UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐ Filed

by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

E. I. du Pont de Nemours and Company

(Name of Registrant as Specified In Its Charter)

Trian Fund Management, L.P.

Trian Fund Management GP, LLC

Trian Partners, L.P.

Trian Partners Strategic Investment Fund,

L.P.

Trian Partners Strategic Investment Fund

II, L.P.

Trian Partners Master Fund, L.P.

Trian Partners Parallel Fund I, L.P.

Trian Partners Master Fund (ERISA), L.P.

Trian Partners Strategic Investment Fund-A,

L.P.

Trian Partners Strategic Investment Fund-D,

L.P.

Trian Partners Strategic Investment Fund-N,

L.P.

Trian SPV (SUB) VIII, L.P.

Trian Partners Fund (Sub)-G, L.P.

Trian Partners Fund (Sub)-G II, L.P.

Nelson Peltz

Peter W. May

Edward P. Garden

John H. Myers

Arthur B. Winkleblack

Robert J. Zatta

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) |

Proposed maximum aggregate value of transaction: |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

2) |

Form, Schedule or Registration Statement No.: |

From time to time, Trian Fund Management, L.P. (“Trian”)

may provide the materials titled “Trian’s Implied Target Value Analysis for DuPont Stock” to stockholders of

E.I. du Pont de Nemours and Company and certain other persons. These materials are attached hereto as Exhibit 1 and are being filed

by Trian in HTML and PDF formats as a convenience for readers.

###

Exhibit 1

1 Trian’s Implied Target Value Analysis For DuPont Stock © 2015 Trian Fund Management, L.P. All rights reserved.

Disclaimers The views expressed in this presentation represent the opinions of Trian Fund Management, L.P. (” Trian “) and the investment funds it manages that hold shares of E.I. du Pont de Nemours and Company (collectively, Trian with such funds, ” Trian Partners “), and are based on publicly available information with respect to E. I. du Pont de Nemours and Company (the ” Company “). Trian Partners recognizes that there may be confidential information in the possession of the Company that could lead it to disagree with Trian Partners’ conclusions. Trian Partners reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Trian Partners disclaims any obligation to update the information or opinions contained in this presentation. Certain financial projections and statements made herein have been derived or obtained from filings made with the Securities and Exch ang e Commission (” SEC “) or other regulatory authorities and from other third party reports. Neither the Participants (as defined below) nor any of their affiliates shall be responsible or have any liability for any misinformation contained in any third party SEC or other reg ulatory filing or third party report. The estimates, projections and potential impact of the opportunities identified by Trian Partners herein are based on assumptions that Trian Partners believes to be reasonable as of the date of this presentation, but there can be no assurance or guarantee that actua l results or performance of the Company will not differ, and such differences may be material. This presentation is provided merely as information and is not intended to be, nor should it be construed as, an offer to sell or a s olicitation of an offer to buy any security. This presentation does not recommend the purchase or sale of any security. Funds managed by Trian currently beneficially own, and/or have an economic interest in, shares of the Company. These funds are in the business of trading – buyin g and selling – securities. It is possible that there will be developments in the future that cause one or more of such funds from time to time to sell all or a portion of their holdings of the Company in open market transactions or otherwise (including via short sales), buy addit ion al shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls or other derivative instrume nts relating to such shares. 2

Disclaimers (Cont’d) Cautionary Statement Regarding Forward - Looking Statements This presentation contains forward - looking statements. All statements contained in this presentation that are not clearly histor ical in nature or that necessarily depend on future events are forward - looking, and the words “anticipate,” “believe,” “expect,” “potential,” “opp ortunity,” “estimate,” “plan,” and similar expressions are generally intended to identify forward - looking statements. The projected results and statements contained in this presentation that are not historical facts are based on current expectations, speak only as of the date of thi s presentation and involve risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially di ffe rent from any future results, performance or achievements expressed or implied by such projected results and statements. Assumptions relati ng to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and futur e b usiness decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of Trian Partners. Although Trian Partners believes that the assumptions underlying the projected results or forward - looking statements are reasonable as of the date of this presentation, any of the assumptions could be inaccurate and therefore, there can be no assurance that the projected res ult s or forward - looking statements included in this presentation will prove to be accurate. In light of the significant uncertainties inheren t i n the projected results and forward - looking statements included in this presentation, the inclusion of such information should not be regarded a s a representation as to future results or that the objectives and strategic initiatives expressed or implied by such projected r esu lts and forward - looking statements will be achieved. Trian Partners will not undertake and specifically declines any obligation to disclose the results of any revisions that may be made to any projected results or forward - looking statements in this presentation to reflect events or circ umstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events. Additional Information Trian Partners, together with other Participants (as defined below), filed a definitive proxy statement and an accompanying proxy c ar d with the SEC on March 25, 2015 to be used to solicit proxies in connection with the 2015 Annual Meeting of Stockholders of the Company , i ncluding any adjournments or postponements thereof or any special meeting that may be called in lieu thereof (the “2015 Annual Meeting “). Information relating to the participants in such proxy solicitation (the “Participants”) has been included in that definitive proxy state men t and in any other amendments to that definitive proxy statement. Stockholders are advised to read the definitive proxy statement and any other doc uments related to the solicitation of stockholders of the Company in connection with the 2015 Annual Meeting because they contain im por tant information, including additional information relating to the Participants. Trian Partners’ definitive proxy statement and a form of proxy have been mailed to stockholders of the Company. These materials and other materials filed by Trian Partners in connection with the solicitation of proxies are available at no charge at the SEC’s website at www.sec.gov. The definitive proxy statement and other relevant doc ume nts filed by Trian Partners with the SEC are also available, without charge, by directing a request to Trian’s proxy solicitor, MacKenzie Partners, Inc. 105 Madison Avenue, New York, New York 10016 (call collect: 212 - 929 - 5500; call toll free: 800 - 322 - 2885) or email: proxy@mackenziepartners.com . 3

