UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 11-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission File Number: 01-14010

| A. |

Full title of the plan and the address of the plan, if different from that of the issuer name below: |

Waters Employee Investment Plan

| B. |

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

Waters Corporation

34

Maple Street

Milford, Massachusetts 01757

Required Information

Financial Statements and Supplemental Schedule

Report of

Independent Registered Public Accounting Firm

Statements of Net Assets Available for Benefits as of December 31, 2014 and 2013

Statement of Changes in Net Assets Available for Benefits for the Year Ended December 31, 2014

Notes to Financial Statements

Form 5500 – Schedule H,

Part IV, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2014

Exhibit

|

|

|

|

|

| Designation |

|

Description |

|

Method of Filing |

|

|

|

| Exhibit 23.1 |

|

Consent of Grant Thornton LLP |

|

Filed with this Report |

SIGNATURE

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan)

have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Waters Employee Investment Plan |

|

|

|

|

| Date: June 23, 2015 |

|

|

|

By: |

|

/s/ EUGENE G. CASSIS |

|

|

|

|

|

|

Eugene G. Cassis |

|

|

|

|

|

|

Employee Benefits Administration Committee |

WATERS EMPLOYEE INVESTMENT PLAN

FINANCIAL STATEMENTS

AND

SUPPLEMENTAL

SCHEDULE

AS OF DECEMBER 31, 2014 AND 2013

AND FOR THE YEAR ENDED DECEMBER 31, 2014

WITH

REPORT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

WATERS EMPLOYEE INVESTMENT PLAN

INDEX TO FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE

as of December 31, 2014 and 2013

and for the Year Ended December 31, 2014

| * |

Other supplemental schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been

omitted because they are not applicable. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Employee Benefit Administration Committee and Plan Administrator of

Waters Employee Investment Plan

We have audited the

accompanying statements of net assets available for benefits of Waters Employee Investment Plan (the Plan) as of December 31, 2014 and 2013 and the related statement of changes in net assets available for benefits for the year ended

December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we

plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan’s internal control over financial reporting. Our audits

included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s

internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles

used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of Waters Employee

Investment Plan as of December 31, 2014 and 2013 and the changes in net assets available for benefits for the year ended December 31, 2014 in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of Schedule H, Part IV, Line 4(i) – Schedule of Assets (Held at End of Year) as of

December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of Waters Employee Investment Plan’s financial statements. The supplemental information is presented for purposes of additional analysis and

is not a required part of the basic financial statements but include supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974.

The supplementary information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the basic financial statements or the underlying accounting and other

records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated

whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our

opinion, the supplemental information referred to above is fairly stated, in all material respects, in relation to the basic financial statements taken as a whole.

/s/ Grant Thornton LLP

Westborough, Massachusetts

June 23, 2015

1

WATERS EMPLOYEE INVESTMENT PLAN

Statements of Net Assets Available for Benefits

as of December 31, 2014 and 2013

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| Assets |

|

|

|

|

|

|

|

|

| Investments, at fair value |

|

|

|

|

|

|

|

|

| Waters Corporation Stock Fund |

|

$ |

42,839,672 |

|

|

$ |

39,531,226 |

|

| Mutual funds |

|

|

389,878,691 |

|

|

|

445,789,704 |

|

| Self-directed Brokeragelink option: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

12,930,889 |

|

|

|

10,778,143 |

|

| Mutual funds |

|

|

5,415,696 |

|

|

|

5,184,149 |

|

| Other investments |

|

|

368,449 |

|

|

|

519,903 |

|

| Cash and cash equivalents |

|

|

2,959,972 |

|

|

|

3,689,891 |

|

| Collective trusts |

|

|

97,992,943 |

|

|

|

6,927,454 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investments |

|

|

552,386,312 |

|

|

|

512,420,470 |

|

|

|

|

| Receivables |

|

|

|

|

|

|

|

|

| Notes receivable from participants |

|

|

9,504,539 |

|

|

|

8,716,812 |

|

| Employer contributions |

|

|

— |

|

|

|

531,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets with all investments valued at fair value |

|

|

561,890,851 |

|

|

|

521,668,622 |

|

|

|

|

| Adjustment from fair value to contract value for fully benefit-responsive investment contracts |

|

|

(118,797 |

) |

|

|

(104,418 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets available for benefits |

|

$ |

561,772,054 |

|

|

$ |

521,564,204 |

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the financial statements.

