UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported) September 30, 2015

TIDEWATER INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-6311 |

|

72-0487776 |

| (State of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 601 Poydras Street, Suite 1500

New Orleans, Louisiana |

|

70130

(Zip Code) |

| (Address of principal executive offices) |

|

|

(504) 568-1010

(Registrant’s telephone number, including area code)

N/A

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrants under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

1

Item 8.01. Other Events

In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the Company notes that certain

statements set forth in this Current Report on Form 8-K provide other than historical information and are forward looking. The actual achievement of any forecasted results, or the unfolding of future economic or business developments in a way

anticipated or projected by the Company, involve numerous risks and uncertainties that may cause the Company’s actual performance to be materially different from that stated or implied in the forward-looking statement. Among those risks and

uncertainties, many of which are beyond the control of the Company, include, without limitation, volatility in worldwide energy demand and oil and gas prices; and the potential long-term effects of a depressed level of oil and gas prices;

consolidation of our customer base: fleet additions by competitors and industry overcapacity; our views with respect to the need for and timing of the replenishment of our asset base, including through acquisitions or vessel construction; changes in

capital spending by customers in the energy industry for offshore exploration, field development and production; loss of a major customer: changing customer demands for vessel specifications, which may make some of our older vessels technologically

obsolete for certain customer projects or in certain markets; delays and other problems associated with vessel construction and maintenance; uncertainty of global financial market conditions and difficulty in accessing credit or capital; acts of

terrorism and piracy; integration of acquired businesses and entry into new lines of business; disagreements with our joint venture partners; significant weather conditions; unsettled political conditions, war, civil unrest and governmental actions,

such as expropriation or enforcement of customs or other laws that are not well developed or consistently enforced, or requirements that services provided locally be paid in local currency, in each case especially in higher political risk countries

where we operate; foreign currency fluctuations; labor changes proposed by international conventions; increased regulatory burdens and oversight; changes in laws governing the taxation of foreign source income; retention of skilled

workers; and enforcement of laws related to the environment, labor and foreign corrupt practices. Readers should consider all of these risk factors as well as other information contained in this report.

On September 30, 2015, Joseph M. Bennett, Executive Vice President and Chief Investor Relations Officer, presented at the Johnson Rice

2015 Energy Conference in New Orleans, Louisiana.

The following information is being provided under Item 8.01 Other Events in this

Current Report on Form 8-K: (1) a slide presentation presented at the Johnson Rice 2015 Energy Conference on September 30, 2015 in New Orleans, Louisiana included as Exhibit 99.1 and (2) a transcript of the presentation at the Johnson

Rice 2015 Energy Conference on September 30, 2015 in New Orleans, Louisiana included as Exhibit 99.2. Both Exhibit 99.1 and 99.2 are incorporated herein by reference as if fully set forth.

The information contained in the transcript, which was prepared by Wall Street Webcasting, is a textual representation of the Company’s

presentation. There may be material errors, omissions or inaccuracies in the reporting of the contents of the presentation. The Company assumes no responsibility to correct or update the third-party transcript. Users are advised to review the

Company’s SEC filings before making any investment or other decisions.

Item 9.01. Financial Statements and Exhibits.

The following exhibits are furnished with this Form 8-K:

|

|

|

| 99.1 |

|

Slide presentation presented at the Johnson Rice 2015 Energy Conference on September 30, 2015 in New Orleans, Louisiana. |

2

|

|

|

|

|

| 99.2 |

|

Transcript of the presentation presented at the Johnson Rice 2015 Energy Conference on September 30, 2015 in New Orleans, Louisiana. |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| TIDEWATER INC. |

|

|

| By: |

|

/s/ Joseph M. Bennett

|

|

|

Joseph M. Bennett |

|

|

Executive Vice President and Chief Investor Relations Officer |

Date: October 5, 2015

4

|

Johnson Rice 2015 Energy Conference September 30, 2015 Joseph M. Bennett Executive Vice President and Chief Investor Relations Officer Exhibit 99.1 |

| FORWARD-LOOKING STATEMENTS In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of

1995, the Company notes that certain statements set forth in this presentation

provide other than historical information and are forward looking.

