Equinix Adds Capacity in Asia - Analyst Blog

May 04 2012 - 2:45PM

Zacks

Data center provider

Equinix Inc. (EQIX) is set to acquire an aggregate

of six data centers and a disaster recovery center from Asia Tone

for a cash consideration of $230.5 million. Asia Tone is a Hong

Kong-based data center and colocation service provider. Its

facilities are located in Hong Kong, Shanghai and Singapore, which

creates an opportunity for Equinix to expand its footprint across

the Asia-Pacific. Those three regions happen to be the

fastest-growing data center markets.

Of the six data centers, one is new

and located in Shanghai. The facility is expected to be fully

operational by the second half of 2012 and will provide 80,000

square feet of data center space. Another one is still under

construction.

The cash deal is expected to be

completed by the third quarter of 2012. Post completion, Equinix

will be operating 104 data centers in 38 markets across the world.

We believe that the acquisition will be commensurate with the

increasing demand for its data center support.

As per recent studies conducted by

research firms Frost and Sullivan and Gartner, data center growth

in the Asia-Pacific will be the most sought after. Gartner also

expects China to grow into the second largest global data center

market by 2015.

Equinix has seen an annualized

revenue growth rate of 30% from the Asia-Pacific region. In the

recently concluded first quarter of 2012, the region generated

13.9% of total revenue, up from 13.3% in the prior-year quarter.

The region also witnessed strong bookings growth in the

quarter.

We believe that with support from

the newly acquired data centers, Equinix will be able to provide

colocation, interconnection and managed services to match the

growing demand in China.

Equinix has delivered strong first

quarter results and provided a decent guidance for the coming

quarter and fiscal 2012. We believe that strategic acquisitions and

international expansion will help expand its client base, thus

enhancing its revenue growth potential.

We are also optimistic about the

company’s recurring revenue model and current expansion plans.

However, despite all these positives, competitive pressures from

the likes of AT&T Inc. (T) and Verizon

Inc. (VZ) should not be ignored. European exposure and

industry consolidation also concern us.

Equinix has a Zacks #3 Rank,

implying a short-term Hold rating.

EQUINIX INC (EQIX): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

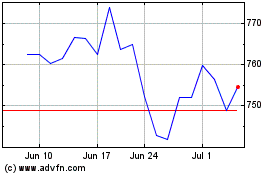

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

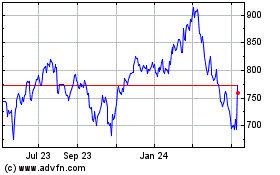

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2023 to Apr 2024