2

WATERS EMPLOYEE INVESTMENT PLAN

Statement of Changes in Net Assets Available for Benefits

for the Year Ended December 31, 2014

|

|

|

|

|

| Additions |

|

|

|

|

| Net investment income: |

|

|

|

|

| Net appreciation in fair value of investments (Note 5) |

|

$ |

14,962,628 |

|

| Interest income |

|

|

1,376 |

|

| Dividend income |

|

|

23,830,107 |

|

|

|

|

|

|

| Total investment income |

|

|

38,794,111 |

|

|

|

| Interest income on notes receivable from participants |

|

|

298,083 |

|

|

|

| Contributions: |

|

|

|

|

| Employer’s contributions |

|

|

12,816,918 |

|

| Employees’ contributions |

|

|

20,091,242 |

|

| Rollovers |

|

|

1,904,374 |

|

|

|

|

|

|

| Total contributions |

|

|

34,812,534 |

|

|

|

|

|

|

|

|

| Other income |

|

|

361,672 |

|

|

|

| Total additions |

|

|

74,266,400 |

|

|

|

| Deductions |

|

|

|

|

| Benefits paid directly to beneficiaries and participants |

|

|

33,935,399 |

|

| Administrative expenses |

|

|

123,151 |

|

|

|

|

|

|

| Total deductions |

|

|

34,058,550 |

|

|

|

|

|

|

|

|

| Net increase |

|

|

40,207,850 |

|

|

|

| Net assets available for benefits: |

|

|

|

|

| Beginning of year |

|

|

521,564,204 |

|

|

|

|

|

|

|

|

| End of year |

|

$ |

561,772,054 |

|

|

|

|

|

|

See accompanying notes to the financial statements.

3

WATERS EMPLOYEE INVESTMENT PLAN

Notes to Financial Statements for the Year Ended December 31, 2014

The following description of the Waters Employee Investment Plan (the

“Plan”) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan, effective August 19, 1994, was

created to provide an opportunity for eligible employees of Waters Technologies Corporation (“Waters” or the “Company”) and any eligible legally affiliated company to provide for their future financial security through

participation in a systematic savings program to which each participating employer (the “Employer”) also contributes. The Plan is a defined contribution plan covering substantially all employees of the Company and its affiliates who work

in the United States. The Plan is designed to take advantage of provisions of the Internal Revenue Code of 1986, as amended (the “Code”), which allow a participant to elect to reduce taxable compensation (subject to certain limitations)

with the amount of such reduction being contributed to the Plan by the Employer on behalf of the electing participant. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

The Plan is a Safe Harbor Plan, which provides for catch-up contributions by participants who have attained age 50 before the close of the Plan year, to

satisfy the alternative methods of meeting nondiscrimination requirements, and redefine employer matching contributions. Accordingly, no discrimination testing is applicable.

Eligibility

Employees are eligible to participate in the

Plan immediately upon their date of hire or rehire. Employees are automatically enrolled in the Plan upon their date of hire or rehire. Unless the employee elects to suspend automatic contributions, the automatic participation will commence at 3% of

annual compensation and increase 1% each year until contributions reach 6% of annual compensation.

Contributions

Subject to certain limitations, participants may elect to voluntarily contribute to the Plan from 1% to 60% of their annual compensation on a pre-tax basis

through payroll deductions. Participants who have attained the age 50, or who will reach age 50 during the year, may elect to make an additional pre-tax contribution to the Plan of up to $5,500 for 2014, provided their regular pre-tax contributions

reach either the Plan’s limit of 30% of eligible earnings or the Internal Revenue Service (“IRS”) dollar limit of $17,500 for 2014. As of December 31, 2014, participants had 28 investment options in which to direct the investment

of their contributions and Company contributions. Each investment option offers a different level of risk and expected rate of return. All contributions are subject to the limitations of the Code.

For contribution purposes, compensation includes salary, lump sum cash payments of merit pay increases, commissions, overtime pay, shift differentials,

short-term disability pay, unused vacation pay, bonuses paid under the performance bonus plan and management incentive bonuses or certain other designated incentive plans. The Employer will match 100% of the first 6% of compensation contributed by

the participant. The Employer matching contribution is effective immediately upon date of eligibility and follows the investment elections selected by the participant for employee contributions. Contributions and compensation considered for matching

contribution purposes are subject to certain limitations.

Participants direct their elective contributions into various investment options offered by the

Plan, which include a self-directed brokerage account feature and the Waters Corporation Stock Fund, and can change their investments options on a daily basis.

