The intrinsic value idea is a clear concept (see yesterday’s newsletter) but any numbers produced from it are bound to be fuzzy because the (c) element of the projected annual owner earnings is very difficult to estimate. A reminder:

| Owner earnings and intrinsic value |

| (a) Reported earnings |

| Plus (b) depreciation, depletion, amortization, and certain other non-cash charges |

| Minus (c) amount needed to be spent on plant and equipment and incremental working capital the business requires to fully maintain its long-term competitive position and its unit volume. |

| (a), (b) and (c) TOTAL TO OWNER EARNINGS

Intrinsic value is the present value of the stream of future owner earnings after discounting. |

Despite its fuzziness it is incredibly important for not just investors, but for managers – they must understand it. Look for managers who do.

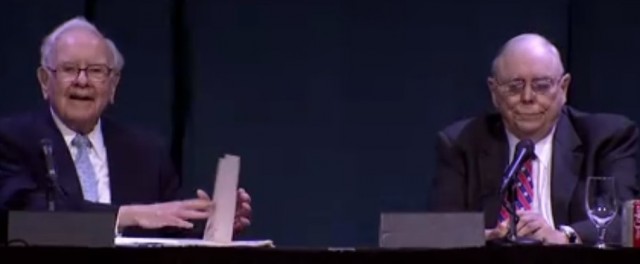

Warren Buffett expressed this very well in his 1994 letter:

“When managers are making capital allocation decisions – including decisions to repurchase shares – it’s vital that they act in ways that increase per-share intrinsic value and avoid moves that decrease it. This principle may seem obvious but we constantly see it violated. And, when misallocations occur, shareholders are hurt.

For example, in contemplating business mergers and acquisitions, many managers tend to focus on whether the transaction is immediately dilutive or anti-dilutive to earnings per share (or, at financial institutions, to per-share book value). An emphasis of this sort carries great dangers. Going back to our college-education example, imagine that a 25-year-old first-year MBA student is considering merging his future economic interests with those of a 25-year-old day laborer. The MBA student, a non-earner, would find that a “share-for-share” merger of his equity interest in himself with that of the day laborer would enhance his near-term earnings (in a big way!). But what could be sillier for the student than a deal of this kind?

In corporate transactions, it’s equally silly for the would-be purchaser to focus on current earnings when the prospective acquiree has either different prospects, different amounts of non-operating assets, or a different capital structure. At Berkshire, we have rejected many merger and purchase opportunities that would have boosted current and near-term earnings but that would have reduced per-share intrinsic value.

Our approach, rather, has been to follow Wayne Gretzky’s advice: “Go to where the puck is going to be, not to where it is.” As a result, our shareholders are now many billions of dollars richer than they w

………………To read more subscribe to my premium newsletter Deep Value Shares – click here http://newsletters.advfn.com/deepvalueshares/subscribe-1

Hot Features

Hot Features