FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of May, 2015

Commission File Number: 001-12102

YPF Sociedad

Anónima

(Exact name of registrant as specified in its charter)

Macacha Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No

x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No

x

YPF Sociedád Anonima

TABLE OF CONTENTS

ITEM

| 1 |

Translation of Q1 2015 Earnings Presentation. |

YPF 1st Quarter 2015 Earnings Webcast May 8, 2015

YPF 2 Safe harbor statement under the US Private Securities Litigation Reform Act of 1995. This document

contains statements that YPF believes constitute forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. These forward-looking statements may include statements regarding the intent, belief, plans,

current expectations or objectives of YPF and its management, including statements with respect to YPF’s future financial condition, financial, operating, reserve replacement and other ratios, results of operations, business strategy,

geographic concentration, business concentration, production and marketed volumes and reserves, as well as YPF’s plans, expectations or objectives with respect to future capital expenditures, investments, expansion and other projects,

exploration activities, ownership interests, divestments, cost savings and dividend payout policies. These forward-looking statements may also include assumptions regarding future economic and other conditions, such as future crude oil and other

prices, refining and marketing margins and exchange rates. These statements are not guarantees of future performance, prices, margins, exchange rates or other events and are subject to material risks, uncertainties, changes and other factors which

may be beyond YPF’s control or may be difficult to predict. YPF’s actual future financial condition, financial, operating, reserve replacement and other ratios, results of operations, business strategy, geographic concentration, business

concentration, production and marketed volumes, reserves, capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings and dividend payout policies, as well as actual future

economic and other conditions, such as future crude oil and other prices, refining margins and exchange rates, could differ materially from those expressed or implied in any such forward-looking statements. Important factors that could cause such

differences include, but are not limited to, oil, gas and other price fluctuations, supply and demand levels, currency fluctuations, exploration, drilling and production results, changes in reserves estimates, success in partnering with third

parties, loss of market share, industry competition, environmental risks, physical risks, the risks of doing business in developing countries, legislative, tax, legal and regulatory developments, economic and financial market conditions in various

countries and regions, political risks, wars and acts of terrorism, natural disasters, project delays or advancements and lack of approvals, as well as those factors described in the filings made by YPF and its affiliates with the Securities and

Exchange Commission, in particular, those described in “Item 3. Key Information—Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in YPF’s Annual Report on Form 20-F for the fiscal year ended

December 31, 2014 filed with the US Securities and Exchange Commission. In light of the foregoing, the forward-looking statements included in this document may not occur. Except as required by law, YPF does not undertake to publicly update or revise

these forward-looking statements even if experience or future changes make it clear that the projected performance, conditions or events expressed or implied therein will not be realized. These materials do not constitute an offer for sale of YPF

S.A. bonds, shares or ADRs in the United States or otherwise. Disclaimer

YPF Contents Q1 2015 Results Financial Situation Summary 1 2 3

YPF 4 Revenues of Ps 34.7 billion (+13% vs. Q1 2014) Crude oil production 247.2 Kbbl/d (+2.3%) Natural gas

production 43.9 Mm3/d (+18.6%) Crude processed 300 Kbbl/d (+9.1%) Operating Income was Ps 4.5 billion (+2%) Net Income was Ps 2.1 billion (-26%) Total Capex(2) was Ps 12.4 billion (+27%) Q1 2015 Results – Highlights Adj.

EBITDA(1) reached Ps 10.2 billion (+21%) Operating Cash Flow topped Ps 12 billion (+78%) (1) See description of Adj. EBITDA in footnote (2) on page 5 (2) Compared to Q1 2014 not including additions relating to the

acquisitions of Apache Group assets in Argentina (net of Pluspetrol assignment) and an additional 38.45% stake in Puesto Hernández joint venture.

YPF 5 578 517 Q1 2014 Q1 2015 1,110 1,182 Q1 2014 Q1 2015 4,040 4,016 Q1 2014 Q1 2015 Despite 50% reduction

y-o-y in Brent prices, the company showed solid results. Revenues (1) (in millions of USD) Operating Income (1) (in millions of USD) Adj. EBITDA (1) (2) (in millions of USD) (1)YPF financial statement values in IFRS converted to

USD using average exchange rate of Ps 7.6 and Ps 8.6 per U.S $1.00 for Q1 2014 and Q1 2015, respectively. (2)Adjusted EBITDA = Net income attributable to shareholders + Net income (loss) for non-controlling interest—Deferred income

tax—Income tax—Financial income (losses) gains on liabilities—Financial income gains (losses) on assets—Income on investments in companies + Depreciation of fixed assets + Amortization of intangible assets + Unproductive

exploratory drillings. -0.6% -10.5% +6.4% Q1 2015 Results Expressed in US Dollars

YPF 4,384 4,469 4,038 1,318 6 -2,741 -1,661 -745 -130 Q1 2014 Revenues Purchases Exploration expenses Other

costs of sales DD&A SG&A Others expenses Q1 2015(in millions of Ps) Q1 2015 Operating Income Operating income increased 1.9% driven by higher revenues and lower imports.