Participant Accounts

Each participant’s account is

credited with the participant’s contributions, any applicable Employer matching contributions and an allocation of Plan earnings, and is charged with an allocation of administrative expenses to the extent that they are paid by the Plan. Certain

administrative expenses are charged directly against participants’ accounts. Allocations of earnings and expenses are based on the participant account balances, as defined. The benefit to which a participant is entitled is the benefit that can

be provided from the participant’s account balance.

4

WATERS EMPLOYEE INVESTMENT PLAN

Notes to Financial Statements for the Year Ended December 31, 2014

Vesting

Participants are immediately vested in their voluntary contributions as well as Employer matching contributions, plus actual earnings thereon.

Rollover Election

Employees may make an eligible

rollover contribution to the Plan at any time.

Administration

Fidelity Management Trust Company (“Fidelity”) is the trustee and custodian for the Plan. Fidelity Investments Institutional Operations Company

(“FIIOC”) is the record keeper for the Plan.

Benefits

Upon termination of service due to death, disability, retirement or other reason, a participant or beneficiary may elect to receive a lump-sum amount equal to

the value of the participant’s vested interest in his or her account balance or annual or more frequent installments over a period not to extend beyond the life expectancy of the participant. The Plan also allows participants who are actively

employed and have attained the age of 59 1/2 to withdraw all or any portion of their account balance for any reason. The Plan also provides for certain hardship withdrawals upon approval by the Plan administrator, a representative of the

Company’s management.

Administrative Expenses

Certain administrative expenses, including loan maintenance, brokerage account fees, Waters Corporation Stock Fund (“Stock Fund”) administrative fees

and in-service withdrawal fees, are paid by the participants. Other expenses, such as legal, audit and consulting fees, incurred in the administration of the Plan are paid by the Company. A portion of the operating expenses and management fees is

returned to the Plan on revenue sharing arrangements. The revenue sharing amounts received are recorded as other income in the statement of changes in net assets available for benefits.

Notes Receivable from Participants

Participants in the

Plan may borrow from their account balance, with a maximum of two loans permitted per participant. A participant may borrow an amount greater than or equal to $1,000 but not to exceed the lesser of (a) $50,000 minus the largest outstanding loan

balance in the twelve months preceding the loan request or (b) 50% of the total account balance minus current outstanding loan balances. Principal and interest are repaid through payroll deductions for a period of up to five years, except for

loans made for purchasing or constructing a principal residence for which the repayment term may be up to 20 years. The loans bear interest at a fixed rate equal to the prime rate on the first business day of the calendar quarter in which the loan

is funded and are collateralized by the participant’s account balances. At December 31, 2014, interest rates on outstanding loans ranged from 3.25% to 9.0%.

| 2 |

Summary of Significant Accounting Policies |

Basis of Accounting

The financial statements of the Plan are prepared on the accrual basis of accounting in conformity with accounting principles generally accepted in the United

States of America (“US GAAP”). Benefits payable at year end are not accrued as they are considered to be a component of net assets available for benefits.

Investment Transactions and Investment Income

The

Plan’s investments are stated at fair value. Shares of common stock and mutual funds are valued at quoted market prices, which represent the net asset value of the shares held by the Plan at year end. The difference between fair value and

contract value of the commingled trust fund is presented as an adjustment to net assets available for benefits. Purchases and sales of securities are recorded on a trade-date basis. Dividends are recorded on the ex-dividend date. Interest income is

recorded on the accrual basis as earned.

Waters Corporation common stock is traded on a national securities exchange and is valued at the last reported

sales price on the last business day of the year. The common stock was valued at $112.72 and $100.00 per share at December 31, 2014 and 2013, respectively.

5

WATERS EMPLOYEE INVESTMENT PLAN

Notes to Financial Statements for the Year Ended December 31, 2014

Cash equivalents are stated at cost which approximates fair value and include shares of two Fidelity money

market funds that are highly liquid.

The Plan presents in the statement of changes in net assets the net appreciation or depreciation in the fair value

of its investments that consists of the realized gains or losses and unrealized appreciation or depreciation on those investments.

Contributions

Employer and participant contributions are recorded in the period in which payroll deductions are made from the participant’s compensation.

Benefit Payments

Benefit distributions are recorded when

paid.

