Report of Foreign Issuer (6-k)

December 29 2016 - 4:58PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2016

Commission File Number: 001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

YPF Sociedad An

ó

nima

TABLE OF CONTENTS

ITEM

1 Translation of letter to the Buenos Aires Stock Exchange dated December 29, 2016

TRANSLATION

Autonomous City of Buenos Aires, December 29, 2016

To the

Bolsa de Comercio de Buenos Aires

(Buenos Aires Stock Exchange)

|

|

Re

: Relevant Information

|

Dear Sirs:

The purpose of this letter is to comply with the requirements of Article 23 of Chapter VII of the Buenos Aires Stock Exchange Regulations.

In that connection, please be informed that YPF S.A. ("YPF" or the "Company") is in the process of achieving a merger by absorption with its following subsidiaries: YSUR PARTICIPACIONES S.A.U., YSUR INVERSIONES PETROLERAS S.A.U., YSUR INVERSORA S.A.U., YSUR PETROLERA ARGENTINA S.A., YSUR RECURSOS NATURALES S.R.L., YSUR ENERGIA ARGENTINA S.R.L., PETROLERA LF COMPANY S.R.L. y PETROLERA TDF COMPANY S.R.L. (the "Absorbed Companies"), which are companies controlled by YPF as a result of the asset acquisition of the Apache group in Argentina in accordance with the information provided to the market through Relevant Information dated February 12, 2014, February 13, 2014 and March 12, 2014. The effective date of the merger will be January 1, 2017, after which the Absorbed Companies' operations must be considered performed by YPF.

With respect to the merger, YPF will be the absorbing company and will continue the activities and operations of each of the Absorbed Companies, which will be dissolved without liquidation.

The aforementioned merger will centralize the management of the companies under a single corporate organization, thereby obtaining operational and economic benefits related to the achievement of higher operating efficiency and effectiveness, the enhanced use of available resources and of technical, administrative and financial structures, and the rationalization and reduction of related costs.

Once the process of negotiation and the preparation of documentation has been completed, the corresponding prior merger agreement will be signed, which will be submitted for the approval of the respective directors and shareholders' meetings of each of the companies involved in the merger. The merger will be subject to obtaining the applicable regulatory approvals.

Yours faithfully,

Diego Celáa

Market Relations Officer

YPF S.A.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

YPF Sociedad Anónima

|

|

|

Date: December 29, 2016

|

By:

|

/s/

Diego Celáa

|

|

|

|

Name:

Title:

|

Diego Celáa

Market Relations Officer

|

|

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

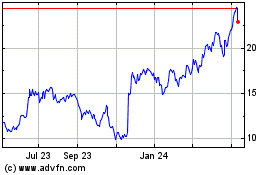

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024