Dollar Cost Averaging (DCA) is an investment strategy that involves regularly investing a fixed amount of money at scheduled intervals, regardless of the asset’s price. The basic idea behind DCA is to reduce the impact of market volatility on your overall investment by spreading out your purchases over time.

DCA involves consistent fixed investments, offering a stress-free alternative for navigating volatile assets. With enhanced market data and insights, investors now wield a more informed DCA application, providing a valuable tool to manage market volatility. This week, we assess the performance and effectiveness of DCA in the digital asset market, offering insights into its role in today’s investment landscape.

An Assessment Across Both Bullish and Bearish Market Phases

We take a close look at how investments perform by carefully checking risk-adjusted returns and comparing different assets and strategies. Our special method involves pretending to invest $10 every day from January 1st in 2019, 2021, and 2023. This helps us understand how different market periods affect the results. Discover the power of Dollar-Cost Averaging (DCA) in smoothing out the ups and downs of the market. Just keep in mind that we haven’t factored in transaction fees in this straightforward model.

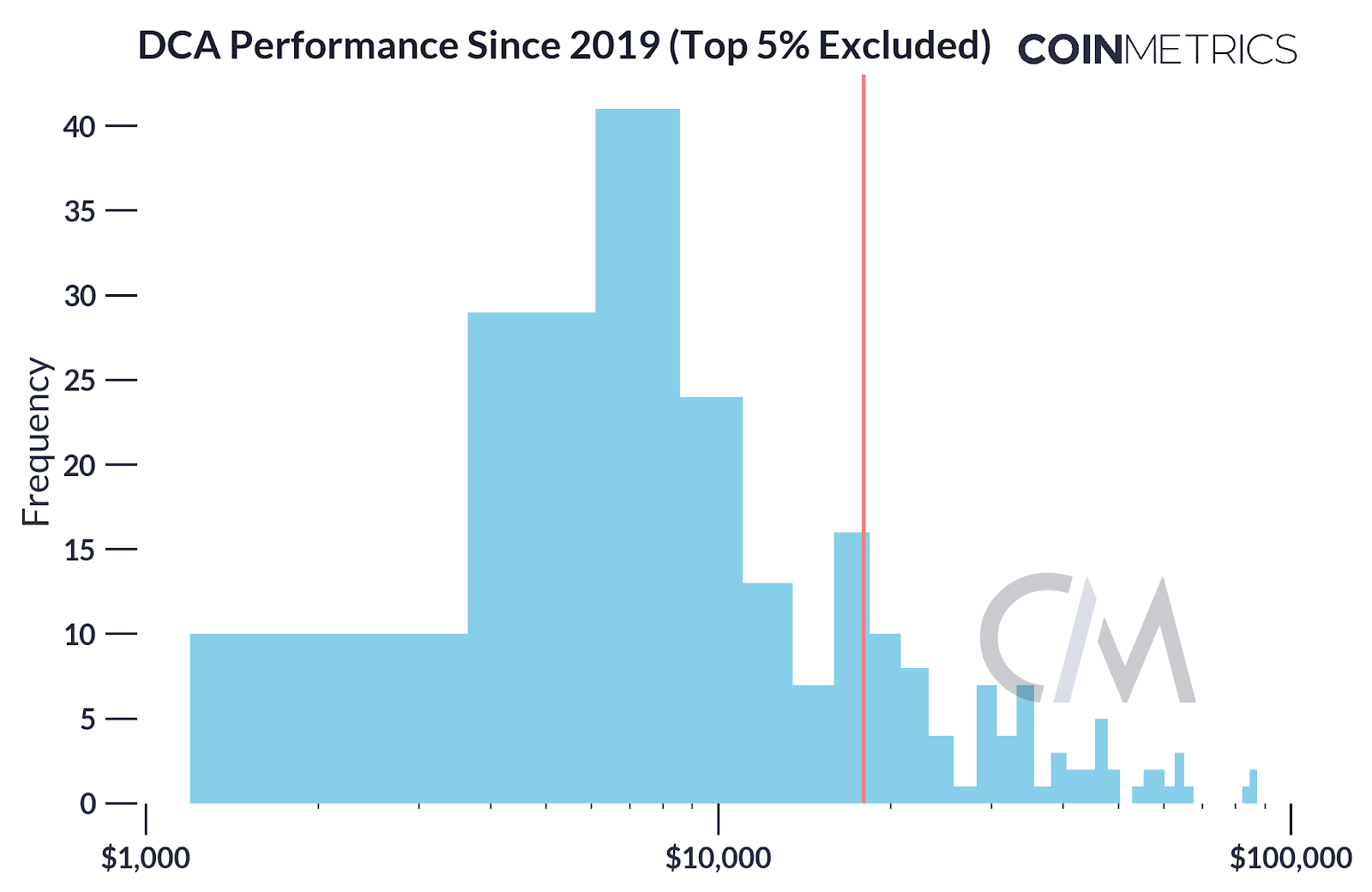

Dollar-Cost Averaging Performance Since 2019

Examining the chart, it’s evident that DCA’s performance has been commendable, though not without surprises. Surprisingly, around 60% of the tested assets fall below the breakeven point, with notable exceptions. The cumulative cash invested during this period amounts to $17,920.

