- Current report filing (8-K)

March 01 2012 - 6:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): February 23, 2012

Marketing Worldwide Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-50586

|

68-0566295

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

2212 Grand Commerce Dr., Howell, Michigan 48855

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (517) 540-0045

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 3.02. Unregistered Sales of Equity Securities

On February 23,

2012, Marketing Worldwide Corporation (the “Company”)

reached a Settlement Agreement with Ronald W. Kletter

Family Dynasty Trust to resolve the legal relationship created by the $100,000 face amount Senior Convertible Note due July 15,

2012 (the “Convertible Note”), the Common Stock Purchase Warrant covering 2,500,000 Warrant Shares (the “Warrant”)

and the Securities Purchase Agreement dated June 29, 2011 (the “SPA”). Under the terms of the Settlement Agreement,

the Company issued 25,000,000 shares to the Ronald W. Kletter Family Dynasty Trust in full satisfaction of all obligations. In

early January 2012, the Company issued the Ronald W. Kletter Family Dynasty Trust 1,479,633 shares of common stock for the quarterly

interest payment due under the Convertible Note.

There was no underwriter, no underwriting discounts

or commissions, no general solicitation, no advertisement, and resale restrictions were imposed by placing a Rule 144 legend on

the certificates. The persons who received securities have such knowledge in business and financial matters that he/she/it is capable

of evaluating the merits and risks of the transaction. This transaction was exempt from registration under the Securities Act of

1933, based upon Section 4(2) for transactions by the issuer not involving any public offering.

Item 8.01. Other Events

On February 27, 2012, Marketing Worldwide Corporation

(the “Company”) sold a $102,500 Convertible Promissory Note to an accredited investor for net proceeds of $100,000.

The funds will be used for working capital.

Between January 1, 2012 and February 29, 2012,

Marketing Worldwide Corporation (the “Company”) issued shares of its common stock pursuant to the terms of the Company’s

Series A Convertible Preferred Stock and the conversion features of the Company’s outstanding indebtedness. A summary of

these issuances of shares is set forth below. The shares of common stock were issued without registration under the Securities

Act of 1933 based upon legal opinions provided to the Company and its transfer agent that registration was not required.

|

|

1.

|

3,766,234 shares of its common stock for $14,500 of principal and interest due under a Convertible

Promissory Note.

|

|

|

2.

|

4,499,998 shares of its common stock to pay dividends on the Series A Convertible Preferred Stock.

|

|

|

3.

|

3,000,000 shares of its common stock for $8,997.80 Convertible Promissory Note.

|

|

|

4.

|

5,238,095 shares of its common stock for $22,000 of principal and interest due under a Convertible

Promissory Note.

|

|

|

5.

|

13,292,614 shares of its common stock for $58,760 of principal and interest due under a Convertible

Promissory Note.

|

|

|

6.

|

3,800,000 shares of its common stock for $11,212.29 Convertible Promissory Note.

|

|

|

7.

|

6,700,000 shares of its common stock to Fairhills Capital Offshore for $20,000 Convertible Promissory

Note.

|

|

|

8.

|

7,500,000 shares of its common stock for $19,743.75 of principal and interest due under a Convertible

Promissory Note.

|

|

|

9.

|

14,720,812 shares of its common stock for $58,000 of principal and interest due under a Convertible

Promissory Note.

|

|

|

10.

|

9,000,000 shares of its common stock for $38,700 of principal and interest due under a Convertible

Promissory Note.

|

|

|

11.

|

7,926,941 shares of its common stock for $23,780.82 of principal and interest due under a Convertible

Promissory Note.

|

|

|

12.

|

8,200,000 shares of its common stock for $19,987.50 of principal and interest due under a Convertible

Promissory Note.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: February 29, 2012

|

|

Marketing Worldwide Corporation

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Charles Pinkerton

|

|

|

|

Charles Pinkerton

|

|

|

|

President

|

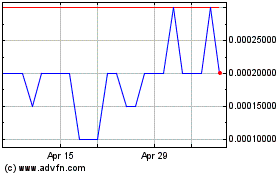

Marketing Worldwide (PK) (USOTC:MWWC)

Historical Stock Chart

From Mar 2024 to Apr 2024

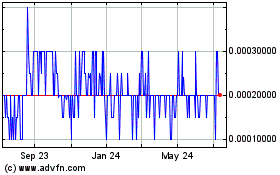

Marketing Worldwide (PK) (USOTC:MWWC)

Historical Stock Chart

From Apr 2023 to Apr 2024