Layer-2 scaling solution Polygon, originally known as Matic, is based on the Ethereum network. Its major objective is to solve Ethereum’s scalability problems and offer cheaper, quicker transactions. Transaction fees may become unprofitable for frequent or small investments if Ethereum-based decentralized applications (dApps) gain popularity.

A sidechain called Polygon operates in tandem with the main Ethereum blockchain. Users can engage with a variety of well-known crypto apps that were previously restricted to Ethereum by connecting crypto assets to Polygon, but with quicker transactions and reduced costs.

MATIC, the native cryptocurrency of the network, is utilized for fee payment, staking, and governance.

The purpose of Polygon is to make Ethereum more swift, secure, effective, and helpful. The platform has recently concentrated on the Web3 trend and gained popularity in the decentralized finance (DeFi) and non-fungible token (NFT) markets.

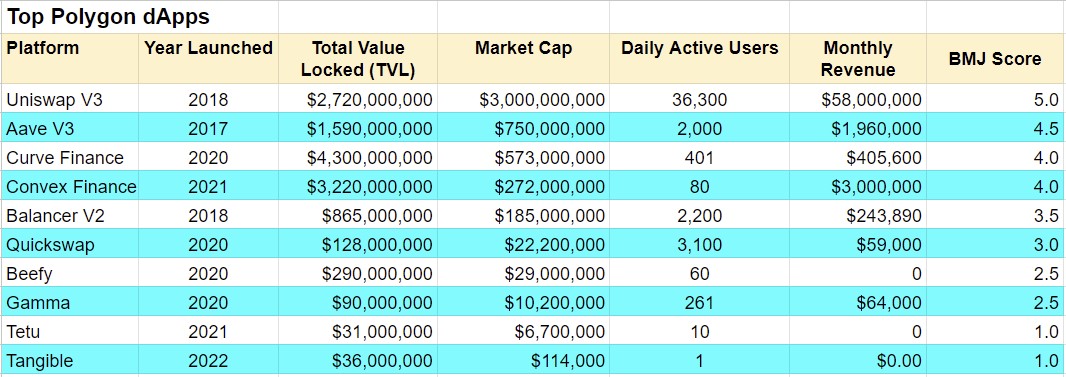

Below are the top five Decentralized Finance projects on Polygon.

Uniswap V3

The biggest DEX by trading volume is Uniswap, and the biggest TVL is Curve Finance. It represents an AMM with typical crypto-pair pools. The first iteration was released in 2018. In 2021, the most recent version of V3, which included Polygon, was gradually implemented on six chains. With the addition of focused liquidity and several fee tiers in the most recent version, liquidity providers may manage capital allocation and mitigate risk.

Aave V3

Decentralized lending protocol Aave was launched in 2017 and changed its name in 2018. It gives users the ability to lend and borrow digital assets without taking custody of them. Aave V3, the most recent version, is offered on eight different chains, including Polygon. By adding cutting-edge technologies, the V3 version significantly improves yield generation and borrowing services.

By ensuring smooth liquidity movement across all supported networks, the Portal function enables authorized bridges to transfer assets between Aave V3 markets. Users can move between Polygon and seven other networks, including Ethereum, Avalanche, Optimism, and Arbitrum, thanks to this feature. The Efficiency Mode makes it possible to optimize borrowing power for correlated assets (such as stablecoins), opening doors for high-leverage forex trading and productive farming.

By confining collateral to a single asset and strengthening risk management, isolation mode makes it possible to list new assets as isolated. To reduce the risk to the protocol’s solvency, siloed borrowing enables the independent borrowing of potentially manipulatable oracles.

Curve Finance

The largest DEX by TVL is Curve Finance, which has roughly $4.3 billion in locked pools. Curve is an AMM trading platform that focuses on stablecoins like USDC, USDT, DAI, BUSD, and TUSD, as opposed to Uniswap or QuickSwap, though it also accepts Ethereum derivatives.

Thanks to a special pricing algorithm, Curve makes effective token swaps possible at cheap prices and with little perceptible slippage.

The native token (CRV) of Curve encourages the provision of liquidity and grants holders the chance to take part in governance. Due to Curve’s enormous liquidity, rival DeFi programs such as the lending platform Compound or the yield farming protocols Convex Finance and Yearn Finance cannot compare to Curve.

Convex Finance

A DeFi system called Convex Finance (CVX) boosts benefits for Curve Finance liquidity providers and CRV token owners. By combining resources and obtaining CRV to convert it into veCRV, which can increase CRV payouts for Curve LP token holders, it streamlines staking and increases rewards.

Additionally, customers can stake their CRV tokens on Convex to get cvxCRV tokens, which give them access to veCRV rewards, Convex platform earnings, CVX tokens, and airdrops.

Balancer V2

The DeFi protocol Balancer was initially introduced on Ethereum. It serves like a DEX and lets users buy and sell a variety of digital assets, but unlike other DEXs, it works more like an index fund because users may construct Balancer pools made up of a variety of tokens from their portfolios. By adding assets to these pools, liquidity providers gain compensation from trading fees in addition to the platform’s native token (BAL).

For improved security, flexibility, and gas efficiency, Balancer V2, released in 2021, added features including liquidity bootstrapping pools and a single Vault architecture.

Over 8% of the TVL on Balancer’s four chains is made up of polygons.

Conclusion

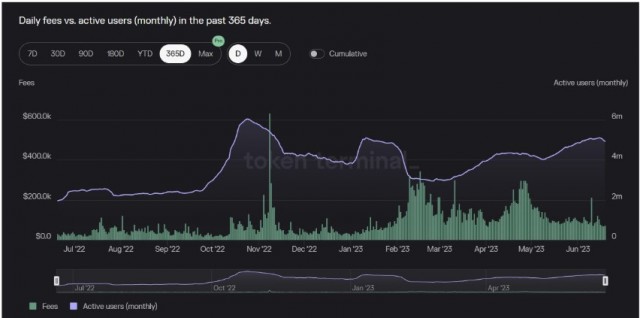

Ethereum now offers a revolutionary layer-2 scaling solution in the form of Polygon (MATIC). Polygon has gained popularity among both users and developers due to its sidechain architecture and integration of several scaling options.

The network also supports Web3 and NFT projects, in addition to a number of well-liked DeFi protocols. Investors wanting exposure to DeFi have a variety of opportunities available through these protocols. Of course, for the MATIC token to appreciate in value, the network must draw in additional users and developers.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features