The actual achievement of any forecasted results, or the unfolding

of future economic or business developments in a way anticipated or projected by the Company, involve numerous risks and uncertainties that may cause the Company’s actual

performance to be materially different from that stated or implied in the

forward-looking statement. Among those risks and uncertainties,

many of which are beyond the control of the Company, include,

without limitation, fluctuations in worldwide energy demand and oil and gas prices; fleet additions by competitors and industry overcapacity; changes in capital spending by

customers in the energy industry for offshore exploration, development and

production; changing customer demands for different vessel

specifications, which may make some of our older vessels

technologically obsolete for certain customer projects or in certain markets;

uncertainty of global financial market conditions and difficulty

accessing credit or capital; acts of terrorism and piracy;

significant weather conditions; unsettled political conditions, war, civil unrest

and governmental actions, such as expropriation or enforcement of

customs or other laws that are not well- developed or

consistently enforced, especially in higher political risk countries where we operate; foreign currency fluctuations; labor changes proposed by international conventions; increased

regulatory burdens and oversight; and enforcement of laws related to the

environment, labor and foreign corrupt practices. Readers should

consider all of these risks factors, as well as other information

contained in the Company’s form 10-K’s and 10-Q’s.

TIDEWATER 601 Poydras Street, Suite 1500, New Orleans, La.

70130 Johnson Rice 2015 Energy Conference

2 Phone: 504.568.1010 | Fax: 504.566.4580 Web site address: www.tdw.com Email: connect@tdw.com |

|

Providing safe, efficient and compliant operations

New fleet comprised of vessels that service all water depths

Geographic diversity

Staying close to our customers

Prompt, proactive cost-cutting initiatives (“control what we

can control”)

Reducing CapEx, and returning capital to shareholders as

operating outlook improves

Maintaining a solid balance sheet (low leverage) and sufficient liquidity

to deal with industry uncertainties & seize opportunities when

presented Experienced management team to lead the way

Tidewater’s Strategy & Focus in a Challenging Market

Johnson Rice 2015 Energy Conference

3 |

|

Stop Work Obligation

Safety performance is 25% of mgt. incentive comp

Safe Operations is Priority #1

Johnson Rice 2015 Energy Conference

4 0.00 0.10 0.20 0.30 0.40 0.50 0.60 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 TOTAL RECORDABLE INCIDENT RATES (per 200,000 Man Hours) TIDEWATER DOW CHEMICAL CHEVRON EXXON/MOBIL |

| Too Many

Offshore Rigs, and Activity Levels Drive OSV Demand Johnson Rice

2015 Energy Conference 5

Source: IHS-Petrodata

Note: 31 “Other” rigs, along with the Jackups and Floaters, provide a total

working rig count of 587 in September 2015. 356

200 Jackups Floaters Rig CIP Jackups 127 Floaters 73 Other 9 209 |

| Drivers

of our Business “Peak to Present” Johnson Rice 2015

Energy Conference 6

July 2008 (Peak) Jan. 2011 (Trough) September 2015 Working Rigs 603 538 587 Rigs Under Construction 186 118 209 OSV Global Population 2,033 2,599 3,357 OSV’s Under Construction 736 367 399 OSV/Rig Ratio 3.37 4.83 5.72 (5.04 without ~400 old vessels believed not available) Source: IHS-Petrodata and Tidewater |

|

Tidewater’s Active Fleet

As of June 30, 2015 Johnson Rice 2015 Energy Conference 7 Year Built Deepwater vessels Towing Supply/Supply Other vessels 222 “New” vessels – 7.4 avg yrs 12 “Traditional” vessels – 27.3 avg yrs (only 4 OSVs) |

| Vessel

Population by Owner (AHTS and PSVs only) Estimated as of September

2015 Johnson Rice 2015 Energy Conference

8 Tidewater Competitor #2 Competitor #3 Competitor #4 Competitor # 5 Competitor #1 Avg. All Others (~2,580 total vessels for 400+ owners) Source: IHS-Petrodata and Tidewater |

|

Geographic Diversity –

Vessel Count by Region (Excludes stacked vessels – as of 6/30/15) Johnson Rice 2015 Energy Conference 9 Americas 65(28%) SS Africa/Europe 103(44%) MENA 44(19%) Asia/Pac 22(9%) 38 additional Tidewater vessels were stacked as of 6/30/15. |

| A New

Fleet that Services All Water Depths (Excludes

stacked vessels – as of 6/30/15) Johnson Rice 2015 Energy Conference 10 New Avg. Traditional Vessels NBV Vessels Deepwater 8 $26.1M 0 Towing Supply 14 $10.8M 0 Other 0 0 0 22 0 New Avg. Traditional Vessels NBV Vessels Deepwater 33 $28.3M 0 Towing Supply 36 $12.6M 1 Other 30 $1.5M 3 99 4 New Avg. Traditional Vessels NBV Vessels Deepwater 36 20.7M 0 Towing Supply 19 $10.4M 2 Other 5 $1.6M 3 60 5 New Avg. Traditional Vessels NBV Vessels Deepwater 13 $17.0M 1 Towing Supply 28 $11.5M 0 Other 0 0 2 41 3 Americas SSAE MENA Asia/Pac Vessel count info is as of 6/30/15, and includes leased vessels. Avg NBV excludes the impact of leased vessels which have no NBV.