Notes Receivable from Participants

Notes

receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative

expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2014 or 2013. If a participant ceases to make loan repayments, the Plan administrator will deem the participant loan to be a

distribution in accordance with applicable legal requirements, and the participant’s account balance will be reduced at the earliest permitted date as outlined in the Plan document.

Use of Estimates

The preparation of the Plan’s

financial statements in conformity with US GAAP requires the Plan administrator to make significant estimates and assumptions that affect the reported amounts of net assets available for benefits at the date of the financial statements and the

changes in net assets available for benefits during the reporting period and, when applicable, disclosures of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan provides for various

investment options in any combination of stocks, bonds, fixed income securities, mutual funds and other investment securities. Investment securities are exposed to various risks, such as interest rate, market and credit risks. Due to the level of

risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances

and the amounts reported in the statements of net assets available for benefits.

| 3 |

Fair Value Measurements |

In accordance with the accounting standards for fair value measurements and

disclosures, the Plan’s assets are measured at fair value on a recurring basis as of December 31, 2014 and 2013. Fair values determined by Level 1 inputs utilize observable data, such as quoted prices in active markets. Fair values

determined by Level 2 inputs utilize observable data points other than quoted prices in active markets that are observable either directly or indirectly. Fair values determined by Level 3 inputs utilize unobservable data points for which there is

little or no market data, which require the reporting entity to develop its own assumptions. If the Plan were to change its valuation inputs for measuring financial assets and liabilities at fair value, either due to changes in current market

conditions or other factors, it would need to transfer those assets or liabilities to another level in the hierarchy based on the new inputs used. The Plan would recognize these transfers at the end of the reporting period in which the transfers

occurred. During the years ended December 31, 2014 and 2013, there were no transfers of financial assets or financial liabilities between the hierarchy levels.

6

WATERS EMPLOYEE INVESTMENT PLAN

Notes to Financial Statements for the Year Ended December 31, 2014

The following table discloses the Plan’s assets measured at fair value on a recurring basis as of

December 31, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

December 31, 2014 |

|

|

Quoted Prices in

Active Market for

Identical Assets

(Level 1) |

|

|

Significant Other

Observable Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

|

|

|

|

| Waters Corporation Stock Fund: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Waters Common Stock |

|

$ |

41,528,753 |

|

|

$ |

41,528,753 |

|

|

$ |

— |

|

|

$ |

— |

|

| Money market funds |

|

|

1,310,919 |

|

|

|

— |

|

|

|

1,310,919 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Waters Corporation Stock Fund |

|

|

42,839,672 |

|

|

|

41,528,753 |

|

|

|

1,310,919 |

|

|

|

— |

|

|

|

|

|

|

| Mutual funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large-cap - U.S. companies |

|

|

74,832,156 |

|

|

|

74,832,156 |

|

|

|

— |

|

|

|

— |

|

| Asset allocation funds |

|

|

140,198,425 |

|

|

|

140,198,425 |

|

|

|

— |

|

|

|

— |

|

| International companies |

|

|

52,372,597 |

|

|

|

52,372,597 |

|

|

|

— |

|

|

|

— |

|

| Small/mid-cap - U.S. companies |

|

|

64,223,018 |

|

|

|

64,223,018 |

|

|

|

— |

|

|

|

— |

|

| Intermediate-term fixed income bonds |

|

|

36,348,543 |

|

|

|

36,348,543 |

|

|

|

— |

|

|

|

— |

|

| U.S. government securities |

|

|

21,903,952 |

|

|

|

21,903,952 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total mutual funds |

|

|

389,878,691 |

|

|

|

389,878,691 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

| Self-directed Brokeragelink assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Healthcare stocks |

|

|

3,599,386 |

|

|

|

3,599,386 |

|

|

|

— |

|

|

|

— |

|

| Technologies stocks |

|

|

2,210,658 |

|

|

|

2,210,658 |

|

|

|

— |

|

|

|

— |

|

| Exchange-traded funds |

|

|

1,391,633 |

|

|

|

1,391,633 |

|

|

|

— |

|

|

|

— |

|

| Other common stocks |

|

|

6,087,830 |

|

|

|

6,087,830 |

|

|

|

— |

|

|

|

— |

|

| Large-cap mutual funds |

|

|

1,075,704 |

|

|

|

1,075,704 |

|

|

|

— |

|

|

|

— |

|

| Fixed income bond funds |

|

|

1,060,271 |

|

|

|

1,060,271 |

|

|

|

— |

|

|

|

— |

|

| Asset allocation funds |

|

|

682,145 |

|

|

|

682,145 |

|

|

|

— |

|

|

|

— |

|

| Other mutual funds |

|

|

2,607,407 |

|

|

|

2,607,407 |

|

|

|

— |

|

|

|

— |

|

| Money market funds |

|

|

2,959,972 |

|

|

|

— |

|

|

|

2,959,972 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Self-directed Brokeragelink assets |