YPF 7 3,013 2,260 3,656 -2,175 -1,487 -478 -269 Q1 2014 Revenues Production costs DD&A Royalties Other

expenses Q1 2015 Q1 2015 Upstream Results Upstream Operating Income reached Ps 2.3 billion (-25%) due to increases in costs and depreciation that outpaced the increases in revenues due to the decrease in local oil prices. In million of Ps

(1) Includes Ps 32 millions of SG&A, Ps 6 millions of Exploration Expenses, Ps -136 millions of Purchases and Ps -171 millions of Other Expenses

YPF 8 241.6 247.2 Q1 2014 Q1 2015 37.2 43.9 Q1 2014 Q1 2015 529.7 583.8 Q1 2014 Q1 2015 Crude oil production

(Kbbl/d) Natural gas production (Mm3/d) Q1 2015 Upstream Results – Production Total production (Kboe/d) +2.3% +18.0% +10.2% Total y-o-y production growth of 10.2%: 2.3% in crude oil, 18% in natural gas and 12% in NGL

YPF 9 8.1 10.1 13.2 17.4 19.0 22.7 31.7 38.0 41.7 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4

2014 Q1 2015 Q1 2015 Upstream Results – Shale Update Significant production engineering activity in all areas of Loma Campana to optimize well productivity. Encouraging horizontal well productivity in El Orejano. Still in an early stage of

understanding of the subsurface. Total of 9 producing wells and another 8 more wells expected to be in production soon. 47 wells drilled in Q1 2015 (total of 332 producing wells), including 3 horizontal shale oil wells in the east area of Loma

Campana and 2 horizontal shale gas wells in El Orejano. Continue development of west area of Loma Campana with vertical drilling with high productivity wells in the sweet spot; managing interferences between wells to reduce the impact in production.

Best production peak rate of almost 1,200 bbl/d in a Loma Campana horizontal well. Drilling, casing and cementation achievement in a 4,750 meters measured depth horizontal well finished in 27 days. Total Gross Production (Kboe/d)

YPF 10 Loma La Lata (121 km2 – 29,900 acres)(1) Objective: Lajas formation •100% YPF •9 wells

drilled in Q1 2015 (88 total wells drilled) •Depth: 2,600 m to 2,800 m 0.7 0.6 0.7 1.8 2.7 3.3 4.1 4.0 4.3 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 0.04 0.14 0.87 1.22 1.41 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015

Total Gross Production (Mm3/d) Total Gross Production (Mm3/d) Rincón del Mangrullo (183 km2—45,200 acres) Objective: Mulichinco formation •50% YPF – 50% Petrolera Pampa •10 wells drilled in Q1 2015 (49 total wells drilled)

•Depth: 1,600 m to 1,800 m Tight gas production in Q1 2015 represents 12% of total gas production, compared to 8% in Q1 2014. (1)Refers to Lajas prospective area called “Segmento 5” in Loma La Lata block. Q1 2015 Upstream Results

– Tight Gas Update

YPF 11 2,453 1,494 2,306 -27 -1,985 -628 -534 -146 Q1 2014 Revenues Other expenses Purchases Production costs

SG&A DD&A Q1 2015 (1) (1) Includes stock variations. Q1 2015 Downstream Results Downstream operating income decreased by 39%. Lower international prices resulted in a drop in exports, which did not affect domestic sales. (in millions of Ps)

YPF 12 4,004 4,326 Q1 2014 Q1 2015 Others LPG Fuel Oil JP1 Gasoline Diesel275 300 Q1 2014 Q1 2015 +9.1% Crude

processed (kbbl/d) Domestic sales of refined products (Km3) +8.0% Q1 2015 Downstream Results—Sales +1.4% -0.7% Refinery utilization reached 94% helped by lighter crude coming from unconventional production. Imported volumes of diesel dropped

67% against Q1 2014.