Average NBV of the 12 Traditional vessels is ~$720,000 each at 6/30/15.

|

| Staying

Close to our Customers – Strong Customer Base

Current Revenue Mix Johnson Rice 2015 Energy Conference 11 Super Majors 34% NOC's 33% Others 33% Approximately 60% of our revenue is derived from drilling support activity and 40% from non-drilling related activity, such as support of production and construction activity Our top 10 customers in Fiscal 2015 (4 Super Majors, 5 NOC’s, and 1 IOC) accounted for 61% of our revenue |

| Our

Remaining Construction Backlog Johnson Rice 2015 Energy

Conference 12

Count Deepwater PSVs 9 Deepwater AHTSs - Towing Supply/Supply 2 Other - Total 11 Vessels Under Construction As of June 30, 2015 (adjusted for subsequent amendments*)

Estimated delivery schedule –

9 remaining in FY ’16 and 2 in FY ‘17. CAPX of $104m remaining in

FY ‘16 and $42m in FY ‘17.

* In September 2015, construction contracts for one Towing Supply/Supply vessel and 4

Deepwater PSVs were renegotiated to options to purchase from November 2015

to October 2016. These 5 option vessels are not included in the table

above. |

|

CapEx is Decreasing from Recent High Levels Johnson Rice 2015 Energy Conference 13 Amounts in Fiscal 2016 and 2017 represent CAPX on the 11 vessels under construction as of 9/24/15. Fiscal 2014 is exclusive of Troms acquisition NOTE: Fiscal 2016 and 2017 estimated CAPX above is exclusive of any refunds from possible cancelled vessel construction contracts (see note on previous slide re option vessels) Fiscal Year |

| Solid

Balance Sheet and Financial Flexibility Our Financial Position Provides Us

Strategic Optionality Johnson Rice 2015 Energy

Conference 14

As of June 30, 2015

Cash & Cash Equivalents

$103 million Total Debt $1,544 million Shareholders Equity $2,451 million Net Debt / Net Capitalization 37% Total Debt / Capitalization 39% ~$700 million of available liquidity as of 6/30/15, including $600 million of unused capacity under the company’s revolving credit facility. |

| Debt

Maturities and Covenants as of 6/30/15 Maturities Limited for Several

Years Johnson Rice 2015 Energy Conference

15 Debt Covenants: 1) Debt/Total Capitalization Ratio of not greater than 55% 2) EBITDA/Interest coverage of not less than 3.0X Fiscal Year |

| Return

Capital to Shareholders Consistent Dividends and Opportunistic Share

Repurchases Johnson Rice 2015 Energy Conference

16 (in millions) Fiscal Years ~6.5% Current Dividend Yield During this 16-year period, $659 million of dividends were paid and $757 million of total stock repurchases were made.

|

|

Tidewater’s Subsea Business

Johnson Rice 2015 Energy Conference

17 Eight work-class ROVs in current fleet Commercial operations underway with additional opportunities in Americas, SSAE and Asia/Pac ROV capabilities generating potential for OSV pull through |

|

Tidewater’s Strategy

Johnson Rice 2015 Energy Conference

18 Continue to improve upon stellar safety and compliance programs Stay close to our customers Monitor industry developments to adjust our playbook accordingly - Pro-active cost reduction initiatives - Maintain/protect liquidity Maintain solid balance sheet and financial flexibility to deal with industry uncertainties and seize opportunities when presented Return capital to shareholders through dividends and opportunistic share repurchases |

|

HOUSTON, TEXAS Tidewater Marine, L.L.C. 6002 Rogerdale Road Suite 600 Houston, Texas 77072-1655 P: +1 713 470 5300 NEW ORLEANS, LOUISIANA Worldwide Headquarters Tidewater Inc. Pan American Life Center 601 Poydras Street, Suite 1500 New Orleans, Louisiana 70130 P: +1 504 568 1010 Johnson Rice 2015 Energy Conference 19 |

| The

Worldwide OSV Fleet (Includes AHTS and PSVs only) Estimated as of September

2015 Johnson Rice 2015 Energy Conference

20 As of September 2015, there are approximately 399 additional AHTS and PSV’s (~12% of the global fleet) under construction. Some number of these, we believe, will not be completed and delivered. Vessels > 25 years old today Global fleet is estimated at ~3,357 vessels, including ~700 vessels that are 25+ yrs old (21%).

