The Fx pair stays on the defensive through Tuesday’s early European session into American session and is currently positioned close to the lower end of its daily trading range, around the low-level area of 0.9515. The risk-on flow helped the bond yields from the U.S. Treasury to stage a good recovery from all-time lows. It eventually helped alleviate the US dollar’s recent bearish pressure but unable to lift the pair.

USDCHF Price Analysis – March 3

Key Levels

Resistance Levels: 1.0231, 1.0027, 0.9845

Support Levels: 0.9500, 0.9438, 0.9370

![]()

USDCHF Long term Trend: Bearish

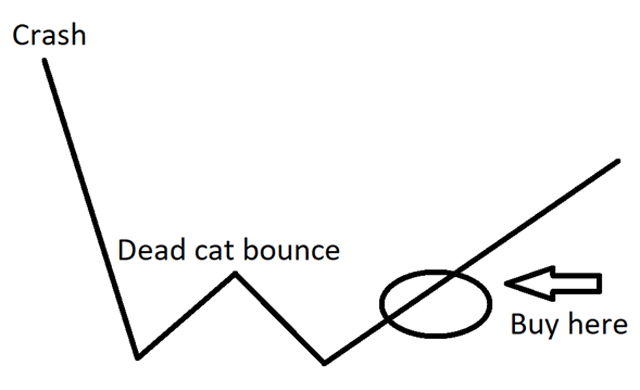

After a strong collapse over the last few days, the bears are likely to wait for a regular closing beneath the low price level of September 2018 close to 0.9541 level, thus targeting 0.9500 levels during the further declines.

Nonetheless, it may recall the buyers targeting 0.9700 marks on the off-chance the pair’s recovery moves past-0.9629 price levels including lows marked on January 31.

![]()

USDCHF Short term Trend: Bearish

Technically with a low resistance level of 0.9654, the intraday bias in USDCHF stays on the downside as the current fall from 1.0231 may aim a forecast of 100 percent from 0.9845 to 0.9438 levels.

On the upside, breakage of 0.9654 minor resistance level may first alter the neutral intraday bias and recovery may be well beneath the resistance level of 0.9845 to usher in continuation of fall resumption.

Instrument: USDCHF

Order: Sell

Entry price: 0.9541

Stop: 0.9613

Target: 0.9438

Source: https://learn2.trade

Hot Features

Hot Features