In the world of trading—and in life—success rarely hinges on how much information you have, how fast your internet connection is, or what indicator you just discovered. The real difference lies in mindset. A single idea shared by comedian Jimmy Carr captures this perfectly:

“If you see the distance between where you are and where you want to be as your problem, that’s ambition.

If you see that distance as someone else’s problem, that’s entitlement.”

Simple. Clear. And yet profoundly misunderstood by many traders.

The Gap Isn’t the Problem—Your Interpretation Is

Every trader feels a gap between their current performance and the results they dream about. The question is: How do you interpret that gap?

- Ambition sees the gap as a personal project.

“I can learn this. I can improve. I can take responsibility for closing the distance.” - Entitlement sees the gap as an injustice.

“The market should be easier. My broker should give me better fills. Someone should tell me when to buy.”

The charts are the same. The gap is the same.

But the interpretation changes everything.

Entitlement Makes Traders Passive; Ambition Makes Them Accountable

Entitlement invites stagnation. It convinces traders that progress is something owed to them, not earned by them.

The entitled trader:

- Waits for trade ideas instead of building scanning routines

- Complains about stop-losses instead of adjusting position size

- Wants consistency without creating a consistent process

Ambition does the opposite.

The ambitious trader:

- Collects their own data

- Studies losses without excuses

- Refines signals, systems, and execution

- Accepts that mastery requires apprenticeship

And once the gap becomes your responsibility, you reclaim something powerful—control.

You can improve. You can refine. You can iterate.

And slowly, the gap starts to shrink.

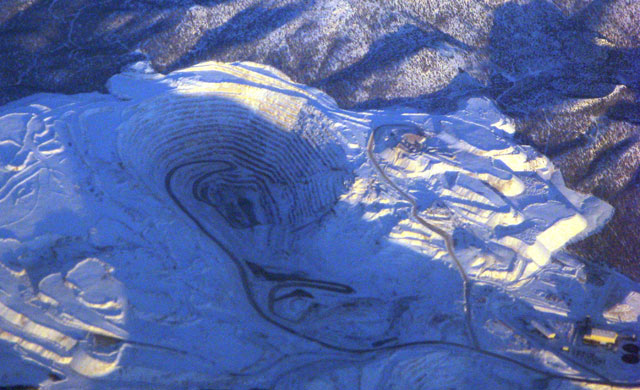

Source: create.vista.com

Trading: The Ultimate Meritocracy

Markets don’t care who you are, what you believe you deserve, or how badly you want to be profitable.

You cannot charm a chart.

You cannot negotiate with price action.

You cannot guilt a candlestick into moving your way.

Entitled traders lean heavily on the word “deserve.”

Ambitious traders lean heavily on the word “do.”

And the market consistently rewards the latter.

Ambition Builds Systems; Entitlement Builds Excuses

Behind every successful trader lies a system—structured, disciplined, repeatable.

Behind every struggling trader lies a collection of reasons why success hasn’t arrived yet.

- Signals do not generate themselves

- Themes do not announce themselves

- Risk management doesn’t automate itself

- Trading logs don’t fill themselves

Only ambition produces these building blocks.

Entitlement, on the other hand, clings to the fantasy of the “perfect indicator” or a secret shortcut only professionals know. It keeps traders chasing illusions instead of building foundations.

The Hard Truth—and the Hidden Opportunity

The distance between who you are today and the trader you aim to become is not a flaw.

It is your training ground.

Every chart you review is a step forward.

Every disciplined stop-loss is a lesson.

Every journal entry is evidence that the gap belongs to you—and you’re closing it.

Trading doesn’t require perfection.

It requires responsibility.

The traders who eventually break through are not the loudest, the luckiest, or the most gifted. They are the ones who quietly decide:

“This gap is mine. And I’m becoming the person capable of closing it.”

In that commitment—steady, humble, and unglamorous—ambition does its finest work.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features