Current Report Filing (8-k)

December 30 2016 - 11:47AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 30, 2016 (December 28, 2016)

Financial Institutions, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

New York

|

|

0-26481

|

|

16-0816610

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

220 Liberty Street, Warsaw, New York

|

|

14569

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area

Code: 585-786-1100

N/A

(Former Name or Former Address, if Changed Since Last Report): Not Applicable

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On December 28, 2016, the Board of

Directors (the “

Board

”) of Financial Institutions, Inc., a New York Corporation (the “

Corporation

”), approved a form of director’s and officer’s indemnification agreement (the “

D&O

Indemnification Agreement

”). The D&O Indemnification Agreement indemnifies directors and officers who are parties thereto with indemnification rights arising out of, or relating to, their service as directors and officers of the

Corporation or where they serve at the request of the Corporation as an officer, director, representative or other agent at another entity. The foregoing description of the form of D&O Indemnification Agreement does not purport to be complete

and is qualified in its entirety by reference to the complete text of the form of D&O Indemnification Agreement, a copy of which is attached to this Current Report on Form

8-K

as Exhibit 10.1 and

incorporated by reference herein in this Item 1.01 in its entirety.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information included in Item 1.01 of this Current

Report on Form

8-K

relating to the Company’s form of D&O Indemnification Agreement is incorporated by reference in this Item 5.02.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On December

28, 2016, the Board approved amendments to amend and restate the Corporation’s bylaws, effective as of December 28, 2016 (the “

Bylaws

”). The Bylaws have not been amended since they were last filed with the U.S. Securities

and Exchange Commission (the “

SEC

”) on March 12, 2009 as an exhibit to the Corporation’s Annual Report on Form

10-K

for the fiscal year ended December 31, 2008. The amendments

to the Bylaws are intended to conform the Bylaws to more current and customary public company practice, including to (i) enhance the information that the Board would have access to about the persons deemed to be proposing director nominees

and/or shareholder proposals and further the Board’s ability to make informed recommendations to shareholders relating thereto; (ii) provide fixed, certain, predictable and customary deadlines for shareholder proposals and director

nominations intended to be brought before an annual meeting of the Corporation’s stockholders, that, rather than being derived from the date of such annual meeting which may not have been fixed, would instead be, except as provided below, the

thirty (30) calendar day period that is no more than

one-hundred

twenty (120) and not less than ninety (90) calendar days prior to the first anniversary of the immediately preceding year’s

annual meeting; (iii) enhance the information that the Board would have access to about proposed nominees and/or shareholder proposals and further the Board’s ability to make informed recommendations to shareholders relating thereto;

(iv) enhance the information that the Corporation would have access to in preparing proxy materials commenting on any shareholder proposed nominees and/or shareholder proposals; and (v) enhance the information available to all shareholders

in advance of a shareholders’ meeting and, accordingly, allow shareholders to make more informed voting decisions. Among other things, the amendments to the Bylaws:

|

|

•

|

|

Specify certain procedural matters relating to the requirements for any business to be brought before an annual meeting of shareholders, including, but not limited to, the prerequisites for a shareholder to bring any

business before an annual meeting of shareholders;

|

2

|

|

•

|

|

Add provisions requiring an advance notice of shareholder proposals to be submitted to the Corporation in connection with business intended to be brought before an annual meeting of shareholders (the “

Proposal

Notice

”), including, but not limited to, provisions that:

|

|

|

•

|

|

Specify that, to be timely, a shareholder’s Proposal Notice must be delivered to, or mailed and received by, the Secretary at the principal executive offices of the Corporation not earlier than the close of

business on the one hundred and twentieth (120th) calendar day and not later than the close of business on the ninetieth (90th) calendar day prior to the

one-year

anniversary date of the immediately preceding

year’s annual meeting of shareholders (the “

Anniversary Date

”);

provided,

however

, that in the event that the date of the annual meeting is more than thirty (30) calendar days before or more than sixty

(60) calendar days after the Anniversary Date, or if the Corporation did not hold an annual meeting in the preceding fiscal year, notice by the shareholder to be timely must be so delivered, or mailed and received, not later than the later of

