Genuine Parts Beats, Profits Up 16% - Analyst Blog

April 19 2012 - 9:45AM

Zacks

Genuine Parts Company (GPC) posted a 16% rise

in profit to $146.3 million or 93 cents per share in the first

quarter of 2012 from $126.5 million or 80 cents in the same quarter

of last year. With this, the auto parts maker outdid the Zacks

Consensus Estimate by 7 cents per share.

Sales in the quarter grew 7% to $3.2 billion, which was in line

with the Zacks Consensus Estimate. The improvement was attributable

to strong sales in mainly Automotive and Industrial segments.

Operating profit rose 5% to $690.9 million in the quarter from

$656.8 million a year ago, driven by higher gross profits.

Sales in the Automotive segment grew 6% to $1.5 billion driven

by the positive impact from sales initiatives and improving

fundamentals in the automotive industry. Sales in the Motion

Industries or Industrial segment scaled up 12% to $1.1 billion,

making it the best performing segment, driven by internal

strategies and a recovery in the economy.

Sales in the EIS or Electrical segment inched up 5% to $147.1

million with the recovery of the manufacturing sector of the

economy. However, sales in the S. P. Richards or Office Products

segment declined 1.5% to $426.2 million due to challenging

environment in the office products industry.

Genuine Parts had cash and cash equivalents of $424.4 million as

of March 31, 2012, down from $465.9 million as of March 31, 2011.

Long-term debt remained unchanged at $500 million as of March 31,

2012 compared with the year-ago level.

In the quarter, the company’s net cash flow from operations

improved significantly to $172.3 million from $53.4 million in the

prior-year, due to an improvement in profit and favorable changes

in operating assets and liabilities. Meanwhile, capital

expenditures increased to $16.9 million from $14.5 million in the

first quarter of 2011.

Genuine Parts has undertaken various initiatives to boost sales

and earnings, such as product line expansion, penetration into new

markets and cost-saving activities. The company relies on a diverse

product portfolio for top-line and bottom-line growth. Its major

competitors include Advance Auto Parts (AAP),

AutoZone (AZO) and W.W. Grainger

(GWW).

Currently, the company retains a Zacks #2 Rank on its stock,

which translates to a Buy rating for the short term (1–3

months).

ADVANCE AUTO PT (AAP): Free Stock Analysis Report

AUTOZONE INC (AZO): Free Stock Analysis Report

GENUINE PARTS (GPC): Free Stock Analysis Report

GRAINGER W W (GWW): Free Stock Analysis Report

To read this article on Zacks.com click here.

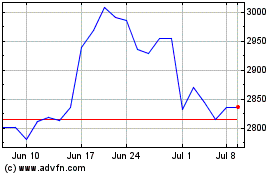

AutoZone (NYSE:AZO)

Historical Stock Chart

From Mar 2024 to Apr 2024

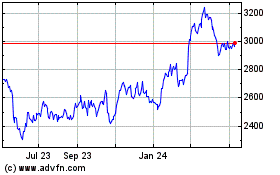

AutoZone (NYSE:AZO)

Historical Stock Chart

From Apr 2023 to Apr 2024