Avalanche is a Layer-1 blockchain; like Ethereum, it was designed to tackle the Blockchain trilemma, which includes scalability, security, and decentralization. It also supports smart contracts and facilitates the creation of decentralized applications. The X-Chain, C-Chain, and P-Chain are the main chains in Avalanche’s design. AVAX, the native token, facilitates transactions, rewards, and governance. It represents 3% of all chains, with numerous DeFi apps and over $1.3 billion locked in Avalanche protocols.

The creation of some different Layer-2 networks was aimed at meeting the deficiencies of the Ethereum network. Instead of creating a layer-2 network, the Avalanche team decided to build the blockchain from scratch so that it could effectively compete with Ethereum. Therefore, Avalanche has become the most sought-after when it comes to decentralized finance (DeFi). However, Avalanche cannot compete with Ethereum based on the number of users per day. While Avalanche has 73,000 regular users daily, Ethereum has 370,000 regular users daily.

The following three core chains are part of Avalanche’s distinctive architecture.

- Exchange Chain (otherwise known as X-Chain): It helps facilitate the creation and exchange of assets.

- Contract Chain (also known as C-Chain): It helps facilitate smart contracts and cross-chain interoperability.

- Platform Chain (also known as P-Chain) helps facilitate the coordination of validator nodes and the management of subnetworks.

AVAX, the native token of Avalanche, is crucial for transactions, rewards, and governance. The ecosystem gained substantial investments after a successful $42 million public sale in July 2020, establishing itself as a significant player in DeFi. Currently, over $1.3 billion worth of crypto is locked on Avalanche protocols, representing nearly 3% of all chains. Notably, Avalanche has experienced an impressive 247.5% growth in daily active users (DAU) over the past 90 days.

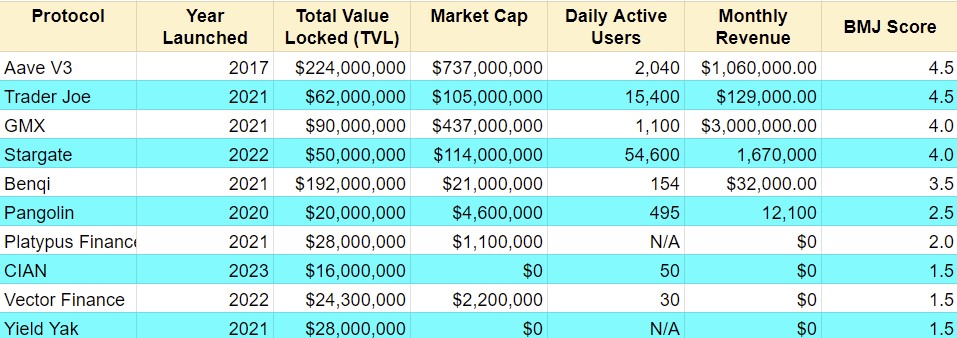

Here Is Some of the List of Protocols Built on the Avalanche Network:

Aave V3

Aave is a decentralized lending and borrowing platform. It launched in 2017 and rebranded in 2018. Aave’s latest version, Version 3, introduced new features like the Portal for cross-chain liquidity, Efficiency Mode for high-efficiency borrowing, and Isolation Mode for restricted-risk asset listings.

Avalanche supports Aave Version 3, with over $180 million in total value locked (TVL) as of mid-June. This TVL on Avalanche ranks second only to Ethereum. However, the amount locked in Version 3, approximately $1.7 billion, is less than half of the $3.6 billion locked in Version 2.

Trader Joe

Trader Joe started as a Decentralized Exchange on the Avalanche Network. However, it aims to expand into a larger ecosystem offering DeFi services like yield farming, lending, staking, and an NFT market. Joe, the native token, serves for staking, yield farming, and governance. It has various functions within the ecosystem. Recent plans include Liquidity Book V2.1, an improved trading engine to accelerate token addition to liquidity pools.

Currently, the cryptocurrency locked in this ecosystem is approximately $65 million, significantly lower than its peak of nearly $3 billion in 2021.

GMX

This protocol is a spot and perpetual trading platform with low swap fees. Initially launched on the Arbitrum network in 2021, it later became available on Avalanche in the following year.

It features a unique multi-asset liquidity pool that generates rewards from various sources and distributes them to liquidity providers. The platform allows leverage of up to 50x.

Combining advanced DeFi technology with crypto exchange features, it supports popular stablecoins and digital assets. The protocol relies on two tokens: GLP for trading liquidity and GMX for governance.

Currently, GMX has a Total Value Locked (TVL) of approximately $900 million, with $90 million on the books.

Stargate

This platform is a cross-chain liquidity protocol enabling fast stablecoin exchange across multiple Ethereum Virtual Machine (EVM)-compatible networks. It supports Ethereum, Avalanche, BNB Chain, Arbitrum, Optimism, Fantom, and Polygon. Liquidity providers receive attractive incentives with up to 8% APY for stablecoin deposits.

Led by LayerZero Labs, the protocol competes with others like the Synapse Protocol. Stargate, the protocol, addresses security concerns commonly associated with bridges by utilizing omni-chain tokens and implementing cross-verification technologies between LayerZero and Oracle.

Avalanche’s Prospects for Investors

Avalanche aims to be a strong competitor in the DeFi market, challenging Ethereum’s dominance by addressing the blockchain trilemma and offering scalability, security, and decentralization. Can it surpass Ethereum?

Avalanche offers diverse DeFi applications tailored to investors’ needs with a growing ecosystem of protocols. User adoption has surged over 200% in the past six months, surpassing Ethereum’s growth of 11.9% in the same period. Avalanche’s rapid expansion positions it with the potential to outshine Ethereum in a short time.

AVAX is among the top 20 cryptocurrencies in value currently. However, the token has faced significant downward pressure over the past 18 months.

For investors seeking innovative blockchain solutions, Avalanche stands out with its unique architecture and supportive DeFi ecosystem. As a pioneer in the field, Avalanche presents a potential opportunity for growth. Although its status as an Ethereum rival may seem uncertain, the ecosystem’s expansion makes it an intriguing project worth monitoring.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features