(i) the close of business on the ninetieth (90th) calendar day prior to such annual meeting or (ii) the close of business on the tenth (10th) calendar day following the day on which public disclosure of the date of such annual meeting was

first made;

|

|

|

•

|

|

Provide for a defined term, “

Proposing Person

,” to encompass the individuals for whom information will be required to be included in a Proposal Notice or Nominating Notice (as defined below), as the

case may be, and defining “

Proposing Person

” to include the shareholder providing the applicable notice, the beneficial owner of the Corporation’s capital stock, if different, on whose behalf the applicable notice is given, any

“affiliate” or “associate” (as such terms are defined in the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”)) of such shareholder or beneficial owner, each other person who is “Acting in

Concert” (as defined below) with such shareholder or beneficial owner, persons who are members of any Schedule 13D group (as such term is used in Rule

13d-5

under the Exchange Act) with such shareholder

or beneficial owner and persons who are participants in any solicitation of proxies by such shareholder or beneficial owner;

|

|

|

•

|

|

Provide that a person shall be deemed to be “

Acting in Concert

” with another person if such

person knowingly acts (whether or not pursuant to an express agreement, arrangement or understanding) in concert with, or towards a common goal relating to the management, governance or control of the Corporation in parallel with, such other person

where (A) each person is conscious of the other person’s conduct or intent and this awareness is an element in their decision-making processes and (B) at least one additional factor suggests that such persons intend to act in concert

or in parallel, which such additional factors may include, without limitation, exchanging

|

3

|

|

information (whether publicly or privately), attending meetings, conducting discussions, or making or soliciting invitations to act in concert or in parallel; provided, that a person shall not be

deemed to be Acting in Concert with any other person solely as a result of the solicitation or receipt of revocable proxies from such other person in response to a solicitation made pursuant to, and in accordance with, Section 14(a) of the Exchange

Act by way of a proxy or consent solicitation statement filed on Schedule 14A. A person Acting in Concert with another person shall be deemed to be Acting in Concert with any third party who is also Acting in Concert with such other person;

|

|

|

•

|

|

Further specify the information required to be provided by Proposing Persons in respect of the business proposed in their Proposal Notice, including, but not limited to, the following information regarding such persons:

|

|

|

•

|

|

their ownership, direct and indirect, in the Corporation’s securities, including any shares, owned beneficially (as defined in Rule

13d-3

(or any successor thereof) under the

Exchange Act) and/or held of record by such persons (including any shares of any class or series of the Corporation as to which such person has a right to acquire beneficial ownership at any time in the future, whether such right is exercisable

immediately, only after the passage of time or only upon the satisfaction of certain conditions precedent);

|

|

|

•

|

|

a description in reasonable detail of any pending, or to the knowledge of any such persons, threatened legal proceeding in which any Proposing Person is a party or participant involving the Corporation or any officer,

director, affiliate or associate of the Corporation;

|

|

|

•

|

|

a description in reasonable detail of any relationship (including any direct or indirect interest in any agreement, arrangement or understanding, written or oral) between any Proposing Person and the Corporation or any

director, officer, affiliate or associate of the Corporation;

|

|

|

•

|

|

a description in reasonable detail of any derivative interests that are directly or indirectly, held or

maintained by such persons with respect to any shares of any class or series of shares of the Corporation’s securities (including any short position or any borrowing or lending of shares of stock) that has been made by or on behalf of such

persons, the effect or intent of any of the foregoing being to mitigate loss to, or to manage risk of stock price changes for, any such persons or any of their “affiliates” or “associates” (as such terms are defined in Rule

