Ripple (XRP) Price Analysis – July 24

After testing the long-term demand zone ($0.28 – $0.29) last week, the market saw a little price growth to the $0.34 area, from where the XRP bears stepped back into the market. As of now, the price is steadily falling back to this demand zone. However, the cryptocurrency is trading around $0.30 at the moment. Ripple’s XRP may turn positive if the $0.30 can bolster as support for the market.

Ripple (XRP) Price Analysis: Daily Chart – Bearish

Key resistance levels: $0.34, $0.36

Key support levels: $0.29, $0.28

As appeared on the daily chart, Ripple’s XRP remains on a downtrend as the price continues to test lower levels. Evidently, the bearish momentum is very strong as the $0.29 and $0.28 supports may be exposed to a retest due to the current swing low.

As observed in our crypto trading signals, the $0.3 is likely to act as solid support for the XRP/USD pair if the selling pressure becomes weak. We can then expect price to climb back to $0.34 and $0.36 resistances.

If the above price fails to hold as support, the price of XRP will floor at the critical demand zone.

The Stochastic RSI is now turning downward after seeing a bullish crossover on July 16. We may resume uptrend if the indicator can stay above the 20 level. As revealed in our crypto trading signal, RSI is likely to bounce back after touching the oversold line.

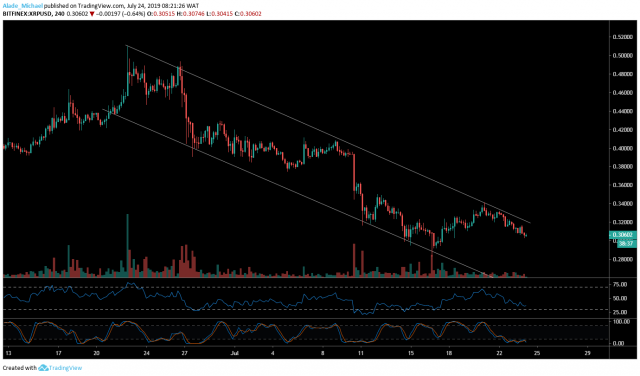

Ripple (XRP) Price Analysis: 4H Chart – Bearish

On the 4-hour chart, the XRP/USD pair is still on the downside, trading within four weeks falling channel formation. Up until now, we are yet to see a significant bullish signal to surge price to the key levels. As spotted on our crypto trading signals, the price drop is due to a low trading volume in the market.

If a surge in volatility occurs, the price of XRP may rise as high as $0.32, $0.34 and $0.36 resistances. Nevertheless, the bear remains strongly in dominance.

For the past three days, Ripple’s XRP is falling and the market is now facing the $0.30. A break below the mentioned price could floor price at $0.29 and $0.28 support area.

On our crypto trading signals, the RSI is revealed in a downward position near the 30 level. The Stochastic RSI is at the same time lying at its lowest condition. While compounding buying pressure, a positive cross is likely to play out.

XRP SELL SIGNAL

Sell Entry: $0.31074

TP: $0.30514 / $0.29821

SL: $0.31777

Source: Learn2.trade

Note: Learn2.Trade is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Hot Features

Hot Features