Telefonica Prices EUR1.2 Billion 4.71% Bond Maturing 2020

October 05 2012 - 9:42AM

Dow Jones News

By Ben Edwards

Spanish telecommunications company Telefonica SA (TEF) priced a

1.2 billion euro ($1.55 billion) bond, maturing January 2020, one

of the banks running the deal said Friday.

BayernLB, BNP Paribas SA, Citigroup Inc., Commerzbank AG,

Mitsubishi UFJ Securities International and Societe Generale SA

were the lead managers of the sale, which has the following

terms:

Amount: EUR1.2 billion

Maturity: Jan. 20, 2020

Coupon: 4.71%

Reoffer Price: 100

Payment Date: Oct. 19, 2012

Spread: 330 basis points over midswaps

Debt Ratings: Baa2 (Moody's)

BBB (Standard & Poor's)

BBB+ (Fitch)

Denominations: EUR100,000

Listing: London

Interest: Annual

Write to Ben Edwards at ben.edwards@dowjones.com

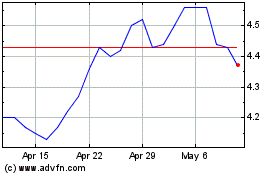

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

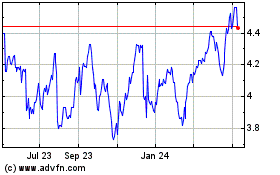

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024