12b-2

of the Exchange Act) or to increase or decrease the voting power or pecuniary or economic interest of such persons or any of their affiliates or associates with respect to stock of the Corporation, including

any security or instrument that would not otherwise constitute a “derivative security” (as such term is defined in Rule 16a-

|

4

|

|

1(c) under the Exchange Act) as a result of any feature that would make any conversion, exercise or similar right or privilege of such security or instrument becoming determinable only at some

future date or upon the happening of a future occurrence;

|

|

|

•

|

|

a description in reasonable detail of any proxy, contract, arrangement, understanding or relationship, written or oral and formal or informal, between such Proposing Person and any other person or entity (naming each

such person or entity) pursuant to which the Proposing Person has a right to vote any shares of the Corporation;

|

|

|

•

|

|

a description in reasonable detail of any rights to dividends on the shares of any class or series of shares of the Corporation directly or indirectly held of record or beneficially by such Proposing Person that are

separated or separable from the underlying shares of the Corporation;

|

|

|

•

|

|

a description in reasonable detail of any performance-related fees (other than an asset-based fee) to which the Proposing Person may be entitled as a result of any increase or decrease in the value of shares of the

Corporation or any of its derivative securities;

|

|

|

•

|

|

any direct or indirect interest of such Proposing Person in any contract or agreement with the Corporation, or any affiliate or associate of the Corporation (naming such affiliate or associate); and

|

|

|

•

|

|

a description in reasonable detail of all agreements, arrangements and understandings, written or oral, formal or

informal (1) between or among any of the Proposing Persons or (2) between or among any of the Proposing Persons and any other person or entity (naming each such person or entity) in connection with or related to the proposal of business by

a shareholder, including without limitation, (A) any understanding, formal or informal, written or oral, that any Proposing Person may have reached with any shareholder of the Corporation (naming each such shareholder) with respect to how such

shareholder will vote its shares in the Corporation at any meeting of the Corporation’s shareholders or take other action in support of or related to any business proposed, or other action to be taken, by the Proposing Person, and (B) any

agreements that would be required to be disclosed by any Proposing Person or any other person or entity pursuant to Item 5 or Item 6 of a Schedule 13D that would be filed pursuant to the Exchange Act and the rules and regulations promulgated

thereunder (regardless of whether the requirement to file a Schedule 13D is applicable to the Proposing Person or other person or entity); and all other information relating to such Proposing Persons that would be required to be disclosed in a proxy

statement or other filing required to be made by any Proposing Persons in connection with the contested

|

5

|

|

solicitation of proxies by such persons in support of the business proposed to be brought before the shareholders’ meeting pursuant to Section 14(a) and Regulation 14A under the Exchange

Act;

|

|

|

•

|

|

Further specify, as to each item of business that the shareholder giving the Proposal Notice proposes to bring before the annual meeting, the information required to be provided about such proposed business, including,

but not limited to the following:

|

|

|

•

|

|

the reasons (including the text of any reasons for the business that would be disclosed in any proxy statement or supplement thereto to be filed with the SEC) detailing why such shareholder or any other Proposing Person

believes that the taking of the action or actions proposed to be taken would be in the best interests of the Corporation and its shareholders;

|

|

|

•

|

|

the text of the proposal or business (including the text of any resolutions proposed for consideration);

|

|

|

•

|

|

a description in reasonable detail of any interest of any Proposing Person in such business, including any anticipated benefit to the shareholder or any other Proposing Person therefrom, including any interest that

would be disclosed to the Corporation’s shareholders in any proxy statement to be distributed to the Corporation’s shareholders; and

|

|

|

•

|

|

all other information relating to such proposed business that would be required to be disclosed in a proxy statement or other filing required to be made by any of the Proposing Persons in connection with the

solicitation of proxies in support of such proposed business by one or more Proposing Persons pursuant to Section 14(a) and Regulation 14A under the Exchange Act.

|

|

|

•

|

|

Require the Proposing Person to, from time to time, update and supplement the information provided by such shareholder in its Proposal Notice to include a provision that allows the Corporation, the Board or any duly

authorized committee thereof to request the Proposing Person to provide written verification of the information submitted by the Proposing Person such that the information contained in the Proposal Notice is true, correct and complete in all

respects;

|

|

|

•

|

|

Require that the Proposal Notice include a representation as to whether any Proposing Person intends to deliver a proxy statement and form of proxy to holders of at least the percentage of the Corporation’s

outstanding capital stock entitled to vote and required to approve the proposed business described in the Proposal Notice and, if so, identifying each such Proposing Person;

|

6

|

|

•

|

|

Require that the Proposal Notice include a representation that the shareholder or its qualified representative intends to appear in person at the meeting to propose the actions specified in the Proposal Notice and to

vote all proxies solicited;

|

|

|

•

|

|

Require a shareholder to specifically identify in the Proposal Notice by way of an express reference how the information being provided is intended to comply with a specific advance notice requirement of the