Trian’s Investment Thesis For DuPont ▪ When Trian issued its Summary White Paper (September 2014), Trian arrived at an implied target value per share in excess of $120 (1) by the end of 2017, a 21% internal rate of return (IRR) for shareholders holding DuPont stock during this period ▪ The Key Assumptions for Trian’s Analysis in its Summary White Paper were as follows: – Valuation: 9.9x blended next twelve months (NTM) Enterprise Value (EV)/EBITDA multiple (2 ) o Benchmarks valuation for DuPont’s businesses using the following peer companies: • GrowthCo (Agriculture ; Industrial Biosciences; Nutrition & Health) : Monsanto, Syngenta, Novozymes , Givaudan , Symrise , IFF, Chr. Hansen, Kerry, Tate & Lyle • CyclicalCo / CashCo (Safety and Protection, Performance Materials, Electronics & Communications): 3M, Eastman Chemical, Celanese, Dow Chemical • Performance Chemicals: Kronos, Tronox , Huntsman, Arkema o DuPont currently trades at a consolidated NTM EV/EBITDA multiple of 10.3x, which is 0.4 x higher than the multiple used in the Summary White Paper (3 ) – Best - in - class operating performance : Revenue growth and margins in - line with peers and management long - term targets o Models 410bps of margin improvement from 2014 - 2018 • If one assumes a ~30% flow - through on incremental revenue, the resulting cost savings implied by the model would be less than $1bn of cost savings (4) – Prudent Leverage: 2x net debt/EBITDA across the businesses as a whole; maintain investment grade rating – Focus on Returns to Shareholders: Grow dividend at 10% compounded annual growth rate (CAGR); assuming all excess free cash flow returned to shareholders – Tax Rate: 33% tax rate (higher than the 22% expected by the Company in 2015 (5) ) across the business to provide flexibility with free cash flow 4 (1) The Open Letter to the DuPont Board (Trian Summary White Paper) dated September 16, 2014 is available at www.DuPontCanBeGreat.com . This is not meant to be, nor is it, a prediction of the future trading price or market value of DuPont stock . There can be no assurance or guarantee with respect to the prices at which DuPont stock will trade, and such stock may not trade at pr ices that may be implied herein. (2) EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Assumes 6% increase in the NTM EV/EBITDA mu ltiple based on DuPont’s consensus valuation as of September 2014. (3) Current NTM EV/EBITDA multiple based on consensus estimates for 2015 EBITDA (per Bloomberg, as of April 16, 2015, intraday st ock price). (4) Trian estimates that consolidated DuPont is burdened by $2 - 4bn of excess corporate costs. See pages 71 and 72 of Trian’s White Paper which was filed with the SEC on February 17, 2015. (5) See the Company’s Investor Presentation dated January 27, 2015. The Summary White Paper contemplated a separation of the portfolio as a means to an end to increase the probability that the individual businesses eliminate operational underperformance vs. peers and achieve a multiple re - rating. If elected, Trian’s nominees will work with the Board to assess DuPont’s corporate structure and determine if management is capable of achieving best - in - class performance with the existing portfolio. If management can optimize performance on a consolidated basis, the Company would not need to separate the portfolio or incur any related costs, which would increase our implied target value per share

Model Behind Implied Target Value of DuPont Shares 5 (1) This model is included in the September 16, 2014 Open Letter to the DuPont Board ( Trian Summary White Paper). Sources : DuPont SEC Filings and Trian estimates. $ in millions, except per share data. Implied Target Value: December 31, 2017 (1) Performance CyclicalCo/ Total GrowthCo Chemicals CashCo 2018E Figures Revenue $21,900 $7,977 $15,533 $45,410 5 YR CAGR 5.9% 3.5% 3.9% 4.9% EBITDA $5,084 $1,775 $3,560 $10,418 % - Margin 23.2% 22.2% 22.9% 22.9% EPS $3.59 $1.31 $2.35 $7.25 NTM EV/EBITDA Multiple 11.8x 6.7x 8.8x 9.9x December 31, 2017 Valuation Enterprise Value $60,208 $11,944 $31,488 $103,639 Net Debt and other ($9,068) ($2,961) ($7,438) ($19,467) Equity Value $51,140 $8,983 $24,050 $84,173 Shares Outstanding 735 688 754 735 Implied Share Value $69.55 $13.05 $31.90 $114.50 Implied NTM P/E 19.4x 10.0x 13.5x 15.8x Dividends Per Share (Remaining 2014 & 2015) - - - 2.98 Dividends Per Share (2016-2017) 1.88 0.66 1.95 4.49 Total Dividends Per Share Collected $1.88 $0.66 $1.95 $7.47 Total Implied Value Per DuPont Share at 12/31/17 $121.97 % Potential Upside (With Dividend) 86.6% Debt/EBITDA 2.6x 2.1x 2.6x 2.5x Net Debt/EBITDA 2.0x 1.9x 2.2x 2.0x

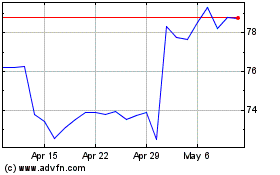

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024