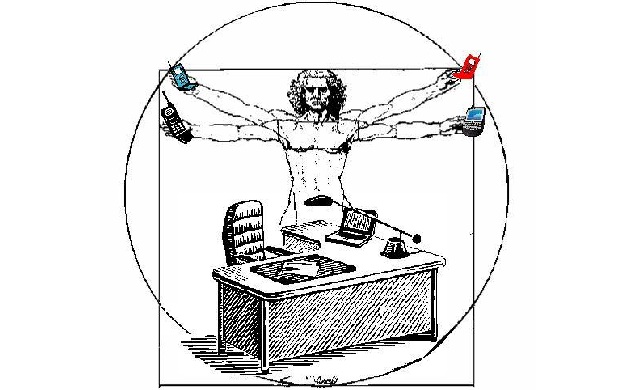

Exploring who will survive the evolution of technology.

Today’s competitive market hosts the ebbs and flows of several hundred technology companies’ stock prices. While many companies face disappointment others are smiling at continual growth.

In regards to technology, what is the most prominent smartphone? Walking the streets of London, you will certainly see Samsung Androids and Apple iPhones but how about those try-to-come-back-kids, Blackberry and Nokia?

Or better yet, how often do you see a tablet on the tube? Have those numbers risen recently?

A glimpse of the world around us reveals which technology companies are hot and which are not. In this technology evolution, phones are getting smarter and personal computers are becoming obtuse. The question is, who will stay on top or be forever left behind?

Recently Blackberry and Nokia relaunched their smarphones with little avail. Their stock prices reveal a gradual rise but with little comfort. Their success is not out weighing their costs of the launch.

“Nokia sells only a fraction of smartphones compared to Apple Inc… and Samsung Electronics Ltd…even though Lumia sales are growing, Nokia’s strenuous efforts to convincingly revitalize its once-world-leading handset business have yielded scant results,” says Juhana Rossi of the Wall Street Journal.

Blackberry is equally troubled as the BBC reports, “The company reported an $84m loss for its last quarter and refused to say how many devices running BB10 it sold – but it sold fewer phones in those three months than in the same period the year before.”

It looks like these once thriving competitors need to evolve if they want to keep up their numbers. In order to say afloat, Nokia and Blackberry have lowered the prices on their products.

“Competing with the Apples and Samsungs of this world is tough, and it’s a difficult climate to put out high-end products when the market is so dominated by a couple of players,” says Ovum telecoms analyst Tony Cripps in an interview with the BBC.

Meanwhile tablets stir fear in the formerly powerful PC as market research firm Gartner confirms global PC shipments fell 10.9% to 76 million in the second quarter, affecting the stock prices. Equally bad news for companies like IBM, Intel and Dell where computers are imperative to their markets. As a result, all three companies have experienced a decrease in stock prices.

According to BBC, Dell has taken such a significant decrease that, “Mr Dell has spent the past five months trying to persuade shareholders to approve the buyout proposal.”

Intel has lowered their expectations as the Wall Street Journal’s Don Clark explains, “Total revenue slid 5% in the second period, and Intel lowered its forecast for PC sales for the year. It now expects its revenue to be flat for all of 2013, versus its prior expectations for slight growth.”

Microsoft is also nervous. Who will they sell their windows 8 operating system if the sales of PC don’t rise? Trying to remain a competitor, Microsoft created the Surface tablet but upon the poor sales has nearly halved their prices.

“Microsoft made $4.5bn in the second quarter, but announced that it would take a $900m charge relating to poor sales of its Surface tablet,” says the BBC.

Over the past year, each company has experienced stock lows and in spite of their growth, are still facing difficult times. The game is sink or swim. As we watch these next few quarters, we will continue to decided who’s hot and who’s not but looks like, as Shakira may well have said, the stocks don’t lie.

Hot Features

Hot Features