The Layer-2 Blockchain came up as a measure to address the scalability problems of Layer-1 blockchains; one example of a Layer-1 blockchain is Ethereum. The accomplishments of Layer-2 have been crucial to the development of DeFi, NFTs, and other Web3 solutions on Ethereum. However, it is anticipated that the Ethereum Layer-1 blockchain will become faster and more scalable than ever after the successful completion of its ongoing PoS upgrade. We shall examine how Layer-2 blockchains will come into play in Ethereum 2.0.

The developers of Layer-2 protocols need to strike a balance between three major factors: security, decentralization, and scalability. This is difficult to attain in conventional layer-1 protocols like Ethereum and Bitcoin. Scalability is sometimes sacrificed for increased security and decentralization.

Ethereum, being the first blockchain to offer smart contract functionality, was able to significantly attract the interest of more users and developers. But when the blockchain transaction volume skyrocketed, the network began to experience agonizing delays, which eventually resulted in absurdly high transaction costs (gas fees).

This led to the creation of the layer-2 blockchain. It was created to speed up processes and reduce gas fees. Layer-2 is built on the Layer-1 blockchain, even though it is a separate blockchain.

The Various Layer-2 Blockchain Implementation Strategies

Out of the multiple approaches created by investors over the years, we are going to look at just two: Plasma and Optimistic rollup.

Plasma

These strategies or approaches involve the establishment of some ‘child chains’ Linked to the Ethereum mainnet. Although plasma chains have high TPS potential, they are difficult to design. Particular use cases, like decentralized exchanges, games, or token transfers, make them more practical. The Leading Layer-2 blockchain Polygon uses plasma chains.

Optimistic Rollup

This approach is designed to carry out a large number of Layer-1 transactions outside the mainnet by compressing a bunch of data into a single piece and then processing it as one. The Rollups function under the presumption that all transaction data committed to the mainnet is accurate by default. This is why it is referred to as ‘Optimistic Rollups’. However, the integrity of the data can still be contested on-chain, which will start a dispute resolution process.

Optimistic rollups drastically speed up transactions by processing transactions in good faith off-chain as soon as they are received. However, because of the mechanism for dispute resolution, there is a minor delay in the confirmation of transactions on the Ethereum mainnet. Two Layer-2 protocols using this method are Arbitrum and Optimistim.

The Development of the Layer-2 Sector

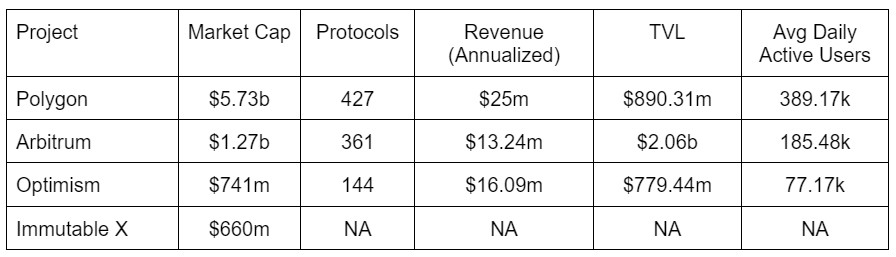

Ethereum remains the industry leader in the growth of the DeFi sector because of the features it offers and its widespread adoption. According to DeFiLlama, the blockchain will account for 58.58% of the ecosystem’s total value, which is expected to reach close to $25 billion in the second quarter of 2023.

Over $174 billion was the peak market value of the whole DeFi ecosystem in the fourth quarter of 2021, with roughly $110 billion of that value being held on the Ethereum network. Such expansion would not have been possible without the aid of Layer-2 blockchains.

Some Top Layer-2 Protocols

Polygon (MATIC)

Polygon (MATIC) was introduced in 2017 in India, initially using the plasma sidechain approach, and then it was relaunched in 2021 after it had grown to incorporate zk-rollups and optimistic rollups.

The current version of Polygon contains a software development kit by the same name, the Polygon SDK. It may be used by programmers to create any form of decentralized application or sidechain that is compatible with Ethereum.

A PoS sidechain serves as the primary Layer-2 blockchain at the center of the Polygon network. MATIC is the name of the native token. The TPS capacity of the Polygon network is 65,000. Furthermore, gas prices are incredibly low.

Arbitrum

Arbitrum is the nearest contender for the Polygon (MATIC) project. It was introduced in 2021 by a New York-based blockchain firm. Arbitrum, in contrast to Polygon, is solely concerned with hopeful rollups. On the Arbitrum sidechain, transactions and smart contracts are resolved before being reported back to the Ethereum mainnet. The Layer-2 protocol promises an insanely low gas cost and a TPS of 40,000.

It is completely compatible with EVM programming languages, and DeFi networks like SushiSwap and Curve have adopted Arbitrum. It was not until very recently (precisely in 2023) that it airdropped its eagerly awaited native coin. The consensus is that Arbitrum is a reliable, mature, and stable scaling solution for Ethereum. With $2.06 billion, or 67.12% of the market, it also dominates all Layer-2 rollups in terms of TVL.

Conclusion

Layer-2 blockchains make transactions on Ethereum a lot easier. Even though Ethereum 2.0 is anticipated to have transaction rates that are very high after they fully switch to PoS, according to Vitalik Buterin, the achievement is still some years away. Even after the update to the mainnet, Layer-2 blockchains will continue to be important in the future.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features