Cigna Study Details How Incentives Help American Workers Engage in Improving Their Health & Making Their Health Care More Aff...

September 22 2015 - 10:30AM

Business Wire

- Three-year Cigna study shows to the

dollar how a handful of correctable health conditions contribute to

the health care costs of American workers

- Study provides evidence that those with

unhealthy biometrics -- and those who have not completed biometric

screening measures – are more likely to incur high costs

- Findings provide evidence that

incentive programs can lead to better health engagement and

behavior, clinical outcomes and costs

The bad news: higher weight, cholesterol, blood pressure and

blood sugar can raise health costs and out-of-pocket health

expenses. The worse news: what you don’t know about your health

could be even more costly to you.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20150922005930/en/

The good news is there are health improvement programs and

incentive strategies that are proven to help people address the

conditions which increase costs, according to a three-year study of

health plan consumer data by global health service company, Cigna

(NYSE:CI).

Where health meets costs

The Cigna study of 200,000 customers shows how a handful of

correctable health conditions, as indicated by unhealthy

biometrics, can contribute to their average annual health care

costs:

- A body mass index (BMI) of more than 30

increases total health care costs by an average of more than $2,460

per customer per year, and adds $492 in annual out-of-pocket

costs.

- A cholesterol reading of more than 240

translates into an average total health care cost increase of

$1,644 per health plan customer per year, and adds more than $353

in annual out-of-pocket costs.

- Two or more chronic conditions

indicated by unhealthy BMI, blood pressure, cholesterol, and blood

sugar raises annual out-of-pocket expense by almost $1,300 per

year, and total healthcare costs by nearly $9,000 per year.

The cost of not knowing

When it comes to health conditions, those who have not undergone

a biometric screening have higher health costs. For example,

- Those who have not had a biometric

screening of their blood pressure values on average have total

health costs which are $2,064 higher per year, and $400 more in

out-of-pocket costs, than those who have verified that their blood

pressure is lower than 140/90.

- Those who have not had a biometric

screening of their blood glucose values on average have total

health costs which are $1,332 higher per year, and $266 more in

out-of-pocket costs, than those who have verified that their blood

glucose is lower than 100.

“In too many cases our health and costs are getting worse, but

it’s also in our power to change that,” said Cigna's Chief Nursing

Officer, Mary Picerno. “Yes, we have to work hard, and have to do

things we haven’t done before, but still, we can change it. And

when we do, there can be financial rewards, along with the ultimate

reward of better health.”

Lowering health costs today by preventing health issues

tomorrow

Notably the study shows how incentive programs – such as

consumer premium discounts, or health spending account funds --

play a key role as the impetus for individuals to participate in a

biometric screening, to engage in healthier behaviors, and improve

their clinical outcomes and costs. According to the Cigna

study:

- Incentives more than doubled biometric

screening rates from 20 percent to 55 percent in 2014

- Incentives increase the probability of

engaging in a coaching program by 24% and in particular by 30% for

populations who have chronic conditions

- Incentives significantly increase the

probably of setting and meeting goals with a health coach, by 18%

and 43% respectively

- Incentives increased the probability of

meeting biometric targets:

- BMI less than 30 – an improvement of

nearly 36 percent

- Total cholesterol less than 240 – an

improvement of nearly 11 percent

- Blood pressure less than 140/90 – an

improvement of more than 47 percent

- Incentives reduced total medical costs

by approximately 10% for those 50+ years of age or with chronic

conditions

“Employers are increasingly rewarding employees who identify and

address their potential health risks, by discounting the employee’s

health plan premiums or adding funds to their health spending

account to lower their annual out-of-pocket expenses,” said

Picerno. “In 2014 Cigna distributed more than $80 million in

rewards to Cigna group health plan customers who completed 1.6

million health goals. In the first eight months of 2015, Cigna

customers have earned $93,814,080 in awards through their employer

incentive programs.*”

* Cigna internal data, Do Incentives drive engagement, health

and financial outcomes? September 1, 2015

About Cigna

Cigna Corporation (NYSE: CI) is a global health service company

dedicated to helping people improve their health, well-being and

sense of security. All products and services are provided

exclusively by or through operating subsidiaries of Cigna

Corporation, including Connecticut General Life Insurance Company,

Cigna Health and Life Insurance Company, Life Insurance Company of

North America and Cigna Life Insurance Company of New York. Such

products and services include an integrated suite of health

services, such as medical, dental, behavioral health, pharmacy,

vision, supplemental benefits, and other related products including

group life, accident and disability insurance. Cigna maintains

sales capability in 30 countries and jurisdictions, and has more

than 89 million customer relationships throughout the world. To

learn more about Cigna®, including links to follow us on Facebook

or Twitter, visit www.cigna.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150922005930/en/

Cigna CorporationJoe Mondy,

860-226-5499Joseph.Mondy@cigna.com

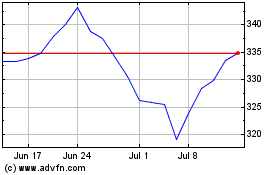

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

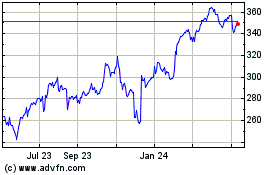

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024