|

|

21,675,006 |

|

|

|

18,715,034 |

|

|

|

2,959,972 |

|

|

|

— |

|

|

|

|

|

|

| Collective trusts (Note 6) |

|

|

97,992,943 |

|

|

|

— |

|

|

|

97,992,943 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

552,386,312 |

|

|

$ |

450,122,478 |

|

|

$ |

102,263,834 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

WATERS EMPLOYEE INVESTMENT PLAN

Notes to Financial Statements for the Year Ended December 31, 2014

The following table discloses the Plan’s assets measured at fair value on a recurring basis as of

December 31, 2013:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total

December 31, 2013 |

|

|

Quoted Prices in

Active Market for

Identical Assets

(Level 1) |

|

|

Significant Other

Observable Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

|

|

|

|

| Waters Corporation Stock Fund: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Waters Common Stock |

|

$ |

38,364,200 |

|

|

$ |

38,364,200 |

|

|

$ |

— |

|

|

$ |

— |

|

| Money market funds |

|

|

1,167,026 |

|

|

|

— |

|

|

|

1,167,026 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Waters Corporation Stock Fund |

|

|

39,531,226 |

|

|

|

38,364,200 |

|

|

|

1,167,026 |

|

|

|

— |

|

|

|

|

|

|

| Mutual funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large-cap - U.S. companies |

|

|

148,653,462 |

|

|

|

148,653,462 |

|

|

|

— |

|

|

|

— |

|

| Asset allocation funds |

|

|

118,702,049 |

|

|

|

118,702,049 |

|

|

|

— |

|

|

|

— |

|

| International companies |

|

|

52,768,767 |

|

|

|

52,768,767 |

|

|

|

— |

|

|

|

— |

|

| Small/mid-cap - U.S. companies |

|

|

65,131,021 |

|

|

|

65,131,021 |

|

|

|

— |

|

|

|

— |

|

| Intermediate-term fixed income bonds |

|

|

36,742,675 |

|

|

|

36,742,675 |

|

|

|

— |

|

|

|

— |

|

| U.S. government securities |

|

|

23,791,730 |

|

|

|

23,791,730 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total mutual funds |

|

|

445,789,704 |

|

|

|

445,789,704 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

| Self-directed Brokeragelink assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Healthcare stocks |

|

|

2,896,697 |

|

|

|

2,896,697 |

|

|

|

— |

|

|

|

— |

|

| Technologies stocks |

|

|

1,601,152 |

|

|

|

1,601,152 |

|

|

|

— |

|

|

|

— |

|

| Exchange-traded funds |

|

|

873,852 |

|

|

|

873,852 |

|

|

|

— |

|

|

|

— |

|

| Other common stocks |

|

|

5,916,441 |

|

|

|

5,916,441 |

|

|

|

— |

|

|

|

— |

|

| Large-cap mutual funds |

|

|

1,071,007 |

|

|

|

1,071,007 |

|

|

|

— |

|

|

|

— |

|

| Fixed income bond funds |

|

|

713,056 |

|

|

|

713,056 |

|

|

|

— |

|

|

|

— |

|

| Asset allocation funds |

|

|

557,585 |

|

|

|

557,585 |

|

|

|

— |

|

|

|

— |

|

| Other mutual funds |

|

|

2,852,405 |

|

|

|

2,852,405 |

|

|

|

— |

|

|

|

— |

|

| Money market funds |

|

|

3,689,891 |

|

|

|

— |

|

|

|

3,689,891 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Self-directed Brokeragelink assets |

|

|

20,172,086 |

|

|

|

16,482,195 |

|

|

|

3,689,891 |

|

|

|

— |

|

|

|

|

|

|

| Collective trusts (Note 6) |

|

|

6,927,454 |

|

|

|

— |

|

|

|

6,927,454 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

512,420,470 |

|

|

$ |

500,636,099 |

|

|

$ |

11,784,371 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments in the Stock Fund are stated at fair value based on the quoted market price on the last business day of the year

for the Company’s common stock and the fair value of short-term liquid investments included in the Stock Fund.