Bylaws;

|

|

|

•

|

|

Specify that a shareholder must set forth in writing directly within the body of the Proposal Notice (as opposed to being incorporated by reference from any other document or writing not included with, and made a part

of, the Proposal Notice) all the information required to be included in the Proposal Notice pursuant to the Bylaws;

|

|

|

•

|

|

Specify that a shareholder submitting the Proposal Notice, by its delivery to the Corporation, represents and warrants that all information contained therein is true, accurate and complete in all respects, contains no

false and misleading statements and such shareholder acknowledges that it intends for the Corporation and the Board to rely on such information as (i) being true, accurate and complete in all respects, without regard to what other information

may be publicly available but not contained in the Proposal Notice, and (ii) not containing any false and misleading statements;

|

|

|

•

|

|

Require that, notwithstanding any notice of the annual meeting sent to shareholders on behalf of the Corporation, a shareholder must separately provide a Proposal Notice in accordance with the Bylaws to conduct business

at any shareholder meeting and further clarifying that, if the shareholder’s proposed business is the same or relates to business brought by the Corporation and included in the Corporation’s annual meeting notice, the shareholder is

nevertheless still required to comply with the advance notice of business provisions of the Bylaws and give its own separate and timely Proposal Notice to the Secretary of the Corporation which complies in all respects with the applicable

requirements of the Bylaws; and

|

|

|

•

|

|

Provide that, in addition to the requirements contained in the Bylaws, a Proposing Person must also comply with all applicable requirements of the Exchange Act and New York law with respect to any shareholder proposal

and business that may be sought to be brought before an annual meeting of shareholders.

|

|

|

•

|

|

Provide that in no event shall any adjournment or postponement of an annual meeting or the announcement thereof commence a new time period for the giving of a Proposal Notice.

|

|

|

•

|

|

Specify certain procedural matters relating to the requirements for any director nominations to be brought before a shareholders’ meeting, including, but not limited to, the prerequisites for a shareholder to bring

a proposed director nomination before a shareholders’ meeting;

|

7

|

|

•

|

|

Amend the provisions related to the advance notice of proposed director nominations, including, but not limited to, revisions to:

|

|

|

•

|

|

Specify that, to be timely, a shareholder’s notice of nomination, shall be made in writing and delivered to, or mailed and received by, the Secretary of the Corporation at the principal office of the Corporation

(i) not earlier than the close of business on the one hundred and twentieth (120th) calendar day and not later than the close of business on the ninetieth (90th) calendar day prior to the Anniversary Date, or (ii) in the case of a special

meeting of shareholders called in accordance with the Bylaws for the purpose of electing directors, or in the event that the annual meeting of shareholders is called for a date that is more than thirty (30) calendar days before or more than

sixty (60) calendar days after the Anniversary Date, or if the Corporation did not hold an annual meeting in the preceding fiscal year, notice by the shareholder to be timely must be so delivered, or mailed and received, not later than the

later of (i) the close of business on the ninetieth (90th) calendar day prior to such meeting or (ii) the close of business on the tenth (10th) calendar day following the day on which public disclosure of the date of such meeting was first

made;

|

|

|

•

|

|

Further specify the information required to be provided by Proposing Persons in their advance notice of proposed nominations of candidates for election to the Board (the “

