Generali Launches Subordinated Bond, Collects Over EUR8 Billion Demand

December 05 2012 - 6:25AM

Dow Jones News

By Serena Ruffoni

Italian insurance giant Assicurazioni Generali (G.MI) has

lowered its interest rate expectations for its proposed

subordinated bond after drawing more demand than it first

anticipated.

The 30-year bond has attracted over eight billion euros ($10.4

billion), one of the banks arranging the deal said Wednesday after

a series of investor meetings in Europe. It is now expected to

price at 7.75%, instead of around 8.125% indicated earlier in the

morning.

Credit Agricole, Morgan Stanley, Nomura, UBS and UniCredit are

arranging the meetings.

The bond will be rated Baa3 by Moody's Investors Service, BBB+

by Standard & Poor's and BBB- by Fitch Ratings. Ratings are

lower than Generali's credit rating because the bond ranks junior

to the company's senior securities.

Write to Serena Ruffoni at serena.ruffoni@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

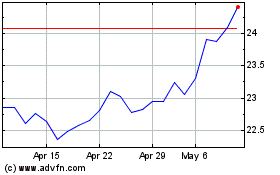

Generali (BIT:G)

Historical Stock Chart

From Aug 2024 to Sep 2024

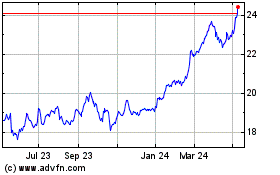

Generali (BIT:G)

Historical Stock Chart

From Sep 2023 to Sep 2024