Investments in mutual funds are

stated at fair value based on the quoted net asset value of shares held by the Plan on the last business day of the year.

Investments under the

self-directed Brokeragelink option are stated at fair value based on the quoted market prices on the last business day of the year.

Investments in

collective trusts are stated at fair value, which represents the net asset value of shares held by the Plan at year end.

The methods described above may

produce a fair value that may not be indicative of the net realizable value or reflective of future fair value. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of

different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

Investments that represent five percent or more of the Plan’s net assets at

December 31 are as follows:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

|

|

| Fidelity Growth Company Commingled Pool |

|

$ |

89,865,364 |

|

|

$ |

* |

|

| Spartan 500 Index Fund – Institutional Class |

|

|

61,924,896 |

|

|

|

53,924,259 |

|

| Waters Corporation Stock Fund |

|

|

42,839,672 |

|

|

|

39,531,226 |

|

| Vanguard Total Bond Market Index Fund Institutional Shares |

|

|

36,348,543 |

|

|

|

* |

|

| Fidelity Puritan Fund – Class K |

|

|

36,212,038 |

|

|

|

33,473,160 |

|

| Fidelity Low-Priced Stock Fund – Class K |

|

|

35,296,485 |

|

|

|

34,541,749 |

|

| Fidelity Diversified International Fund – Class K |

|

|

33,980,922 |

|

|

|

34,651,469 |

|

| Fidelity Growth Company Fund – Class K |

|

|

* |

|

|

|

84,700,610 |

|

| * |

Represents amount less than 5% of net assets available for benefits. |

8

WATERS EMPLOYEE INVESTMENT PLAN

Notes to Financial Statements for the Year Ended December 31, 2014

| 5 |

Net Appreciation in Fair Value |

Net appreciation in fair value for the year ending December 31,

2014 is as follows:

|

|

|

|

|

| Waters Corporation Stock Fund |

|

$ |

4,955,494 |

|

| Collective Trusts |

|

|

7,144,998 |

|

| Mutual funds |

|

|

1,791,771 |

|

| Other |

|

|

1,070,365 |

|

|

|

|

|

|

|

|

| Net appreciation in fair value of investments |

|

$ |

14,962,628 |

|

|

|

|

|

|

Common Collective Trust

The Plan invests in the Fidelity Managed Income Portfolio, which is a common collective trust. It is a commingled pool of the Fidelity Group Trust for Employee

Benefit Plans and is managed by Fidelity, which is also the trustee of the Plan. This fund seeks to preserve principal investments while earning interest income. This fund will try to maintain a net asset value of $1 per unit. The portfolio invests

in investment contracts issued by insurance companies and other financial institutions, and in fixed income securities. A portion of the portfolio is invested in a money market fund to provide daily liquidity. Investment contracts provide for the

payment of a specified rate of interest to the portfolio and for the repayment of principal when the contract matures. All investment contracts and fixed income securities purchased for the portfolio must satisfy the credit quality standards of

Fidelity.

The fair value of the investment contract at December 31, 2014 and 2013 was $8,127,579 and $6,927,454, respectively. The average yield and

crediting interest rates were approximately 0.94% and 1.02% for 2014 and 1.02% and 0.85% for 2013, respectively. The crediting interest rate is based on a formula agreed upon with the issuer, but may not be less than 0%. Such interest rates are

reviewed on a quarterly basis for resetting.

Certain events, such as the premature termination of the contract by the Plan or the termination of the

Plan, would limit the Plan’s ability to transact at contract value with Fidelity. The Plan administrator believes the occurrence of such events that would also limit the Plan’s ability to transact at contract value with Plan participants

is not probable.

Collective Investment Trust

In

July 2014, the Fidelity Growth Company Fund - Class K was replaced with the Fidelity Growth Company Commingled Pool, a collective investment trust. It is maintained by Fidelity Management Trust Company (FMTC) under the Fidelity Group Trust for

Employee Benefit Plans and is managed by Fidelity, which is also the trustee of the Plan, and sub-advised by FMR Co. The funds primary objective is to seek capital appreciation. The portfolio invests primarily in common stocks of domestic and

foreign issuers with the potential for above-average growth. Growth may be measured by factors such as earnings or revenue. It uses fundamental analysis of each issuer’s financial condition and industry position and market and economic

conditions to select investments.

The fair values of collective investment trusts are based upon the net asset values of the underlying investments at

year end. The fair value of the investment trust at December 31, 2014 was $89,865,364.