Nominating Notice

”) which

includes, as to each Proposing Person, substantially the same information about such Proposing Person that is required to be included in a Proposal Notice, as more fully discussed above, except that any reference to “

business

” or

“

proposal

” therein will be deemed to refer to the “

nomination

” of a director or directors by a shareholder which is proposed in a Nominating Notice;

|

|

|

•

|

|

Further specify the information required to be provided in the Nominating Notice about each person being proposed as a nominee for election to the Board, including, but not limited to, the following:

|

|

|

•

|

|

all information with respect to such proposed nominee that would be required to be set forth in a Nominating Notice if such proposed nominee was a Proposing Person;

|

|

|

•

|

|

all information relating to such proposed nominee that would be required to be disclosed in a proxy statement or other filing required to be made with the SEC by any Proposing Person pursuant to Section 14(a) under

the Exchange Act to be made in connection with a contested solicitation of proxies by a Proposing Person for an election of directors in a contested election;

|

8

|

|

•

|

|

such proposed nominee’s executed written consent to be named in the proxy statement of the Proposing Person as a nominee and to serve as a director of the Corporation if elected;

|

|

|

•

|

|

to the extent that such proposed nominee has entered into (1) any agreement, arrangement or understanding (whether written or oral) with, or has given any commitment or assurance to, any person or entity as to the

positions that such proposed nominee, if elected as a director of the Corporation, would take in support of or in opposition to any issue or question that may be presented to him or her for consideration in his or her capacity as a director of the

Corporation, (2) any agreement, arrangement or understanding (whether written or oral) with, or has given any commitment or assurance to, to any person or entity as to how such proposed nominee, if elected as a director of the Corporation,

would act or vote with respect to any issue or question presented to him or her for consideration in his or her capacity as a director of the Corporation, (3) any agreement, arrangement or understanding (whether written or oral) with any person

or entity that could be reasonably interpreted as having been both (a) entered into in contemplation of the proposed nominee being elected as a director of the Corporation, and (b) intended to limit or interfere with the proposed

nominee’s ability to comply, if elected as a director of the Corporation, with his or her fiduciary duties, as a director of the Corporation, to the Corporation or its shareholders, or (4) any agreement, arrangement or understanding

(whether written or oral) with any person or entity that could be reasonably interpreted as having been or being intended to require such proposed nominee to consider the interests of a person or entity (other than the Corporation and its

shareholders) in complying with his or her fiduciary duties, as a director of the Corporation, to the Corporation or its shareholders, a description in reasonable detail of each such agreement, arrangement or understanding (whether written or oral)

or commitment or assurance;

|

|

|

•

|

|

a description in reasonable detail of any and all agreements, arrangements and/or understandings, written or oral, between such proposed nominee and any person or entity (naming each such person or entity) with respect

to any direct or indirect compensation, reimbursement, indemnification or other benefit (whether monetary or

non-monetary)

in connection with or related to such proposed nominee’s candidacy for election

to the Board and/or service on the Board if elected as a member of the Board;

|

|

|

•

|

|

a description in reasonable detail of any and all other agreements, arrangements and/or understandings, written or oral, between such proposed nominee and any person or entity (naming such person or entity) in

connection with such proposed nominee’s service or action as a proposed nominee and, if elected, as a member of the Board; and

|

9

|

|

•

|

|

all information that would be required to be disclosed pursuant to Items 403 and 404 under Regulation

S-K

if the shareholder giving the notice or any other Proposing Person were

the “registrant” for purposes of such rule and the proposed nominee were a director or executive officer of such registrant.

|

|

|

•

|

|

Require the Proposing Person to, from time to time, update and supplement the information provided by such Proposing Person in its Nominating Notice and authorize the Corporation, the Board or any duly authorized

committee thereof to request the Proposing Person or a proposed nominee to provide written verification of the information submitted by the Proposing Person such that the information contained in the Nominating Notice is true, correct and complete

in all respects;

|

|

|

•

|

|

Require a shareholder to specifically identify in the Nominating Notice by way of an express reference how the information being provided is intended to comply with a specific advance notice requirement of the

