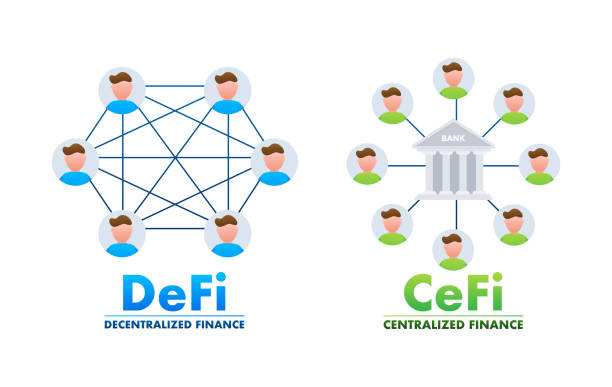

Welcome to the world of decentralized finance (DeFi), where financial services and tools, such as investments, lending, borrowing, trading, tokenized real estate, and insurance, are made available through decentralized websites. In contrast to traditional centralized finance, where banks and financial institutions typically act as intermediaries, DeFi operates on a peer-to-peer basis, facilitated by blockchain technology.

The increasing adoption of DeFi by users over the past three years demonstrates its immense potential, and the data speaks volumes about its transformative impact on the financial landscape.

Ranking the Decentralized Platforms

Analysts use specific criteria to assess the trustworthiness of DeFi platforms, considering factors such as launch date, community engagement, and Total Value Locked (TVL). While TVL is important, it can be misleading, as some projects attract capital quickly but lose user activity. Therefore, we emphasize platform longevity and a thriving user community, akin to how we evaluate traditional banks based on performance and customer satisfaction, not just size.

LIDO

Lido was introduced in tandem with the Ethereum 2.0 Beacon Chain, providing a liquid staking solution for Ethereum and other Proof-of-Stake (PoS) blockchains. This protocol offers non-custodial staking services, enabling users to stake their tokens without the need to lock assets or manage staking infrastructure.

It was launched in 2020 on the Ethereum blockchain. Its main service is liquidity staking. It has a Total Value Locked (TVL) of $13,900,000,000 and a community following of $181,849.

Uniswap (UNI)

Uniswap operates as a decentralized exchange within the Ethereum network, allowing users to autonomously and efficiently trade ERC20 tokens. This is achieved through an algorithm that facilitates trade matching by considering supply and demand within a liquidity pool, effectively eliminating the need for intermediaries and middlemen.

Uniswap was launched in 2018 on the Ethereum blockchain. It has a Total Value Locked of $3,200,000,000 and a community following of 1,179,582.

Aave (AAVE)

Aave, previously recognized as ETHLend, represents an Ethereum-based decentralized peer-to-peer marketplace designed for borrowing and lending digital assets. Within this peer-to-peer lending platform, borrowers and lenders can establish loan terms and execute them seamlessly through the use of smart contracts.

Aave was launched in 2017 on the Ethereum Blockchain to provide services of borrowing and lending. It has a Total Value Locked of $4,410,000,000 and a community following of 609,255.

Curve Finance (CRV)

Curve Finance is a decentralized exchange protocol that facilitates the swapping and trading of Ethereum-based assets. It distinguishes itself by actively providing liquidity to the markets through a market-making algorithm. This algorithm automatically engages in buying and selling assets to capitalize on bid and ask price spreads, encouraging users to contribute their funds to the collective pool and earn interest.

Curve Finance was launched in 2020 on the Ethereum blockchain to provide services such as borrowing, lending, and decentralized exchange. It has a Total Value Locked of $2,401,000,000 and a community following of 370,783.

Maker (MKR)

MakerDAO, operating on the Ethereum network, serves as a decentralized Collateralized Debt Position (CDP) platform backing the stablecoin DAI, designed to maintain a one-to-one value peg with the US dollar. Users have the option to initiate a Collateralized Debt Position (CDP) by depositing ether (ETH) or other Ethereum-based assets as collateral in exchange for DAI as a debt against their locked assets. The platform utilizes the MKR token for interest settlements, with both DAI and MKR being burned upon closure of the CDP.

Maker was launched in 2018 on the Ethereum network to offer the borrowing and lending of stablecoins. It has Total Value Locked of $5,130,000,000 and a community following of 301,906.

JustLend (JST)

JustLend, as the inaugural official lending platform on TRON, empowers users to engage in asset borrowing and lending while generating interest on their deposits. Interest rates within the fund pools are determined by the collective supply and demand dynamics of TRON assets.

Justlend was launched in 2020 on the Tron blockchain to provide borrowing and lending services. It has a Total Value Locked of $3,358,000,000 and a community followership of 58,577.

Getting Started with DeFi Platforms

In summary, there are various avenues for engaging with DeFi platforms:

Earning Yield: Explore the opportunity to generate “interest” on your crypto assets through platforms like Aave or Compound, which offer Annual Percentage Yields (APYs). For the latest DeFi yield options, refer to our Best DeFi Rates list.

Liquidity Mining: Participate in liquidity mining to earn yields by providing capital to liquidity pools on Decentralized Exchanges (DEXs). Some DEXs offer their in-house tokens as rewards, akin to holding company “stock. Discover the top DEX aggregators on our list.

Trading on DEXs: Embrace the freedom of trading directly with peers on decentralized exchanges, enabling access to a wider range of digital assets not typically available on centralized exchanges.

The sustained interest and continuous innovation in the DeFi sector present an exciting landscape for crypto enthusiasts. As new protocols emerge and the decentralized financial ecosystem evolves, the DeFi space remains a captivating realm to observe and participate in.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features