9

WATERS EMPLOYEE INVESTMENT PLAN

Notes to Financial Statements for the Year Ended December 31, 2014

| 7 |

Reconciliation of Financial Statements to Form 5500 |

The following is a reconciliation of net assets

available for benefits per the financial statements to IRS Form 5500 at December 31, 2014 and 2013:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Net assets available for benefits, per the financial statements |

|

$ |

561,772,054 |

|

|

$ |

521,564,204 |

|

| Add: adjustment from contract value to fair value for fully benefit-responsive investment contracts |

|

|

118,797 |

|

|

|

104,418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets available for benefits, per Form 5500 |

|

$ |

561,890,851 |

|

|

$ |

521,668,622 |

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of the net investment income per the financial statements to the IRS Form 5500 for the year

ended December 31, 2014:

|

|

|

|

|

| Net investment gain and interest income on notes receivable from participants, per the financial statements |

|

$ |

39,092,194 |

|

| Add: adjustment from contract value to fair value for fully benefit-responsive investment contracts |

|

|

14,379 |

|

|

|

|

|

|

|

|

| Net investment income, per Form 5500 |

|

$ |

39,106,573 |

|

|

|

|

|

|

| 8 |

Related-Party Transactions |

Certain Plan investments are shares of mutual funds or collective trusts

managed by an affiliate of Fidelity, a subsidiary of which is the trustee of the Plan and, therefore, these transactions qualify as party-in-interest transactions. Fees paid by the Plan to Fidelity or its affiliates for administrative services

amounted to $123,151 for the year ended December 31, 2014. Transactions with respect to participant loans and the Stock Fund also qualify as party-in-interest transactions.

The Plan has investments in shares of the Company’s common stock through the Stock Fund. During the year ended December 31, 2014, the Plan purchased

units in the Stock Fund in the amount of $2,239,298; sold units in the Stock Fund in the amount of $3,866,303; and had net investment appreciation of $4,955,494, administrative expenses of $20,588 and interest and dividend income of $545. The total

value of the Plan’s investment in the Stock Fund was $42,839,672 and $39,531,226 at December 31, 2014 and 2013, respectively.

| 9 |

Plan Amendment and Termination |

The Company expects to continue the Plan indefinitely; however, it has

the right to modify, amend or terminate the Plan at any time subject to the provisions of the Code and ERISA. No such modification or amendment, however, shall have the effect of retroactively changing or depriving participants or beneficiaries of

rights already accrued under the Plan. If the Plan is terminated, participants will remain 100% vested in their account balances.

The IRS has determined and informed the Company by a letter dated October 16, 2014,

that the Plan and related trust are designed in accordance with applicable sections of the Code. The Plan administrator believes that the Plan is designed and is currently being operated in accordance with all applicable requirements of the Code.

Therefore, no provision for income taxes has been included in the Plan’s financial statements.

U.S. GAAP requires Plan management to evaluate

uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan administrator

has analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2014, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax

positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan administrator believes it is no longer subject to income tax examinations for years prior to

2011.

Subsequent events were evaluated through June 23, 2015, which is the date the

financial statements were available to be issued.

10

WATERS EMPLOYEE INVESTMENT PLAN

Form 5500 – Schedule H, Part IV, Line 4i

Schedule of Assets (Held at End of Year) as of December 31, 2014

|

|

|

|

|

|

|

|

|

| EIN: |

|

04-3234558 |

|

|

|

|

|

|

| Plan Number |

|

002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b) |

|

(c) |

|

(d) |

|

(e) |

|

| |

|

Identity of issue, borrower,

lessor or similar party |

|

Description of investment including maturity date,

rate of interest, collateral, par, or maturity value |

|

Cost |

|

Current

value |

|

| Waters Corporation Stock Fund |

|

|

|

|

|

|

|

|

| * |

|

Fidelity Management Trust Company (FMTC) |

|

Cash Reserves |

|

N/A |

|

$ |

1,310,919 |

|

| * |

|

FMTC |

|

Waters Corporation Common Stock |

|

N/A |

|

|

41,528,753 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Waters Corporation Stock Fund |