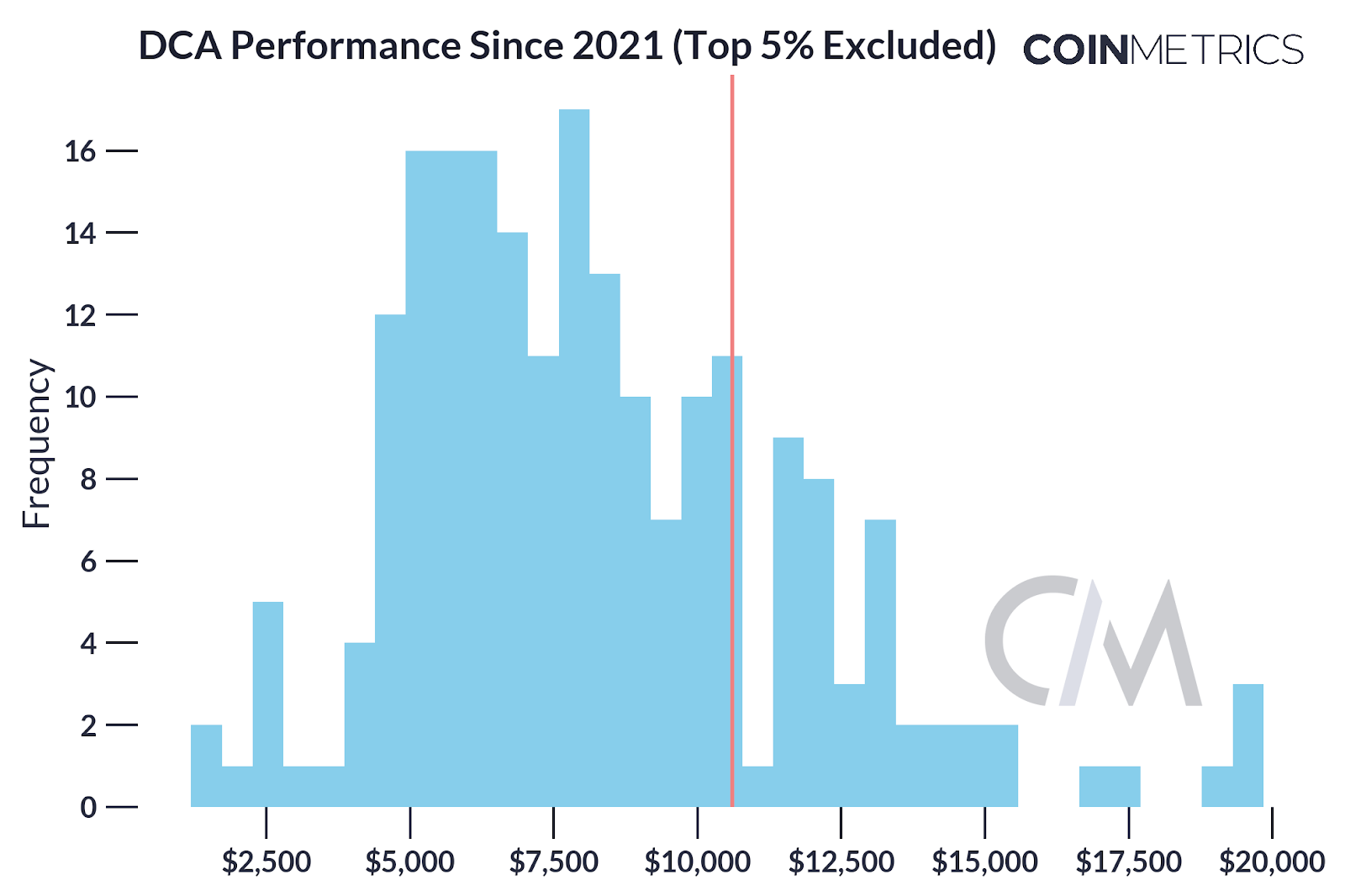

Dollar-Cost Averaging Performance Since 2021

In the volatile crypto market, where even seasoned investors can face losses, DCA emerges as a recommended approach. Designed to counteract emotional impulses during bull markets, DCA offers a balanced portfolio approach. Let’s explore evidence that shapes expectations when incorporating DCA into our investment toolkit.

Many assets haven’t fully rebounded, suggesting that daily DCA may not shield investors from losses. This underscores the importance of caution when entering a bull market, as prudence doesn’t always guarantee immunity from market uncertainties.