Source: ODS-Petrodata and Tidewater |

| Fleet

Renewal & Expansion Largely Funded by CFFO Johnson Rice 2015

Energy Conference 21

Over a 16-year period, Tidewater has invested ~$5.5 billion in CapEx, and paid out

~$1.4 billion through dividends and share repurchases. Over the same

period, CFFO and proceeds from dispositions were ~$4.3 billion and ~$930

million, respectively. Fiscal Year |

| History

of Solid Earnings and Returns on a Through-Cycle Basis Johnson

Rice 2015 Energy Conference 22

** EPS in Fiscal 2004 is exclusive of the $.30 per share after tax impairment charge. EPS in Fiscal 2006 is exclusive of the $.74 per share after tax

gain from the sale of six KMAR vessels. EPS in Fiscal 2007 is exclusive of

$.37 per share of after tax gains from the sale of 14 offshore tugs. EPS in Fiscal 2010 is exclusive of $.66 per share Venezuelan provision, a $.70 per share tax benefit related to favorable resolution of tax litigation and a $0.22

per share charge for the proposed settlement with the SEC of the

company’s FCPA matter. EPS in Fiscal 2011 is exclusive of total $0.21 per share charges for settlements with DOJ and Government of Nigeria for FCPA matters, a $0.08 per share charge related to participation in a multi-company U.K.-based pension

plan and a $0.06 per share impairment charge related to certain vessels.

EPS in Fiscal 2012 is exclusive of $0.43 per share goodwill impairment charge. EPS in Fiscal 2014 is exclusive of $0.87 per share goodwill impairment charge. EPS in Fiscal 2015 is exclusive of $4.67 per share of goodwill and other assets impairment

charges. |

| Active

Vessel Dayrates & Utilization by Segment

Johnson Rice 2015 Energy Conference

23 $6,000 $10,000 $14,000 $18,000 $22,000 $26,000 12/11 6/12 12/12 6/13 12/13 6/14 12/14 6/15 Americas Asia/Pac MENA Sub Sah Africa/Eur. 60% 70% 80% 90% 100% 12/11 6/12 12/12 6/13 12/13 6/14 12/14 6/15 Utilization stats exclude stacked vessels. |

| New

Vessel Trends by Vessel Type Deepwater PSVs

Johnson Rice 2015 Energy Conference

24 22 23 24 25 25 25 25 28 29 32 34 38 40 43 44 45 47 49 51 54 55 57 62 66 69 73 75 76 76 77 80 81 86 - 40 80 120 160 200 240 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 Average Day Rate, Adjusted Average Day Rate, and Average Fleet Size Average Fleet Size Average Day Rate Utilization-Adjusted Average Day Rate Q1 Fiscal 2016 Avg Day Rate: $26,917 Utilization: 72.7% $153 million, or 51%, of Vessel Revenue in Q1 Fiscal 2016 |

| New

Vessel Trends by Vessel Type Deepwater AHTS

Johnson Rice 2015 Energy Conference

25 5 5 5 5 5 5 5 5 6 8 9 9 11 11 11 11 11 11 11 11 11 11 11 11 11 11 12 12 12 12 12 12 12 - 40 80 120 160 200 240 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 Average Day Rate, Adjusted Average Day Rate, and Average Fleet Size Average Fleet Size Average Day Rate Utilization-Adjusted Average Day Rate Q1 Fiscal 2016 Avg Day Rate: $30,813 Utilization: 59.6% $20 million, or 7%, of Vessel Revenue in Q1 Fiscal 2016 |

| New

Vessel Trends by Vessel Type Towing Supply/Supply Vessels

Johnson Rice 2015 Energy Conference

26 39 40 43 46 47 49 51 54 57 59 61 63 68 78 81 83 85 88 93 99 101 101 102 103 103 103 104 105 105 105 105 104 105 - 50 100 150 200 250 $0 $5,000 $10,000 $15,000 $20,000 $25,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 Average Day Rate, Adjusted Average Day Rate, and Average Fleet Size Average Fleet Size Average Day Rate Utilization-Adjusted Average Day Rate Q1 Fiscal 2016 Avg Day Rate: $14,252 Utilization: 74.3% $101 million, or 34%, of Vessel Revenue in Q1 Fiscal 2016 |

| Vessel

Revenue and Vessel Operating Margin Fiscal 2008-2016

Johnson Rice 2015 Energy Conference

27 Note: Vessel operating margin is defined as vessel revenue less vessel operating expenses

53.0% 46.7% 56.4% 47.7% 38.0% 41.0% 36.9% 45.0% 44.1% 40.8% 46.3% 43.1% 45.6% 39.9% $- $100 $200 $300 $400 $500 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 Vessel Revenue ($) Vessel Operating Margin ($) Vessel Operating Margin (%) Prior peak period (FY2009) averaged quarterly revenue of $339M, quarterly operating margin of $175.6M at 51.8% $300 million $150 million 50.0% |

|

Historical Vessel Cash Operating Margins

Johnson Rice 2015 Energy Conference

28 Vessel Cash Operating Margin ($) Vessel Cash Operating Margin (%) $119 million Vessel Margin in Q1 FY2016 (98% from New Vessels) Q1 FY2016 Vessel Margin: 40% |

