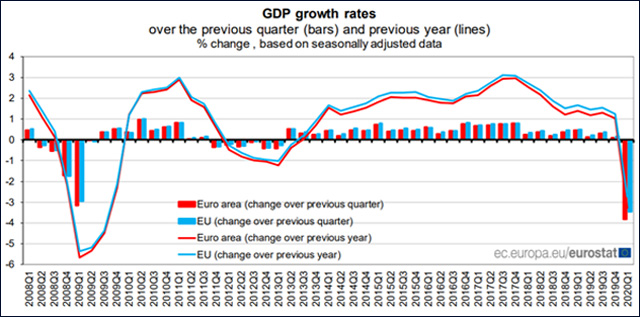

Eurozone

The eurozone economy contracted by 3.8% in the first quarter, compared to the last three months of 2019. France, on the other hand, entered a technical recession, contracting 5.8% in the first three months of 2020 vs last quarter of 2019.

German retail sales dropped at their fastest rate in March, since January 2007. The German statistics office said Thursday that monthly retail sales fell by 5.6% during the month. Berlin has slashed its GDP forecast for 2020 to -6.3% from a January estimate of 1.1%.

Spain contracted 5.2% in the first quarter of 2020 when analysts had forecast a 4.4% decline. Eurostat showed that the unemployment rate rose to 7.4% in March from 7.3% in February. The statistics office also showed that inflation could drop to 0.4% in April, from 0.7% in March.

Business survey indicators registered very weak Swedish business sentiment and a German IFO that fell to the ground, suggesting that EPS estimates still are excessively high.

Companies

Coronavirus has triggered a shift toward digital channels, products, and services across categories. In this context, it shouldn’t be a surprise that major technology companies have been among the strongest performers. Alphabet reported higher revenue but lower profits than expected. Microsoft and Facebook exceeded investors’ expectations. Demand for cloud computing saw an increase as more people began working from home. Apple and Amazon announced largely better than expected results. Demand for Amazon’s eCommerce got a boost from the closure of physical stores. Nevertheless, shares of both companies declined as the impact of coronavirus-related restrictions weighed on their results. Netflix, on the other hand, announced it had added 16 million new subscribers last quarter. Twitter also announced record-high First-quarter user growth.

Still, it is important to mention that the risk of a wave of bankruptcies has drastically increased. According to NYtimes, business filings under Chapter 11 of the federal bankruptcy law rose sharply in March, and attorneys who work with struggling companies are seeing signs that more owners are contemplating the possibility of bankruptcy.

In case of the energy industry, so far, Whiting Petroleum and Diamond Offshore Drilling, filed for bankruptcy. More expected to come as U.S. exploration and production companies struggle with the unprecedented combination of slumping demand and excessive supply while laboring under often-heavy debt loads.

Fitch Ratings is warning that more than $43 billion of high-yield bonds and leveraged loans in the energy sector will default in 2020. In this context, it is worth mentioning that Wells Fargo, along with JP Morgan, is the largest lender to the oil and gas industry.

Macroeconomic Data & Events

May 4: PMI data for China, Sweden, and Norway. We will also have US factory orders and the ISM index for New York. Finally, we will get U.S. factory orders.

May 5: US ISM non-manufacturing, RBA Interest Rate Decision, and U.S. trade balance.

May 6: EU Summit; Pmi, Composite and Caixin from China and ADP National Employment Report

May 7: Norges Bank Interest Rate Decision, US Jobless Claims, and US consumer credit.

May 8: US Nonfarm payrolls and wholesale inventories.

Hot Features

Hot Features