Key Support Levels: $0.25, $0.20, $0.15

Key Resistance Levels: $0.30, $0.40, $0.45

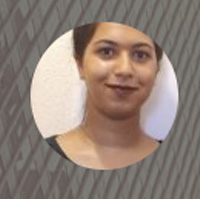

XRP/USD Long-term Trend: Bearish

Ripple has depreciated further and it is now trading at $0.18 at the time of writing. The price was previous fluctuating between the levels of $20 and $0.23. It was assumed in the previous analysis that if the bears break the $0.20 low, the downtrend will resume. On December 17, the bears break the $0.20 support, and the downtrend resumed. The market has fallen to $0.18 which is the previous low in 2017. The coin will likely pause and rebound at this support level. On the other hand, selling pressure may continue.

Daily Chart Indicators Reading:

The Relative Strength Index period 14 level 21 indicates that Ripple is oversold as the market reaches the oversold region, buyers are likely to emerge. In the oversold region, buyers emerge to take control of price. The 21-day SMA and the 50-day SMA are pointing southward indicating the downward move.

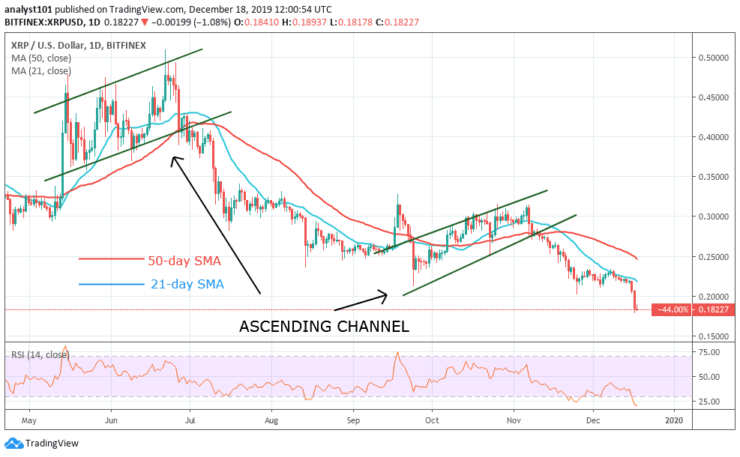

XRP/USD Medium-term Prediction: Ranging

On the 4-hour chart, the bears have broken the support at $0.20 as the market falls to the low of $0.18. The bears have terminated the price range of $0.20 and $0.23. The price has fallen to a low of $0.18 as the market consolidates above it. Ripple may rebound if the bulls defend the current level. However, if the bears break the current level, Ripple will be in serious depreciation.

4-hour Chart Indicators Reading

The stochastic is trading now below the 20% range of the oversold region. This indicates that the coin is in a bearish momentum. The blue and red lines of the daily stochastic are trending horizontally meaning that the bearish momentum has been weakened.

General Outlook for Ripple (XRP)

Ripple is now in a bear market as price breaks the support line of the horizontal channel. The bearish trend also terminates the sideways trend. Ripple is currently fluctuating above $0.18. A rebound is possible if the bulls defend the support level. Besides, the coin is in the oversold region suggesting buyers to take control of price.

Ripple (XRP) Trade Signal

Instrument: XRPUSD

Order: Buy

Entry price: $0.18

Stop: $0.10

Target: $0.23

Source: https://learn2.trade

Hot Features

Hot Features