The majority of investors are aware that the present is the best time to begin investing for retirement. However, many investors are unaware that they can now add Bitcoin and other specific cryptocurrencies to their retirement investment accounts.

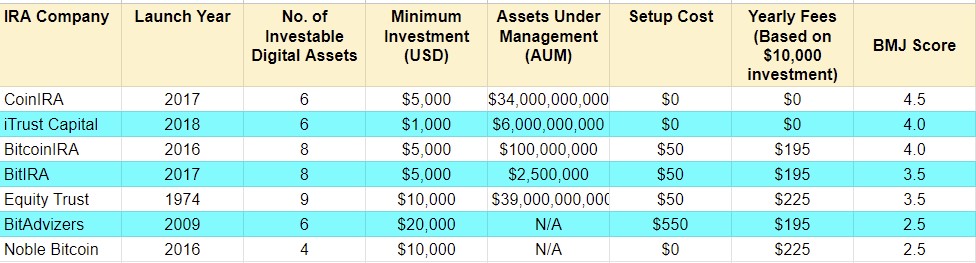

Here, we’ve compiled a handful of the best-managed Bitcoin and cryptocurrency IRAs to assist you in selecting the finest service for your retirement savings in digital assets.

CoinIRA

This platform was created in 2017, and it can take up to 18 cryptocurrencies. Additionally, the users are able to make investments in gold, silver, or platinum through their ‘flex metals’ program. There is no storage fee charged by the company, but the user has to deposit a minimum of $5000 to start an account. The user will also be charged a trading fee of 1.25%. The deposited digital assets are safe in Equity Trust’s care, a supervised and IRS-approved custodian. Assets under the management of CoinIRA are $34 billion.

iTrustCapital

iTrustCapital makes it possible for customers to buy and sell cryptocurrency using IRA retirement funds. This platform was established in 2018. The company provides access to actual gold and silver as well as up to 25 cryptocurrencies. Although transaction costs are set at 1%, there are no setup or management fees to pay. Additionally, to open an iTrustCapital account, you will need at least $1,000. They have up to $6 billion under management.

BitcoinIRA

BitcoinIRA started in 2015. It was founded by Chris Kline, Johannes Haze, and Camilo Concha. The organization offers a variety of assets, including cryptocurrencies and precious metals. You can trade up to 60 different cryptocurrencies using the accounts, which are simple to set up and have up to $700 million in assets safeguarded by Lloyds of London. The organization has a $5,000 minimum investment requirement and charges $195 a year in maintenance fees. Their one-time service charge ranges from 0.99 to 4.99%. A 2% transaction fee and a 0.08% security fee are also included. BitcoinIRA has $100 million worth of assets under its management.

BitIRA

This platform was created in 2017. Customers can grow their assets, including cryptocurrency, for a long time. With a $5,000 minimum investment, BitIRA lets you trade up to 18 different cryptocurrencies while keeping control of your money. The monthly storage fee is fixed at 0.05% each month, and the account setup fee is $50. Additionally, there is a $195 annual maintenance fee. BitIRA has about $2.5 million worth of assets under its management.

Equity Trust

Richard Desich Sr. established Equity Trust in 1974. It’s a self-directed custodian IRA that enables portfolio diversification. With Equity Trust, users are enabled to invest in stocks, bonds, mutual funds, cryptocurrency, and real estate. Additionally, it features a function that enables BitIRA and CoinIRA to connect to its platform. You must pay $50 or $75 to create an account, depending on whether you register online or on paper. The annual maintenance cost varies depending on your account balance, from $225 to $2,250.

The Idea of a Crypto-IRA

The word IRA stands for Individual Retirement Account. It is a popular retirement investment strategy that attracts special tax benefits. Traditional, ROTH, SEP, and SIMPLE IRAs are the four basic types of IRAs, and each one provides a somewhat different option for you to invest in your future while avoiding excessive taxes. Originally designed to hold stocks and mutual funds, IRAs now also hold gold, real estate, and cryptocurrency.

Most of the time, people are permitted to contribute up to $6,500 of earned income (excluding capital gains, social security, child support, and other similar benefits) for those under the age of 50 and $7,500 for those over 50 into an IRA. However, because of age-based withdrawal restrictions, IRAs are not highly liquid. The great majority of IRAs are built on a “set it and forget it” philosophy due to the 10% penalty for early withdrawals from an IRA account before the age of 59.5.

IRAs are made up of well-known, secure investments, including mutual funds, ETFs, bonds, and even blue-chip equities. Digital assets are now being offered by several IRA providers as part of their portfolio options.

Should Bitcoin Be a Part of Your Retirement Fund?

Bitcoin is far more volatile than stocks, bonds, mutual funds, etc. Choosing a Bitcoin IRA over a traditional IRA is like taking on more risk with the possibility of earning much larger rewards. However, investors should conduct their own research before choosing a Bitcoin IRA as their primary retirement fund.

Future widespread acceptance of digital assets will, at least in part, determine the viability of the Bitcoin IRA. However, investors can “get in on the action” with customizable crypto IRAs while maintaining a manageable degree of risk.

Learn from market wizards: Books to take your trading to the next level

Hot Features

Hot Features