UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of report (Date of earliest event reported):

|

November

5, 2015

|

|

|

THE ST. JOE COMPANY

|

|

|

|

(Exact Name of Registrant as

Specified in Its Charter)

|

|

|

Florida

|

|

1-10466

|

|

59-0432511

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

133 South WaterSound Parkway

WaterSound, FL

|

|

32413

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

|

|

(850) 231-6400

|

|

|

|

(Registrant’s Telephone Number, Including Area Code)

|

|

|

|

Not Applicable

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

⃞

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

⃞

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

⃞

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

ITEM 2.02. RESULTS OF OPERATIONS AND

FINANCIAL CONDITION

On November 5, 2015, The St. Joe Company

issued a press release announcing its financial results for the quarter

ended September 30, 2015. A copy of the press release is furnished with

this Current Report on Form 8-K as Exhibit 99.1.

ITEM 9.01. FINANCIAL STATEMENTS AND

EXHIBITS

(d) Exhibits

The following exhibit is furnished as part

of this Current Report on Form 8-K.

99.1 Press Release dated

November 5, 2015.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

THE ST. JOE COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

November 5, 2015

|

|

By:

|

/s/ Marek Bakun

|

|

|

|

|

|

|

Marek Bakun

|

|

|

|

|

|

Chief Financial Officer

|

Exhibit 99.1

The St.

Joe Company Reports Third Quarter 2015 Results and Announces Additional

Authority for Repurchases of Shares of Its Common Stock

WATERSOUND, Fla.--(BUSINESS WIRE)--November 5, 2015--The St. Joe Company

(NYSE: JOE) (the “Company”) today announced Net Income for the third

quarter of 2015 of $2.8 million, or $0.03 per share, compared with Net

Loss of $(0.1) million, or $(0.00) per share, for the third quarter of

2014. For the nine months ended September 30, 2015, the Company reported

Net Income of $0.8 million, or $0.01 per share compared to Net Income of

$417.6 million, or $4.52 per share for the same period last year. The

2014 earnings included the Company’s AgReserves and RiverTown

transactions.

During the nine months ended September 30, 2015, the Company repurchased

a total of 16,982,739 shares of its common stock outstanding. This

amount included 16,348,143 shares of its common stock acquired pursuant

to a tender offer at a purchase price of $18.00 per share, for a total

purchase price of $294.3 million. The tender offer was announced on

August 21, 2015 and expired on September 22, 2015. In addition, prior to

the commencement of the tender offer, the Company purchased 634,596

shares of its common stock under its Stock Repurchase Program at a

weighted average purchase price of $16.03 in open market transactions.

As of September 30, 2015, the Company had approximately 75.3 million

shares outstanding.

The Company’s Board of Directors recently approved an additional amount

of $200 million for the repurchase of its outstanding common stock under

the Company’s Stock Repurchase Program. As a result, the Company

currently has a total of $205.7 million available for share repurchases.

The Company may repurchase its stock in open market purchases pursuant

to Rule 10b-18, in privately negotiated transactions or otherwise. The

timing and amount of any additional shares to be repurchased will depend

upon a variety of factors, including market and business conditions,

applicable legal requirements and other factors. Repurchases may be

commenced or suspended at any time or from time to time without prior

notice. The Stock Repurchase Program will continue until otherwise

modified or terminated by the Company’s Board of Directors at any time

in its sole discretion.

Third Quarter 2015 update includes:

-

Total revenue for the quarter was $27.8 million as compared to $24.0

million in the third quarter of 2014. The Company experienced

increases in real estate sales, resorts and leisure revenues, leasing

revenues and timber sales.

-

Real estate sales increased to $4.9 million in the third quarter of

2015 as compared to $3.9 million in the third quarter of 2014.

-

Resorts and leisure revenue increased approximately $1.6 million, or

10%, during the three months ended September 30, 2015, as compared to

the third quarter of 2014. The increase was primarily due to higher

membership revenue, additional nights rented, higher average rates in

vacation rental programs and ancillary receipts.