Exhibit 99.2

Event Name: The Johnson Rice 2015 Energy Conference

Company

Name: Tidewater

Date: September 30, 2015

<<

Joe Bennett, Executive VP and Chief Investor Relations Officer, Tidewater>> Thanks to everyone for coming today. This is I don’t know how many years in a row that I’ve presented here, but it’s always a pleasure to come home and

to see so many familiar faces especially from the Johnson Rice folks that have supported us for many years and continue to do so. We appreciate that!

As

the last presenter did and as you’re used to, our attorneys still have a play in all these presentations so we’ll go past that. Our presentation is probably largely like many being done here probably yesterday and today. How do you

survive? What are you doing in this marketplace? It’s very challenging. I don’t think you’ll hear anything different from anybody these days. I think everyone has come to that conclusion. That this is, has been and will be a

challenging market for a period of time. The period of time is the question mark, but I don’t think it’s going to be quick, unfortunately.

So,

what do we think about? What are our strategies? And most of these are not new and earth shattering, but as we normally talk about providing safe, efficient and compliant operations. At any point in time, as an operator you are trying to distinguish

yourselves from the rest of the pack. These are certain things and I will cover these much more in detail in a second, but providing our safe operations, you’ll see our snake slide again as you would normally do, talking about safety and

compliance. It’s very important these days. As did the prior presenter, having a new fleet is important these days and it doesn’t mean that the demand, first off, the demand for old vessels is all but gone. So, we don’t have to talk

about “old vessels.” We don’t have hardly any. You’ll see a slide where we have four remaining if you want to call it old traditional OSV’s. They’ll probably be gone in the next year. Everything else is new, new meaning

in the last 15 years, primarily in the last five to seven years. And, we operate in all water depths. So, our approach over the years in the 60 years that we’ve been in existence is to be as diverse as we can. With the classes of assets that we

provide and in the geographies that we spread ourselves over, we want to be as diverse as possible. I think the worst thing today can be to only be subject to one geography, just be a North Sea operator, just be a Gulf of Mexico operator. If those

are good markets, it’s wonderful, but when it’s a bad market, it’s not the time to say well now I’m going to go start an operation somewhere else where its challenging all over the world, to be perfectly honest. The geographic

diversity, staying close to customers, you know, this is kind of a “duh” statement, but it is overly important during challenging times to understand what your clients are looking for. What are their plans, so you can accommodate them as

best you can. Everyone, I am sure, is talking about this -- prompt, proactive, cost cutting

1

initiatives. Control what we can control. There’s so much in our industry today that we cannot control: the price of oil, E&P spending, you know, etc. It can’t be controlled, but

what we can control is making prompts decisions on stacking of assets that are not being utilized as fully as what we would like, removing crews, deferring dry dockings and other maintenance, cutting costs. We are, today, 1000 people down from where

we were year ago. We were a 9,000 employee company. Today, we’re about 8,000 and that number will probably continue to decrease. Most of those head count reductions have come from crew or offshore personnel, but onshore has been impacted and

will continue to be impacted. This is something that is a continual process.

A big story for us has been for the last 15 years is how

much we’ve been spending. You don’t get to a brand new fleet without spending a lot of money. Our CAPX has been significant over the past 15 years again, specifically over the last five or so years. We are at the tail end of that. And

you’ll see a slide and I’ll go into more detail because it’s really important to understand exactly where we are in that regards. And with all of that, we still have a balance sheet that most people in the OSV space would love to

have: low leverage or at least reasonable leverage with sufficient liquidity to continue to deal with the uncertainty. I think the first thing that we have to do is make sure we can deal with the uncertainties. We will survive and so forth, but to

also seize opportunities as they come up. There will be casualties. I’m not telling anybody anything new. There’s going to be casualties in this downturn. There already have been a few and we think it’s going to get worse as time goes

on for a bit, and there will be opportunities for companies that are strong, like ours, to take advantage of that. We do have an experienced management team that’s going to lead the way through this market.

