Aave, a Decentralized Finance lending project has just commenced its long-anticipated Stablecoin named GHO, which was launched on the Ethereum blockchain. Now, Aave version three users can mine the Stablecoin against their saved assets on the project. The newly launched GHO Stablecoin provides users with an unchanging rate of 1.5%, while people who stake AAVE tokens will get a discount of 30%.

All GHO fees will go into the treasury of Aave DAO. Users of Aave v3 can create GHO using any collateral asset that has been provided to the protocol, keep receive a yield on their holdings while having access to dollar-pegged liquidity. The initial debt ceiling for the stablecoin is $100 million.

The GHO Stablecoin increases the competitiveness of borrowing on Aave, supplies additional choices for Stablecoin users, and also produces more income for Aave DAOs by disbursing all the interest on the Stablecoin (GHO) to the DAOs. Aave also mentioned that this new project aims to design a non-centralized, enduring Stablecoin that has no weakness or too much exposure to centralized or single-user digital assets.

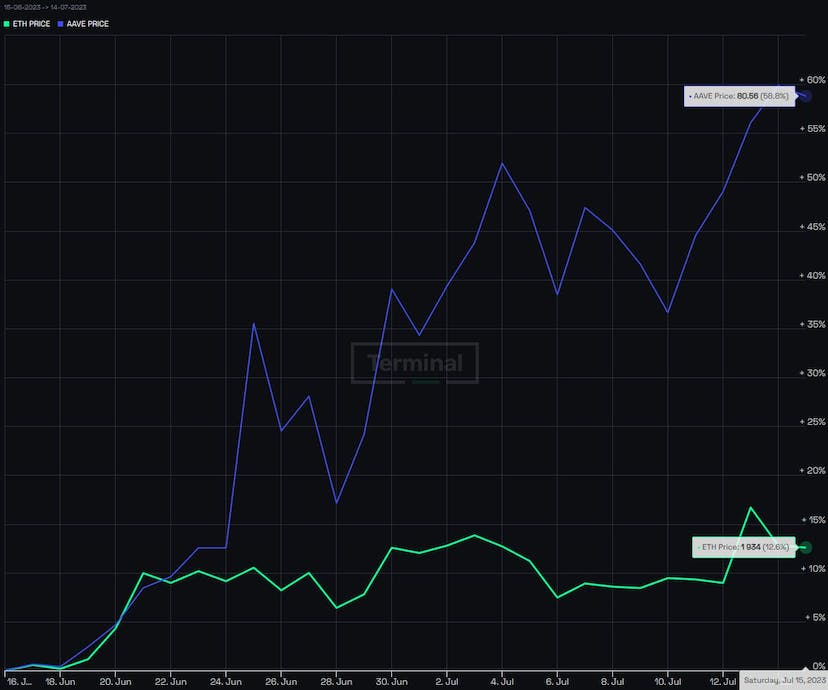

The deployment comes after a governance plan was approved with nearly universal approval on July 14. Before it was launched on the mainnet, GHO’s code underwent four audits. AAVE’s cost has increased by roughly 60% over the previous month.

With GHO, Aave hopes to take advantage of the desire for a solid decentralized solution in the stablecoin market.

Faith in the existing Stablecoin was shaken earlier this year when the leading four centralized Stablecoins lost their peg for a very short time. Even USDC’s market capitalization slumped by 50% over one year, going by the information provided by CoinGecko.

In promoting GHO’s effectiveness for DeFi, cross-border remittances, and micropayments applications, Aave said that it created GHO to enable a permissionless web3 financial ecosystem.

Moderators and Administration

For the first 60 days following GHO’s launch, Chaos Labs and Gauntlet, Aave DAO Risk Contributors, will serve as the organization’s risk stewards.

The steward may increase GHO’s debt ceiling by up to 100% or change interest rates once every five days, subject to approval via an expedited 24-hour governance process.

The Aave DAO will now be in charge of GHO governance. The DAO has the authority to alter GHO’s interest rate, debt ceiling, and appointment of facilitators—entities with the authority to securely mint, burn, and incorporate GHO into other protocols. To apply, prospective facilitators must post a governance proposal in the forum of Aave DAO.

Moderators for GHO have already been authorized, and there are three in total. The list begins with Aave V3 on Ethereum. The administration has also okayed Flashmint Facilitator, allowing users to obtain flash loans so long as the same loan is obtained and repaid on the same ETH block.

The GHO Stability Module, which will support GHO’s peg by enabling one-to-one exchanges between it and other stablecoins, will also soon be published, according to Aave. Aave stated that it will soon also present a multi-chain deployment plan.

Aave also said that it plans to increase the collateral properties that will be recognized by GHO to consist of both blockchain and non-blockchain properties soon.

Lens Integration

It was also gathered that Aave disclosed that the GHO may also serve a key purpose in the Lens’ ecosystem, a non-centralized protocol.

GHO can be unlocked as an asset and used for minting, tipping, donating, and any other payment-related transaction, according to Aave. GHO can also be used as payment for other acts that individuals can perform on Lens.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features