-

Leasing operations increased $0.4 million during the third quarter of

2015, as compared to the third quarter of 2014. The increase was

primarily related to the increase in lease revenue at Pier Park North.

-

Timber sales increased to $1.9 million during the third quarter of

2015 as compared to $1.1 million in the third quarter of 2014 due to

tons sold. Tons sold were approximately 109,000 during the third

quarter of 2015 as compared to approximately 76,000 tons during the

third quarter of 2014. Gross margins increased during the third

quarter of 2015 to 89%, as compared to 82% during the third quarter of

2014.

-

Investment income and realized gains from the Company’s

available-for-sale securities for the third quarter of 2015 was $7.0

million as compared to $1.0 million during the third quarter of 2014.

Approximately $5.3 million in gains related to a sale of corporate

debt securities.

-

As of September 30, 2015, the Company had cash, cash equivalents and

investments of $409.9 million, as compared to $671.4 million as of

December 31, 2014. The decrease was related to the $304.9 million of

cash used for the stock repurchases.

Jeffrey C. Keil, the Company’s President and Interim Chief Executive

Officer said, “We are pleased with the result of the repurchase programs

and the Board’s decision to increase the authority by $200 million.” Mr.

Keil added, “We are committed to maintaining a healthy balance sheet as

we continue to pursue value creation for our shareholders.”

|

FINANCIAL DATA

Consolidated Results

($ in millions except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Nine Months Ended

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

Real estate sales

|

|

$4.9

|

|

$3.9

|

|

$24.3

|

|

$630.6

|

|

Resorts and leisure revenues

|

|

18.5

|

|

16.9

|

|

45.7

|

|

40.4

|

|

Leasing revenues

|

|

2.5

|

|

2.1

|

|

6.8

|

|

4.9

|

|

Timber sales

|

|

1.9

|

|

1.1

|

|

6.0

|

|

10.3

|

|

Total revenues

|

|

27.8

|

|

24.0

|

|

82.8

|

|

686.2

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

Cost of real estate sales

|

|

2.5

|

|

2.1

|

|

12.3

|

|

84.6

|

|

Cost of resorts and leisure revenues

|

|

14.7

|

|

13.7

|

|

38.2

|

|

34.4

|

|

Cost of leasing revenues

|

|

0.7

|

|

0.6

|

|

2.0

|

|

1.5

|

|

Cost of timber sales

|

|

0.2

|

|

0.2

|

|

0.6

|

|

4.3

|

|

Other operating and corporate expenses

|

|

9.9

|

|

6.5

|

|

24.7

|

|

22.3

|

|

Administrative costs associated with special purpose entities

|

|

--

|

|

--

|

|

--

|

|

3.7

|

|

Depreciation, depletion and amortization

|

|

2.2

|

|

2.2

|

|

7.3

|

|

6.2

|

|

Total expenses

|

|

30.2

|

|

25.3

|

|

85.1

|

|

157.0

|

|

Operating (loss) income

|

|

(2.4)

|

|

(1.3)

|

|

(2.3)

|

|

529.2

|

|

Other income

|

|

6.4

|

|

0.8

|

|

5.1

|

|

3.5

|

|

Income (loss) from operations before equity in income from

unconsolidated

affiliates and income taxes

|

|

4.0

|

|

(0.5)

|

|

2.8

|

|

532.7

|

|

Income tax expense (benefit)

|

|

1.2

|

|

(0.3)

|

|

2.0

|

|

115.2

|

|

Net income (loss)

|

|

2.8

|

|

(0.2)

|

|

0.8

|

|

417.5

|

|

Net loss attributable to non-controlling interest

|

|

--

|

|

0.1

|

|

--

|

|

0.1

|

|

Net income (loss) attributable to the Company

|

|

$2.8

|

|

$(0.1)

|

|

$0.8

|

|

$417.6

|

|

Net income (loss) per share attributable to the Company

|

|

$0.03

|

|

$(0.00)

|

|

$0.01

|

|

$4.52

|

|

Weighted average shares outstanding

|

|

92,026,894

|

|

92,295,213

|

|

92,088,253

|

|

92,297,467

|

|

Revenues by Segment

($ in millions)