Bylaws;

|

|

|

•

|

|

Specify that a Proposing Person must set forth in writing directly within the body of the Nominating Notice (as opposed to being incorporated by reference from any other document or writing not included with, and made a

part of, the Proposal Notice) all the information required to be included in the Nominating Notice pursuant to the Bylaws;

|

|

|

•

|

|

Provide that a Proposing Person submitting the Nominating Notice, by its delivery to the Corporation, represents and warrants that all information contained therein is true, accurate and complete in all respects,

contains no false and misleading statements and such Proposing Person acknowledges that it intends for the Corporation and the Board to rely on such information as (i) being true, accurate and complete in all respects, without regard to what

other information may be publicly available but not contained in the Nominating Notice, and (ii) not containing any false and misleading statements;

|

|

|

•

|

|

Provide that, notwithstanding any notice of shareholders’ meeting sent to shareholders on behalf of the Corporation, a Proposing Person must separately comply with the advance notice of nominations provisions of

the Bylaws to propose director nominations at any shareholders’ meeting and would still be required to give its own separate and timely Nominating Notice to the Secretary of the Corporation which complies in all respects with the applicable

requirements of the Bylaws;

|

|

|

•

|

|

Provide that the shareholder or a qualified representative of such shareholder must be present in person at a shareholders’ meeting and must represent that it will be present at such meeting in order for a proposed

director nomination to be brought before the meeting.

|

10

|

|

•

|

|

Provide that in the event that the number of directors to be elected to the Board of the Corporation is increased and there is no public disclosure naming all of the proposed nominees for Director or specifying the size

of the increased Board made by the Corporation at least one hundred (100) calendar days prior to the one year anniversary of the immediately preceding year’s annual meeting, a Nominating Notice required by the Bylaws shall also be

considered timely, but only with respect to proposed nominees for any new positions created by such increase, and only with respect to a shareholder who had, prior to such increase in the size of the Board, previously submitted a Nominating Notice

prior to the deadline for submitting director nominations in compliance with the Bylaws, if such Nominating Notice is delivered to, or mailed and received by, the Secretary of the Corporation at the principal office of the Corporation not later than

the close of business on the tenth (10th) calendar day following the day on which such public disclosure is first made by the Corporation; and

|

|

|

•

|

|

Provide that in no event shall any adjournment or postponement of an annual meeting or the announcement thereof commence a new time period for the giving of a Nominating Notice.

|

|

|

•

|

|

Provide more detailed procedural provisions with respect to shareholders’ meetings, including, but not limited to, the organization and conduct of the meeting, meeting protocol, the retention of inspectors of

election for such meetings, and proxies for such meetings.

|

|

|

•

|

|

Provide procedural provisions for having shareholders request that a record date be set by the Board for determining that the shareholders requesting that a special meeting be called have met the requisite fifty percent

(50%) stock ownership threshold provided for in the Bylaws and requiring informational disclosures to be included with such request that are substantially similar to those required to be included in a Proposal Notice or a Nominating Notice.

|

|

|

•

|

|

Provide procedures for having shareholders, who have met the requisite fifty percent (50%) stock ownership threshold requirement necessary to request that a special meeting of shareholders be called, request that a

special meeting be called and requiring informational disclosures to be made together with such request that are substantially similar to those required to be included in a Proposal Notice or a Nominating Notice.

|

|

|

•

|

|

Provide procedural provisions for special meetings called by shareholders that permit the Board to not call the special meeting under certain circumstances, including if the matter with respect to which the special

meeting sought to be called relates to a similar or substantially similar matter intended to be considered at an upcoming annual meeting or if the actions proposed to be taken are not actions that shareholders can take under New York law or under

the Corporation’s Certificate of Incorporation or Bylaws.

|

11

|

|

•

|

|

Provide procedures for actions taken by written consent of shareholders, including procedures for shareholders to request that the Board set a record date for determining shareholders entitled to take action by written

consent.

