Additional Proxy Soliciting Materials (definitive) (defa14a)

April 21 2015 - 12:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

| ¨ Preliminary

Proxy Statement |

|

¨ Confidential, for Use of the Commission Only(as permitted by Rule 14a-6(e)(2)) |

| ¨ Definitive Proxy Statement |

|

|

|

| x Definitive

Additional Materials |

|

|

|

|

| ¨ Soliciting

Material Pursuant to §240.14a-12 |

|

|

EXXON MOBIL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it

was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

| Exxon Mobil Corporation 5959 Las Colinas Boulevard Irving, TX 75039-2298 |

|

Jeffrey J. Woodbury Vice President, Investor Relations and Secretary |

|

|

|

|

|

|

|

|

|

April 21, 2015 |

|

| Re: Supplemental Information Related to Item 3 – Advisory Vote to Approve Executive Compensation |

Dear Investor,

In the 2015 filing of Exxon Mobil

Corporation’s proxy, we included an Executive Compensation Overview (Overview) as additional proxy material to summarize the linkage between our compensation program and business results. We provided two Charts on page 5 (Charts

10 and 11) of the Overview on CEO compensation versus our compensation benchmark companies during the eight years of the ExxonMobil CEO’s time in position through 2013.

The 2014 data for our compensation benchmark companies have recently become available as they have filed their 2015 proxies. Therefore we have updated Chart 10

(ExxonMobil CEO’s realized pay versus our compensation benchmark companies) and Chart 11 (ExxonMobil CEO’s combined realized and unrealized pay granted versus our compensation benchmark companies) to reflect this new data.

| • |

|

“Realized pay” is compensation actually received by the CEO during the year, excluding any retirement distributions. See the back page of the Overview for a more detailed definition. |

| • |

|

“Unrealized pay” means the current value – not the grant date value used for reporting in the Summary Compensation Table – of outstanding unvested cash and stock-based incentive awards as well as the

current market value of unexercised “in the money” stock options granted during the years 2006 to 2014. Award values are based on target levels of formula awards and fiscal year-end 2014 stock prices. See the back page of the

Overview for a more detailed definition. |

As shown below in Chart 10, ExxonMobil CEO’s realized pay continues to be below the median for most

of his tenure as CEO.

| |

# |

2006 to 2014 compensation payments as reported in the Summary Compensation Table and the Option Exercises and Stock Vested table. Values for Caterpillar include estimates for FY 2014 as the 2015 proxy had not been filed

as of April 15, 2015. |

|

| |

* |

39 percent of ExxonMobil CEO’s realized pay in 2011 was from the exercise of stock options that were granted in 2001 and would have expired in 2011. No stock options have been granted since 2001. |

|

Page 2

Chart 11 illustrates that

ExxonMobil CEO’s combined realized and unrealized granted pay is at the 39th percentile for the period of the ExxonMobil CEO’s time in position through 2014. Both Charts do not adjust

for the substantial differences in size, scale, and scope between ExxonMobil and the compensation benchmark companies; these differences are framed in Chart 12 on page 5 of the Overview.

Pension and nonqualified deferred compensation data are excluded from the above charts. However, depending on how these values for

the 2006 to 2014 period are determined, including pension value and nonqualified deferred compensation together with the realized pay and unrealized award values shown above would place the ExxonMobil CEO between the 38th and the 74th percentiles among the compensation benchmark companies. Specifically:

| • |

|

ExxonMobil CEO would rank at the 38th percentile if pension and nonqualified deferred compensation values are based on nine years of average value per year of pension

service (nine years represents the time in position of the current ExxonMobil CEO through 2014). |

For companies who have had more than

one CEO during this period, the pension and nonqualified deferred compensation values for both paid and accumulated amounts were averaged for this purpose, weighted by the tenure of the respective individual in the CEO position. Pension values are

as reported in the Pension Benefits table. Nonqualified deferred compensation values are as reported in the requisite table and may include executive contributions as well as company contributions and interest earned.

| • |

|

ExxonMobil CEO would rank at the 74th percentile if pension value is simply calculated by aggregating the positive amounts shown in the annual “Change in Pension

Value” column of the Summary Compensation Table for the covered period. |

We look forward to discussing this information with our shareholders

over the next several weeks and during the Webinar on Executive Compensation on May 14, 2015.

Sincerely,

Please read this supplemental information together with the complete Overview and the more detailed

information included in the Compensation Discussion & Analysis, compensation tables, and narrative in ExxonMobil’s 2015 Proxy Statement before you cast your vote on Management Resolution Item 3 – Advisory Vote to

Approve Executive Compensation.

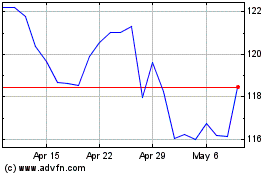

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

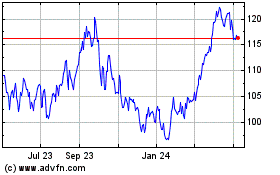

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024