So our safety slide, I’ll cover rather quickly because you’re probably familiar with it, but safety is important. That’s safe

work obligation, a stop work obligation requires every one of our 8,000 employees to stop a job when they see it be unsafe or they expect it to be unsafe. That’s every single person in our organization. It’s not an authority; it’s an

obligation on their part to stop it. The management team’s bonus plan, annual bonus plan, 25% of that is based on our safety results, which you see in the graph below and it’s probably too small to see but our total recordable incident

rate has been descending. We are the gold bar. It bounces around a bit. So far this year, knock on wood, our TRIR, and I remember from the previous presenter slide how proud they were that this year I think they were expecting to end at about the

.35 range, something like that for their TRIR. We’re at a 0.10, with no lost time accidents thus far. Again, something that can differentiate yourself when bidding on work.

What’s the problem? I won’t spend much time because I think everyone knows what the problem is. This is the number of working rigs

since 2004. You see the prior peak or two peaks ago now in about 2007, right before the financial crisis hit, when jack-ups were up to almost 400 jack-ups working and a floater market was another 175 or so range. What you saw during the financial

crisis is the jack-up market was the market that got hit the hardest. That went down to about 300 rigs working, but the floater market never stopped. It just kept going. They kept delivering more, they went to work, the day rates on those took a

little bit of a blip as it did with the vessels that operate with the floater market.

2

For a very short blip, it went back to historic high day rates and off it went. But, what we see in the last year is what we all know that the rig count, the working offshore rig count has gone

down from what was a peak of about 720 in total working rigs, offshore rigs to what it is today, which is in about the 590 range. Where it goes from here, we don’t know. It was interesting seeing the prior presenter and their thoughts on how

many rigs would be retired in both these categories and how many are still left to be delivered is a real question mark. As to what that will be and that will help to dictate what the OSV space will look like. There’s still 200 rigs plus under

construction and I think there’s lots of questions, as there is on the boat side, of how many of those truly will be delivered. So this is a bit of a comparison and again, I won’t spend much time with it other than the bottom line of the

OSV to rig ratio, which is something we all keep an eye on. When that number is four or less, then the boat business is in pretty good shape. Things are tight because that’s about how many boats it takes per rig out there, well we’re

nowhere near that right now. It’s a very challenged market. This would suggest through ODS-Petrodata that the global OSV population is 3,300. I don’t feel like it’s anywhere near that. They have a very difficult time of taking vessels

out of that count. There are 600 to 700 vessels buried in that 3,300 vessels that are 25 to 30 years and older, that I can assure you in today’s market don’t work. So, I think you remove that and then you play around with the ratio

thereafter. Also, how many of these some 400 boats that are under construction will be delivered? A big, big part of those are being built in China. A big part of that number are being built speculatively, not by the Tidewater’s of the world,

but even by the shipyards themselves. I think there’s a real question these days as to how many of those truly will be finished and delivered. I don’t know how to quantify that but it’s going to be a number less than this 400.

This is what our fleet looks like by the years delivered and just kind of depicts easily to see how young our fleet is and this is our active

vessels. So, this is removing, we had 38 vessels stacked at the end of June, our 222 “new” vessels with about a 7 1⁄2 year average age and only 12

traditional vessels, four of which are OSVs, the other eight are crew boats and tugs that we don’t talk about too much. But again, most of those are heading out the door.

This is the OSV vessel count by competitor. Just to kind of put it in perspective, we are still the largest. We don’t put competitor

names on there, but you can probably figure them out and I think what this slide shows more than anything is just how fragmented our business is. You see the next five closest competitors by sheer numbers of OSVs and we give the statistic we could

combine all of ourselves with the next five and we would maybe have a 25% global market share. The most important part of this slide, which we’ve used for a long time, is the last column. There’s lots of five boat operators, on average,

circling the world, so consolidation, I’m afraid to say, isn’t the answer in our business. I think, as I said before, there will be casualties, and there will be some consolidation that will help strengthen the companies that are in that

position to opportunistically pick those up.

So where are we around the world? We report in four segments. These numbers, we’re

still a major operator in Sub-Saharan Africa and Europe, primarily Sub-Saharan Africa in those numbers, so about 45% of our total fleet count is there. I think the revenue kind of matches up with the same percentages. That’s a number

that’s lower than what it

3

used to be. The number used to be about 55%, but due to just moving vessels around. I mean one of the real opportunities and strengths of Tidewater is our international infrastructure. We

don’t have to rely on just one geographic market. If a boat doesn’t have a job in this market, we can look around and find a job elsewhere before making the decision to stack it in this market. So, we’ve done that. So you see

Sub-Saharan Africa and Europe, the Americas with about 28% of our vessel count is not very large in the Gulf of Mexico. I will make sure that people understand that we have 10 to 12 boats operating in the Gulf of Mexico. The rest is primarily in

Mexico and Brazil, a little bit in Trinidad and around that region. The next largest region is MENA, or Middle East and North Africa. That has been a growing number and a growing percentage. I would say that all the geographies of the world, when

people say which one is really good and which ones aren’t very good, frankly none of them are very good these days, to be perfectly honest. The Middle East is probably the most stable from our boat count and our activity level. And then

Asia-Pac kind of pulls up the rear and that number has actually been shrinking primarily because of project work that gets turned on and off in Australia. There’s not much happening there these days and just Southeast Asia has been somewhat of

a shrinking market. So again, these are our active vessels in our fleet and again, we have 38 vessels stacked at quarter end.