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Nine Months Ended

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

Real estate sales

|

|

|

|

|

|

|

|

|

|

Residential

|

|

$4.9

|

|

$3.7

|

|

$14.3

|

|

$13.6

|

|

RiverTown Sale

|

|

--

|

|

--

|

|

--

|

|

43.6

|

|

Commercial

|

|

--

|

|

--

|

|

4.7

|

|

3.3

|

|

AgReserves Sale and other rural land sales

|

|

--

|

|

0.2

|

|

5.3

|

|

570.1

|

|

Total real estate sales

|

|

4.9

|

|

3.9

|

|

24.3

|

|

630.6

|

|

Resorts and leisure revenues

|

|

18.5

|

|

16.9

|

|

45.7

|

|

40.4

|

|

Leasing revenues

|

|

2.5

|

|

2.1

|

|

6.8

|

|

4.9

|

|

Timber sales

|

|

1.9

|

|

1.1

|

|

6.0

|

|

10.3

|

|

Total revenues

|

|

$27.8

|

|

$24.0

|

|

$82.8

|

|

$686.2

|

|

Summary Balance Sheet

($ in millions)

|

|

|

|

|

|

|

|

|

|

September 30, 2015

|

|

December 31, 2014

|

|

Assets

|

|

|

|

|

|

Investment in real estate, net

|

|

$315.5

|

|

$321.8

|

|

Cash and cash equivalents

|

|

157.9

|

|

34.5

|

|

Investments

|

|

252.0

|

|

636.9

|

|

Restricted investments

|

|

7.2

|

|

7.9

|

|

Notes receivable, net

|

|

2.9

|

|

24.3

|

|

Pledged cash and treasury securities

|

|

25.3

|

|

25.7

|

|

Property and equipment, net

|

|

10.3

|

|

10.2

|

|

Other assets

|

|

32.7

|

|

32.0

|

|

Investments held by special purpose entities

|

|

208.7

|

|

209.8

|

|

Total assets

|

|

$1,012.5

|

|

$1,303.1

|

|

|

|

|

|

|

|

Liabilities and Equity

|

|

|

|

|

|

Debt

|

|

$69.7

|

|

$63.8

|

|

Accounts payable, accrued liabilities and deferred credits

|

|

50.7

|

|

47.5

|

|

Deferred tax liabilities

|

|

37.5

|

|

34.8

|

|

Senior Notes held by special purpose entity

|

|

177.4

|

|

177.3

|

|

Total liabilities

|

|

335.3

|

|

323.4

|

|

Total equity

|

|

677.2

|

|

979.7

|

|

Total liabilities and equity

|

|

$1,012.5

|

|

$1,303.1

|

|

Debt Schedule

($ in millions)

|

|

|

|

|

|

|

|

|

|

September 30, 2015

|

|

December 31, 2014

|

|

In substance defeased debt

|

|

$25.3

|

|

$25.7

|

|

Community Development District debt

|

|

6.8

|

|

6.5

|

|

Pier Park North joint venture – construction loan

|

|

37.6

|

|

31.6

|

|

Total debt

|

|

$69.7

|

|

$63.8

|

|

Other Operating and Corporate Expenses

($ in millions)