|

|

|

|

|

|

42,839,672 |

|

| Mutual Funds |

|

|

|

|

|

|

|

|

|

|

American Beacon |

|

American Beacon Small Cap Value Fund Institutional Class |

|

N/A |

|

|

12,971,310 |

|

|

|

American Funds |

|

American Funds Washington Mutual Investors Fund – Class R5 |

|

N/A |

|

|

12,907,260 |

|

|

|

Columbia |

|

Columbia Acorn Fund Z |

|

N/A |

|

|

9,872,294 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2005 Fund |

|

N/A |

|

|

126,765 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2010 Fund |

|

N/A |

|

|

3,535,574 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2015 Fund |

|

N/A |

|

|

6,847,226 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2020 Fund |

|

N/A |

|

|

18,791,417 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2025 Fund |

|

N/A |

|

|

13,040,849 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2030 Fund |

|

N/A |

|

|

23,793,664 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2035 Fund |

|

N/A |

|

|

9,079,642 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2040 Fund |

|

N/A |

|

|

13,678,414 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2045 Fund |

|

N/A |

|

|

5,578,468 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2050 Fund |

|

N/A |

|

|

4,988,275 |

|

| * |

|

FMTC |

|

Fidelity Freedom K 2055 Fund |

|

N/A |

|

|

800,543 |

|

| * |

|

FMTC |

|

Fidelity Freedom K Income Fund |

|

N/A |

|

|

3,725,550 |

|

| * |

|

FMTC |

|

Fidelity Diversified International Fund – Class K |

|

N/A |

|

|

33,980,922 |

|

| * |

|

FMTC |

|

Fidelity Low-Priced Stock Fund – Class K |

|

N/A |

|

|

35,296,485 |

|

| * |

|

FMTC |

|

Fidelity Puritan Fund – Class K |

|

N/A |

|

|

36,212,038 |

|

| * |

|

FMTC |

|

Fidelity Retirement Government Money Market Portfolio |

|

N/A |

|

|

21,903,952 |

|

|

|

Oppenheimer |

|

Oppenheimer Developing Markets Fund – Class Y |

|

N/A |

|

|

16,124,632 |

|

|

|

Spartan |

|

Spartan 500 Index Fund – Institutional Class |

|

N/A |

|

|

61,924,896 |

|

|

|

Spartan |

|

Spartan Extended Market Index Fund – Advantage Class |

|

N/A |

|

|

6,082,929 |

|

|

|

Vanguard |

|

Vanguard Total Bond Market Index Fund Institutional Shares |

|

N/A |

|

|

36,348,543 |

|

|

|

Vanguard |

|

Vanguard Total International Stock Index Fund – Admiral Shares |

|

N/A |

|

|

2,267,043 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total mutual funds |

|

|

|

|

|

|

389,878,691 |

|

| Notes receivable from participants |

|

|

|

|

|

|

|

|

|

|

Notes receivable from participants |

|

Interest rates ranging from 3.25% to 9.0%; maturity dates through 2034 |

|

— |

|

|

9,504,539 |

|

| Self-directed brokeragelink options |

|

|

|

|

|

|

|

|

| * |

|

FMTC |

|

Self-Directed Brokeragelink Option |

|

N/A |

|

|

21,675,006 |

|

| Collective trusts |

|

|

|

|

|

|

|

|

| * |

|

FMTC |

|

Fidelity Managed Income Portfolio |

|

N/A |

|

|

8,127,579 |

|

| * |

|

FMTC |

|

Fidelity Growth Company Commingled Pool |

|

N/A |

|

|

89,865,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total collective trusts |

|

|

|

|

|

|

97,992,943 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments |

|

|

|

|

|

$ |

561,890,851 |

|

|

|

|

|

|

|

|

|

|

|

|

11

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our report dated June 23, 2015, with respect to the financial statements and supplemental schedule included in the Annual Report of Waters

Employee Investment Plan on Form 11-K for the year ended December 31, 2014. We hereby consent to the incorporation by reference of said report in the Registration Statement of Waters Corporation on Form S-8 (File No. 333-60054, effective

May 2, 2001).

/s/ GRANT THORNTON LLP

Westborough, MA

June 23, 2015

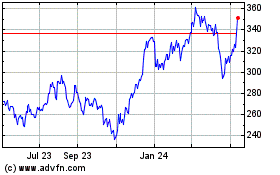

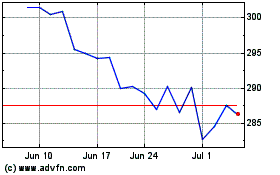

Waters (NYSE:WAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Waters (NYSE:WAT)

Historical Stock Chart

From Apr 2023 to Apr 2024