I’m

going to provide this, and this presentation is on our website so look at it. People are looking at us knowing that we’re trading at about 30% of book value and asking that question. We have taken some small impairments on stacked vessels, but

not on our active fleet and one would question well what is your net book value of your assets? This slide provides that info. We’re not going to go through this time, but if you want to look at it you can. I will summarize it by saying when we

look at our active fleet, our deep water vessels, which total about 82 active vessels, have an average net book value of $23.5 million. Do we feel comfortable with that number? We do. In today’s market, it’s still a comfortable number. I

can’t ever swear that will never have an impairment related to those vessels, but at least thus far the impairments have come from stacking equipment. Therefore we have a different process when reviewing their evaluation, getting third party

appraisals on it. Our towing supply vessels, which are our jack-up support vessels, average net book value about 11 and half million dollars. Again, not a number that bothers us very much. Those seem to be a reasonable average net book values and

being depreciated every day even further.

The customer mix is good. It’s a nice blend of super majors, of the IOC’s, the

NOC’s, and a mix of others. This pie chart doesn’t change much over the years. We remind people that about 60% of our revenue, and this has been pretty consistent too, is related to rig activity, directly to rig activity, but 40% non-rig

activity, construction work, production work, things like that and that’s important to understand as you see that rig count that I showed you earlier.

So let’s talk about our CAPX and our remaining backlog. It’s now down to 11 vessels, and just a couple of data points. In the June

quarter, we were able to either cancel or convert to options five vessels at two different shipyards. We did that because both the shipyards were in default from the standpoint of not delivering on time. So, we were able

4

to negotiate out of those, get all of our progress payments back, or at least for the option boats when those options are not exercised we’ll get our money back on that. So, that was in the

June quarter. We just announced about two or so weeks ago we just did five more boats at one of the same shipyards. They were all converted from commitments to options over the next year, so we have the ability at various delivery times, expected

delivery times, to say “yay” or nay” to taking the vessels. Along with that, that same shipyard is still constructing four additional vessels for us and we’ve got pretty significant discounts on the original construction costs of

those respective four vessels. If we don’t exercise the options on those five, we will remove about $76,000,000 of future CAPX in remaining progress payments, and we will get back $29,000,000 of our progress payments. The shipyard is in good

shape. They have good guarantees that support it. So, we’ll see how that goes over the next year or so, but those are big numbers.

So, what does that leave us with? These 11 boats that we truly have commitments on, the total remaining CAPX on those is about $145 million,

which in round numbers $100million is due in the remainder of this fiscal year, so in the September, December, and March quarter, and we finish this program next June with about $40 million or so in remaining CAPX.

And this depicts it… What has our CAPX been over time on a fiscal year basis? What have we incurred so far the first quarter, the June

quarter, of this year. We had about $90 to $95 million of CAPX and, as I just said, we have about $100 million left the remainder of this fiscal year and then about $40 to $42 million next year. Again, these numbers are, I’ll call them gross

numbers, and that the $29 million that we would get back in progress payments if we don’t exercise the options on those five boats would net this number to a lower number. And then after that, so people ask, what is your maintenance CAPX look

like after this or during this? And the answer is, our maintenance CAPX is basically zero. We expense all of our dry docking costs and all of our major repairs, so our maintenance CAPX would only be under a scenario where we have to modify a vessel

for a customer, or if we decide to upgrade a vessel from say DP1 to DP2. I’ll say $20 million a year would be a big number, especially these days for maintenance” CAPX. We get down to spending very, very little money.

So a quick glimpse of the balance sheet at the end of June – so, $100 million of cash. You see our debt to cap is in that 37% to 39%

range. We don’t see that changing much, going either up or down again. Again, on the assumption that no opportunities are taken advantage of where we would incur more debt. We have a totally undrawn revolver – $600 million. So when we talk

about ready liquidity, we have the $100 million of cash on our balance sheet and $600 million totally undrawn in our revolver.