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

Nine Months Ended

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Employee costs

|

|

$4.5

|

|

$1.8

|

|

$10.0

|

|

$6.9

|

|

AgReserves Sale severance

|

|

--

|

|

--

|

|

--

|

|

1.2

|

|

401(k) contribution / pension costs

|

|

--

|

|

0.9

|

|

1.1

|

|

2.2

|

|

Non-cash stock compensation costs

|

|

--

|

|

0.1

|

|

0.2

|

|

0.2

|

|

Property taxes and insurance

|

|

1.4

|

|

1.6

|

|

4.4

|

|

4.8

|

|

Professional fees

|

|

2.8

|

|

1.2

|

|

5.6

|

|

3.8

|

|

Marketing and owner association costs

|

|

0.3

|

|

0.3

|

|

1.0

|

|

1.1

|

|

Occupancy, repairs and maintenance

|

|

0.2

|

|

0.2

|

|

0.7

|

|

0.7

|

|

Other

|

|

0.7

|

|

0.4

|

|

1.7

|

|

1.4

|

|

Total other operating and corporate expense

|

|

$9.9

|

|

$6.5

|

|

$24.7

|

|

$22.3

|

Additional Information and Where to Find It

Additional information with respect to the Company’s results for the

third quarter of 2015 will be available in a Form 10-Q that will be

filed with the Securities and Exchange Commission.

Important Notice Regarding Forward-Looking Statements

This press release includes forward-looking statements, including

statements regarding the Company’s expectations regarding its financial

position and its pursuit of value creation for its shareholders, as well

as its plans with respect to share repurchases. The Company wishes to

caution readers that certain important factors may have affected and

could in the future affect the Company’s actual results and could cause

the Company’s actual results for subsequent periods to differ materially

from those expressed in any forward-looking statement made by or on

behalf of the Company, including (1) changes in the Company’s strategic

objectives and its ability to implement such strategic objectives; (2)

economic or other conditions that affect the future prospects for the

Southeastern region of the United States and the demand for the

Company’s products, including a slowing of the population growth in

Florida, inflation, or unemployment rates or declines in consumer

confidence or the demand for, or the prices of, housing; (3) any

potential negative impact of the Company’s longer-term property

development strategy, including losses and negative cash flows for an

extended period of time if the Company continues with the

self-development of recently granted entitlements; (4) the impact of

natural or man-made disasters or weather conditions, including

hurricanes and other severe weather conditions, on the Company’s

business; (5) the Company’s ability to capitalize on its leasing

operations in the Pier Park North joint venture; (6) the Company’s

ability to capitalize on opportunities relating to its mixed use and

active adult communities, including its ability to successfully and

timely obtain land-use entitlements and construction financing, maintain

compliance with state law requirements and address issues that arise in

connection with the use and development of its land, including the

permits required for the mixed use and active adult communities; (7) the

impact of market volatility on the value of the Company’s investments,

including potential unrealized losses or the realization of losses on

its investments; (8) the Company’s use of its share repurchase

authorization and its ability to carry out the Stock Repurchase Program

in accordance with applicable securities laws; (9) the Company’s ability

to realize the anticipated benefits of its Stock Repurchase Program; and

(10) the Company’s ability to effectively deploy and invest its assets,

including available-for-sale securities; as well as, the cautionary

statements and risk factor disclosures contained in the Company’s

Securities and Exchange Commission filings including the Company’s

Annual Report on Form 10-K filed with the Commission on February 26,

2015 as updated by subsequent Quarterly Reports on Form 10-Qs and other

current report filings.

About The St. Joe Company

The St. Joe Company together with its consolidated subsidiaries is a

real estate company concentrated primarily between Tallahassee and

Destin, Florida. More information about the Company can be found on its

website at www.joe.com.

© 2015, The St. Joe Company. “St. Joe®”, “JOE®”, the “Taking Flight”

Design®, “St. Joe (and Taking Flight Design)®” are registered service

marks of The St. Joe Company.

CONTACT:

St. Joe Investor Relations

Marek Bakun, 1-866-417-7132

Chief

Financial Officer

Marek.Bakun@Joe.Com

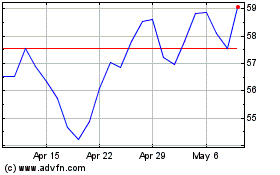

St Joe (NYSE:JOE)

Historical Stock Chart

From Mar 2024 to Apr 2024

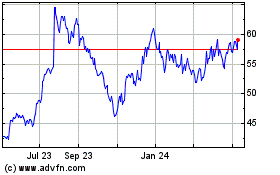

St Joe (NYSE:JOE)

Historical Stock Chart

From Apr 2023 to Apr 2024