The modern cryptocurrency market runs on stablecoins due to their stability in value. Traditional cryptocurrencies like Bitcoin and Ethereum behave more like tech stocks than they do like secure repositories of wealth because of their high volatility.

The need for digital assets with stable values has increased, along with investors’ interest in cryptocurrencies. To meet this need, stablecoins were developed. They serve as trustworthy and liquid stores of value for the blockchain token exchange market.

Stablecoins So Far:

Between 2017 and 2018, the first significant stablecoins began to acquire popularity. The market value of the top 10 stablecoins rose from almost nothing in 2017 to an astounding $186 billion in May 2022. Tokens like Tether, Binance USD, and USDC were the main drivers of this charge.

The bear market of 2022 and 2023 is having a big impact on stablecoins because they are a crucial component of the larger crypto ecosystem. The combined market value of the top ten cryptocurrencies has decreased by around $50 billion in only one year.

The Crisis in the Stablecoin Market

One project—the algorithmic stablecoin TerraUSD (UST) and its sibling LUNA—is responsible for about $40 billion of the market crash. The collapse of Terra/LUNA rocked the cryptocurrency market as a whole and destroyed an estimated $60 billion in investor capital.

Tether, the most widely used stablecoin by market capitalization, had its peg broken twice in 2022, once during Terra’s meltdown and once after FTX closed. Similar to USD Coin, which had exposure to the now-defunct Silicon Valley Bank, USD Coin briefly lost its peg in March 2023.

In 2023, the aftermath of the FTX disaster claimed yet another significant fatality in the stablecoin industry. After alarmed investors withdrew their money from the Binance exchange in large quantities, Binance stopped producing Binance USD (BUSD).

Regulations For Stablecoins

A bill has been drafted and published specifically for the regulation of stablecoins. The main feature of the regulation is that it requires all users to hold reserves for their digital assets at a minimum 1:1 ratio. Additionally, the new legislation includes suggestions for moratoria on stablecoins backed by other digital assets. The implications for algorithmic tokens like DAI could be negative.

The Markets in Cryptoassets (MiCA) Regulation in the European Union seeks to increase transparency and hold cryptocurrency service providers accountable. Regulations for electronic money tokens, or EMTs, will apply to stablecoins.

To conduct business in the EU, all stablecoin issuers must apply for both an EMT license and a MiCA license. A usage cap of €1 million will also apply to any stablecoin that is not tethered to a European currency.

These regulations were made as a result of the collapse of some of these crypto platforms, such as FTX. Lawmakers are concerned about protecting consumers and preventing losses.

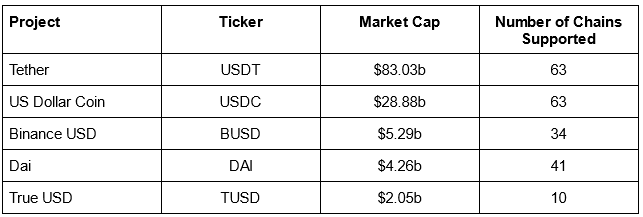

Top Stablecoins in Circulation

Tether (USDT)

The Hong Kong-based iFinex stablecoin is the brain behind Tether. Tether, one of the first stablecoin projects on the market, was introduced in 2014. Tether has more than 4.4 million active addresses and a market valuation of $83 billion. It’s also the most widely used stablecoin in circulation. Tether has a 63% market share as of this writing.

US Dollar Coin (USDC)

Since its introduction in September 2018, USDC has grown to become a significant participant in the stablecoin industry. It claims a market worth $29 billion and $2.1 billion in daily transaction volumes. With over 1.6 million active addresses as of this writing, USDC is the second-most-used stablecoin after Tether.

Binance Coin (BUSD)

Stablecoin Binance USD was released by Paxos, a blockchain infrastructure business with headquarters in New York. Under a partnership and licensing arrangement with Binance, the biggest cryptocurrency exchange in the world, it was introduced in 2019.

BUSD is a US-based stablecoin, similar to Circle’s USD Coin. In US banks and financial institutions, there are currency reserves. According to Binance, the BUSD is entirely backed by US Treasury notes and fiat money.

Conclusion

Recent occurrences like the failures of Terra/LUNA and FTX have completely disrupted the stablecoin industry. Increased regulatory oversight is coming, and algorithmic stablecoins may face a moratorium, which may seriously affect them.

With $130 billion in locked value and daily transaction volumes over $23 billion, investor interest is still high despite the market losing around $50 billion in market cap due to the outflow of money (large withdrawals of cash) and the losses of 2022.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features