Our debt

maturities you see here, nothing significant until fiscal year 2020. So, debt pay downs and most of this debt is, in fact, most of it you see maturing in 2020 is our term loan, our $300 million term loan. The rest is primarily our private placements

debt, which just have traunches along the way. The average coupon on those debts is 4% to 4 1⁄4%. There’s no reason, no desire on our part, to pay them

down early.

5

Covenants – a big topic these days. Here are two covenants. Our debt to total cap ratio not

greater than 55%. You just saw the numbers at 38ish type percent. We have a lot of cushion in that and don’t expect anything to happen in that covenant. The other one, the EBITDA to interest coverage ratio of not less than 3 times, that’s

a trailing 12 month calculation. At the end of June that calculation was 6 1⁄2 times, so we have cushion there, but certainly anybody can run a model and

today’s and future expected day rates, utilization, margins, suggests can we trigger this covenant? It’s a possibility sometime in the future, not saying that we will. We have a good group of banks. We certainly have tremendous liquidity

so we think this is something that is very, very manageable, if we get to that point.

We have been a consistent dividend payer. While

this only goes back 15 years, we’ve paid a dividend every single quarter since 1993, and it’s a big topic these days. Can you guarantee a dividend? We can never guarantee a dividend, but I think you see the priority given to, but things

are different these days and times and certainly there are more discussions about dividends than ever before, but you also see that we’ve been consistent. We haven’t moved up or down in the absolute numbers being paid. We sit here today

with our stock place where it is and we have about a seven and a half percent yield. It was never our intent to have that type of yield, but isn’t it nice to get that while we wait. But, we’ve used share repurchases as really the more

volatile piece to give back to our shareholders. And it’s interesting to look at these numbers over this 15 year period. $660 million of dividends have been paid and $760million of stock repurchases have been made over this 15 year period. So

we will continue to assess these opportunities. We still have $100million authorized under our share repurchase program from our board that will run out next June. So, we have that opportunity still.

And we remind everyone in just closing that we still have a Subsea group. I don’t have a whole lot to report on it. We are operating

eight ROVs. We look to expand that group and we talk about taking advantage of opportunities it could be in the pure vessel, it could be in the ROV, engineering, multipurpose vessel space given the good numbers on those. We still believe in the

subsea space long-term and would expect to continue to expand this over time.

So we’ll finish with strategy and you’ll see the

same things. We have to continue to operate safely in a compliant way, stay close to those customers. We need to continue to cut our costs. When Quinn Fanning, our CFO, provided an operating margin guidance of 36% to 40% for the full fiscal year,

the way we do that, since it is difficult to project what vessels may be stacked in the future, we need to react quickly to stacking vessels, removing costs, trimming G & A, etc., and we will continue to do some. We’ve maintained a solid

balance sheet. I don’t see that debt to cap going up. If it does, it will be an interesting opportunity if that were to come along. And we will continue to return capital to shareholders through dividends and opportunistic share repurchases.

Again, with never any promises in that regards, but we feel good about where we are with that. With that, I’ll end it and take questions if you like.

6

Q&A Session

<< Q>> (inaudible 23:51)

<< Joe Bennett,

Executive VP and Chief Investor Relations Officer, Tidewater>> No. No, other than the two covenants that you saw and however that would impact those two covenants.

<< Q>> (inaudible 24:04)

<< Joe Bennett,

Executive VP and Chief Investor Relations Officer, Tidewater>> Yes. Yes, and all of our debt is unsecured so we sit in pretty good position. No, having said that, we certainly have seen other folks who pay dividends, get into trouble with

their debt covenants, and that’s part of the negotiations with banks to say well, stop your dividends. We’re not suggesting that for us, but we’ve certainly seen that for others so, but there’s nothing in the agreements

themselves that dictates that.

<< Q>> (inaudible 24:31)

<< Joe Bennett, Executive VP and Chief Investor Relations Officer, Tidewater>> Fiscal 2020.

Yes. That whole facility of term loan and revolver expires during March of 2020. We just, as a matter of fact, in the June quarter, that whole agreement was

extended by one year so when people say are you communications with your banks? Sure we are! We just went through an extension with them. They’ve seen everything that we had to show them and agreed to that extension, which basically kept the

agreement the same just pushed it out one more year. Thank you very much for your attention and your interest in Tidewater.

7

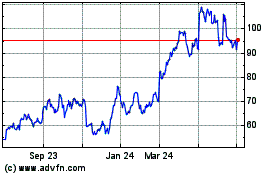

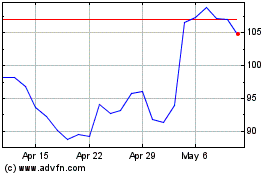

Tidewater (NYSE:TDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tidewater (NYSE:TDW)

Historical Stock Chart

From Apr 2023 to Apr 2024