|

|

|

•

|

|

Revise the section of the Bylaws regarding the indemnification that the Corporation provides to its directors, officers and other agents to clarify the type of proceedings that are indemnified, the expenses that are

reimbursable, the persons who are indemnifiable, the capacity that the person needs to be acting in to be indemnified, and the process that needs to be followed in determining whether indemnification is proper in a particular circumstance. In

addition, the rights granted to indemnified persons to be advanced expenses incurred in defending a proceeding in advance of its final disposition have also been clarified to provide a specific time period by which the advancement needs to be made

and to provide that advancement cannot be conditioned on ability to repay, must be unsecured and must be interest-free and cannot be otherwise conditioned unless New York law provides otherwise. Additional provisions have been added to avoid

duplicate payments to indemnified persons, provide that the Corporation shall be subrogated to all rights of recovery of any person entitled to indemnification and provide that the conduct of one indemnified person will not be imputed to

another.

|

In addition to the foregoing, there are various other

“clean-up”

changes to the Bylaws including, but not limited to, grammatical and other typographical corrections, formatting changes, revisions to headings, titles and captions, and defining certain terms and the capitalization of such defined terms.

The foregoing description of various amendments included in the Bylaws does not purport to be complete and is qualified in its entirety by

reference to the complete text of the Bylaws adopted by the Board on December 28, 2016, a copy of which is attached to this Current Report on Form

8-K

as Exhibit 3.1 and incorporated by reference in this

Item 5.03 in its entirety.

Deadlines for Submission of Shareholder Proposals and Director Nominations

To be considered timely pursuant to the Bylaws, shareholder proposals submitted outside of Rule

14a-8

of the Exchange Act and proposed director nominations, in each case intended to be brought before the Corporation’s 2017 Annual Meeting of Shareholders, must be received by the Corporation’s

Secretary at its principal executive offices no earlier than February 3, 2017 and no later than March 5, 2017, and must be directed to the attention of the Corporation’s Secretary at Financial Institutions, Inc., 220 Liberty Street,

Warsaw, New York 14569. Such advance notices of shareholder proposals and proposed director nominations must also comply with the advance notice of shareholder proposals and director nomination provisions contained in Article I, Section 10 and

Article II, Section 12, respectively, of the Bylaws and shareholders are urged to read the complete text of such advance notice provisions of the Bylaws.

12

In addition, in order for any shareholder proposals submitted outside of Rule

14a-8

of the Exchange Act to be considered “timely” for purposes of Rule

14a-4(c)

of the Exchange Act, the proposal must be received by the Corporation’s

Secretary not later than March 5, 2017.

The foregoing discussion of the Bylaws’ advance notice deadlines for shareholder

proposals submitted outside of Rule

14a-8

and director nominations, and the calculation of such deadlines pursuant to the Bylaws, does not purport to be complete and is qualified in its entirety by reference

to the complete text of the Bylaws adopted by the Board on December 28, 2016, a copy of which is attached to this Current Report on Form

8-K

as Exhibit 3.1 and incorporated by reference in this Item

8.01 in its entirety.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d)

Exhibits

.

|

|

|

|

|

Exhibit

No.

|

|

Exhibit Title

|

|

|

|

|

3.1

|

|

Amended and Restated Bylaws of Financial Institutions, Inc., as adopted on December 28, 2016

|

|

|

|

|

10.1

|

|

Form of Director’s and Officer’s Indemnification Agreement

|

13

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F

INANCIAL

I

NSTITUTIONS

, I

NC

.

|

|

|

|

|

|

|

Date: December 30, 2016

|

|

|

|

By:

|

|

/s/ Kevin B. Klotzbach

|

|

|

|

|

|

|

|

Name:

|

|

Kevin B. Klotzbach

|

|

|

|

|

|

|

|

Title:

|

|

Executive Vice-President, Chief Financial Officer and Treasurer

|

14

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Exhibit Title

|

|

|

|

|

3.1

|

|

Amended and Restated Bylaws of Financial Institutions, Inc., as adopted on December 28, 2016

|

|

|

|

|

10.1

|

|

Form of Director’s and Officer’s Indemnification Agreement

|

15

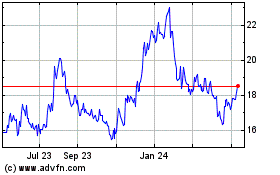

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Apr 2023 to Apr 2024