YPF 13 500 550 600 650 700 750 800 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2013 2014 Q1 2015 300 320

340 360 380 400 420 440 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2013 2014 Q1 2015 Q1 2015 Downstream Results – Demand Monthly Gasoline Sales (Km3) Brand recognition; solid demand based on slight market share growth. Monthly Diesel Sales

(Km3) 54.6% 57.9% 57.7% 58.9% Gasoline Market Share 2013 Q1 2015 Diesel Market Share 2013 Q1 2015 + 3.9% + 0.8% + 1.4% —0.7% 60.0% 2014 57.7% 2014

YPF 14 Q1 2014 Q1 2015 Upstream Downstream Others 25 46 65 75 75 2011 2012 2013 2014 Q1 2015 Q1 2015 Capex

(1) (1) Capex figures as expressed in Note 2.g of Q1 2015 YPF financial statements. (2) Not including additions relating to the acquisitions of Apache Group assets in Argentina (net of Pluspetrol assignment) and an additional 38.45% stake in

Puesto Hernández joint venture. (3)Active rigs at end of period. +27% (in millions of Ps) Downstream Upstream Progress of the new coke unit at the La Plata Refinery and other multi-year projects Neuquina basin: Loma Campana, Rincón del

Mangrullo, Aguada Toledo and Chachahuen Golfo San Jorge basin: Manantiales Behr, El Trébol, Los Perales and Cañadón la Escondida Drilling rigs (3) +200% 9,722 12,351 (2)

YPF 15 Contents Q1 2015 Results Financial Situation Summary 1 2 3

YPF 16 6,715 11,931 Q1 2014 Q1 2015 9,758 11,039 11,931 4,980 -15,630 Cash at the beginning of Q1 2015 Cashflow

from operations Net financing Capex Cash at the end of Q1 2015 (1)Effective spendings in fixed asset acquisitions during the quarter. (2)Includes effect of changes in exchange rates. (3)Net debt to Adj. EBITDA calculated in USD, Net debt at period

end exchange rate of Ps 8.8 to U.S. $1.00 and Adj. EBITDA LTM at average LTM of Ps 8.4 to U.S. $1.00; 5,211 / 5,150 = 1.0. Q1 2015 Cash Flow From Operations Strong Cash Flow From Operations of Ps 12 bn, 78% growth compared to Q1 2014. Sound capital

structure; Net Debt / Adj. EBITDA LTM of 1x(3). (1) (2) +78% Consolidated statement of cash flows (in million of Ps) Cash flow from operations (in million of Ps)

YPF 17 2,685 Cash 2015 2016 2017 2018 2019 2020 +2020 •Peso denominated debt: 28% of total Financial debt

amortization schedule (1) (2) (in millions of USD) •Average interest rates of 7.47% in USD and 23.27% in pesos (1)As of March 31, 2015, does not include consolidated companies (2)Converted to USD using the March 31, 2015

exchange rate of Ps 8.77 to U.S.$1.00 and April 9, 2015 of Ps 8.84 U.S.$1.00 for pro-forma figures of Series XXXVIII Notes. Cash position strengthened by additional indebtedness in the international and local markets during Q2 2015. Continued

to extend average life of debt. Financial Situation Update1 •Average life of almost 4.9 years Includes additional issuance in the international market of Series XXXIX Notes of U.S.$1.5 billion, and in the local market Series XXXVIII Notes of Ps

935 million Proforma highlights including Series XXXIX and XXXVIII Notes:

YPF 18 Contents Q1 2015 Results Financial Situation Summary 1 2 3

YPF 19 Summary Solid results despite challenging global oil price environment Focus in cost reductions to

offset the effects of a strong peso Keeping activity flat as price visibility supports ongoing projects Continued to build cash cushion to avoid potential market volatility Shale and tight development progressing well and addressing learning curve

challenges Committed with a sustainable 5% upstream production growth

1st Quarter 2015 Earnings Webcast Questions and Answers

YPF 1st Quarter 2015 Earnings Webcast May 8, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

YPF Sociedad Anónima |

|

|

|

| Date: May 8, 2015 |

|

By: |

|

/s/ Diego Celaá |

|

|

Name: Title: |

|

Diego Celaá Market Relations

Officer |

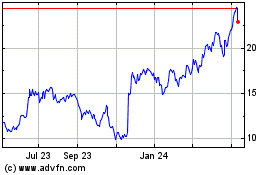

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024