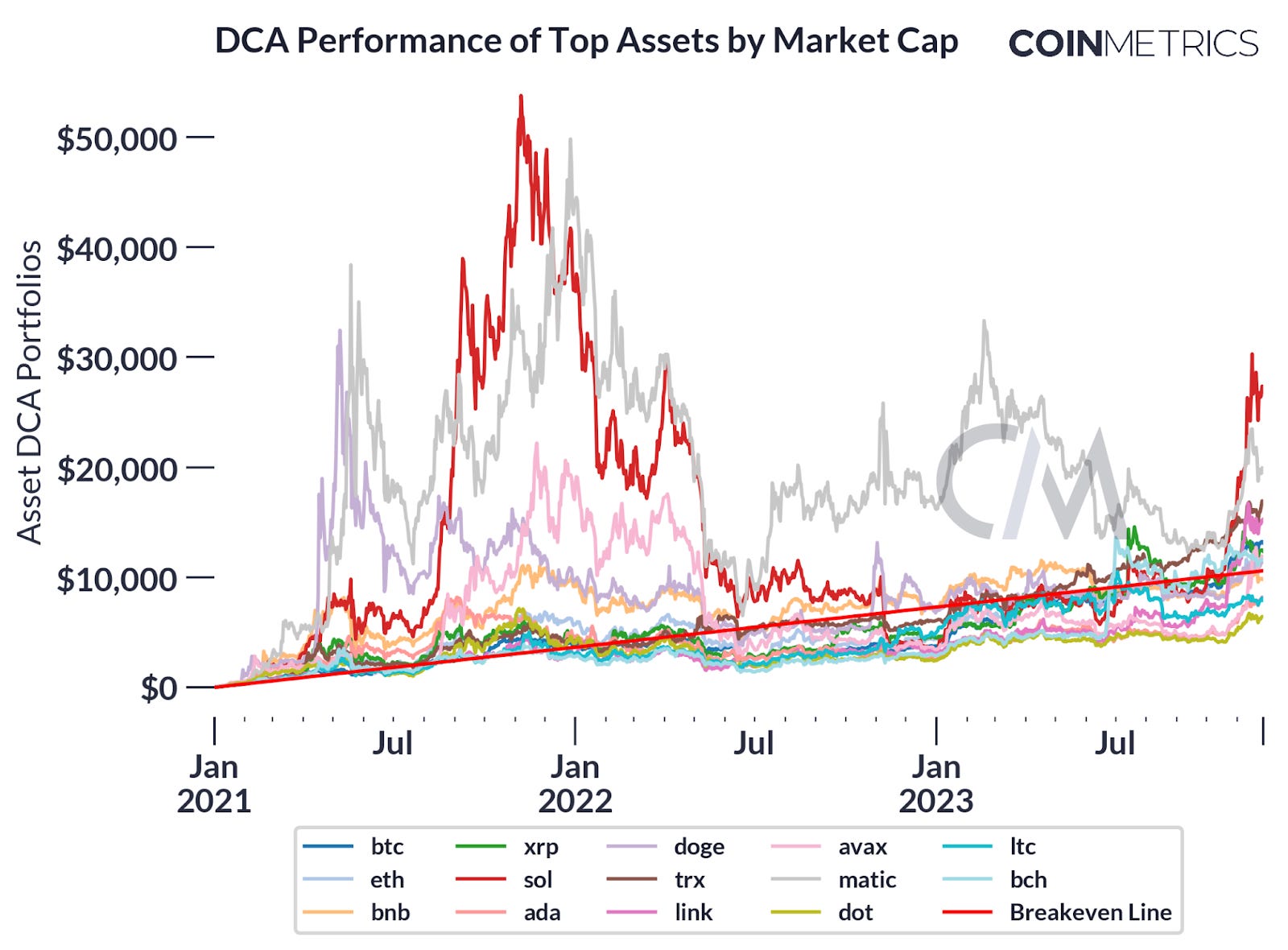

DCA Performance Among Top Assets Since 2021

With insights into return distributions, we turn our attention to DCA performance since 2021, focusing on the top 15 assets by market capitalization. Despite high capitalization, DCA portfolios can trail their cash equivalents. Noteworthy, SOL and MATIC outshine, boasting returns of 252% and 184%, leading the pack in our modeled DCA portfolios.

When we organize things into percentiles, we can spot the best-performing assets, as you can see in the graph. Looking at the Dollar-Cost Averaging (DCA) performance of assets in the top 5%, shown on a logarithmic scale, it really emphasizes outstanding performance. Interestingly, the newcomers to the market are leading the way in this category, and one of them, APT, stands out with an impressive 194 times the initial $10.6K investment.

BTC’s Resilience

Despite a challenging period from fall 2021 to fall 2022, bitcoin’s DCA strategy shines. Starting the daily $10 DCA at BTC’s all-time high of $67.5K on November 8, 2021, the portfolio would be up approximately 33% today. With a hypothetical $7,500 investment, the portfolio now exceeds $10,000, showcasing a positive turnaround in the spring of this year after spending most of 2022 in the red.

While historical success doesn’t guarantee future results, this performance underscores the advantage of prioritizing time in the market over attempting to time it. Even at the peak of a bull market, the benefits of consistent investment demonstrate their resilience.

Key Takeaways on DCA in the Digital Asset Market

Although Dollar-Cost Averaging (DCA) can help handle market ups and downs, it doesn’t promise guaranteed profits. The various results and instances where some investments don’t perform well highlight the limits of this strategy. DCA isn’t a universal fix; it depends on factors like transaction costs and choosing the right platforms. Incorporating DCA into an investment plan means doing your homework and adjusting to changes in the market, especially during significant events such as the upcoming Bitcoin halving. Staying informed and cautious is crucial for investors.

Learn from market wizards: Books to take your trading to the next level.

Hot Features

Hot Features